AI is Converging with Prediction Markets—and it’s Changing the Game Forever

Can AI help us predict the future?

In the world of prediction markets, the answer is a resounding “yes.”

The intersection of artificial intelligence (AI) and prediction markets presents a transformative opportunity unlike we’ve ever seen before. AI’s ability to synthesize large datasets and extract meaningful insights is enhancing the accuracy and utility of prediction markets, making them more accessible and valuable to a broader audience.

There are three main areas of innovation at the intersection of AI and prediction markets: user experience (UX), AI trading agents, and AI training.

Let’s explores each of these and their respective implications at a deeper level.

Enhanced User Experience in Prediction Markets

In early 2024, Vitalik Buterin, co-founder of Ethereum, highlighted AI's potential to enhance decision-making within decentralized systems. By synthesizing large datasets and extracting actionable insights, AI can streamline decision-making processes in prediction markets. These markets thrive on accurate, timely information, but managing vast amounts of data can overwhelm even the most experienced traders.

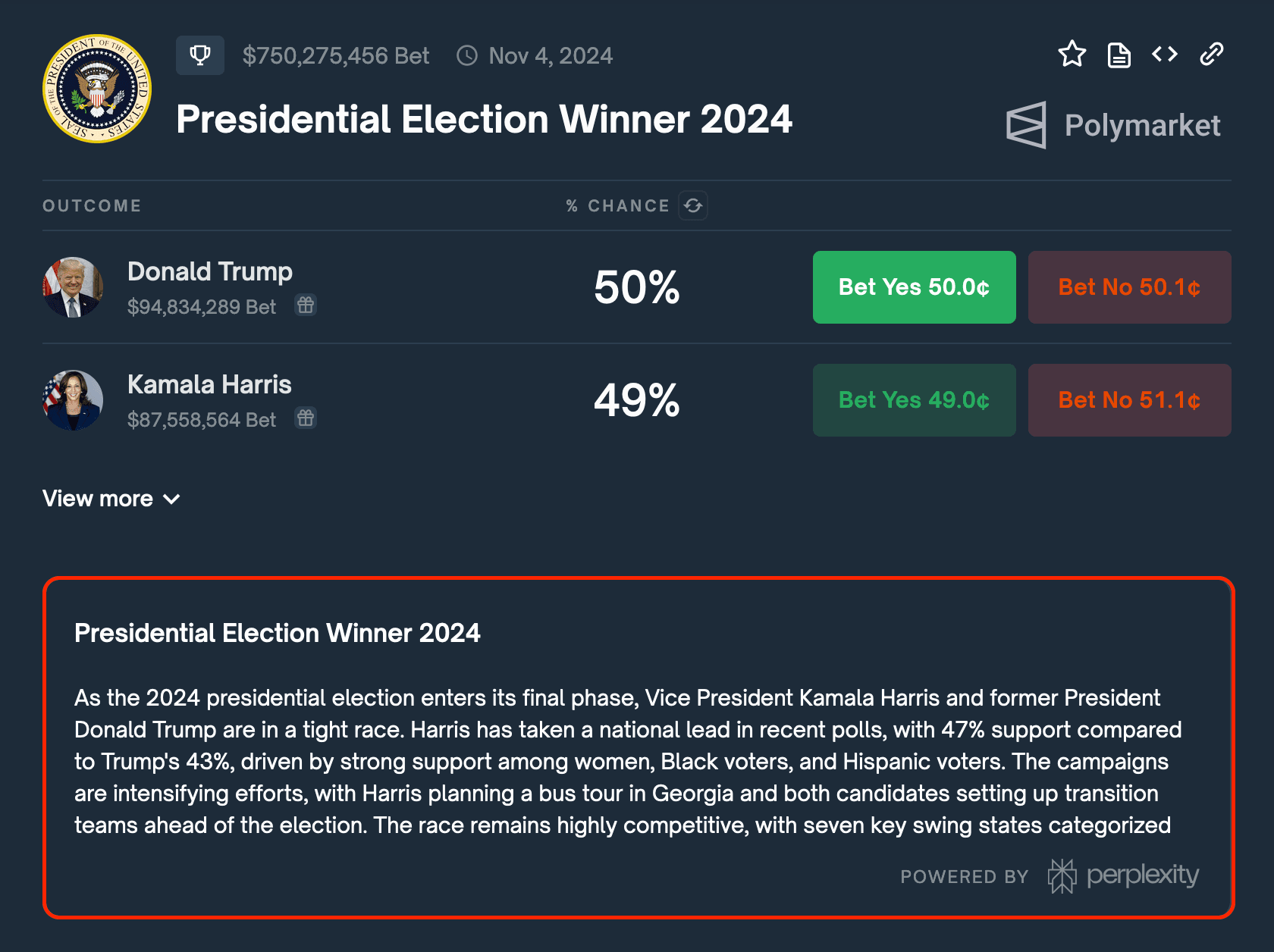

Polymarket, the leading prediction market platform, recently partnered with Perplexity AI to address this challenge. By embedding Perplexity's AI technology into its front-end, Polymarket is able to provide its users with real-time summaries of news and events related to specific markets. This integration enables users to quickly access market insights straight from Polymarket’s UI and make informed predictions, improving the overall user experience.

AI Traders: A New Era of Market Participation

AI agents are now stepping into the trading arena—they can analyze real-time data, making decisions, and executing trades just like human traders.

While still in their early stages, these AI agents are already demonstrating the potential to outperform human traders in specific markets. In July 2024, RoboNet introduced "Pauly," an AI agent that trades election markets on Polymarket. This marked a significant step toward automated market participation, but it also raised an important question: “how can we make AI trading agents more accessible to prediction market traders?”

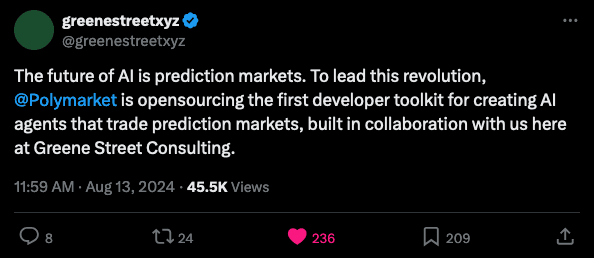

With this question in mind, Polymarket recently outsourced the development of an open-source toolkit for creating AI agents to greenestreetxyz. This initiative will facilitate the open development of AI trading agents in the prediction market space, indicating that more AI agents are expected to participate in prediction markets as better tools and technologies become available.

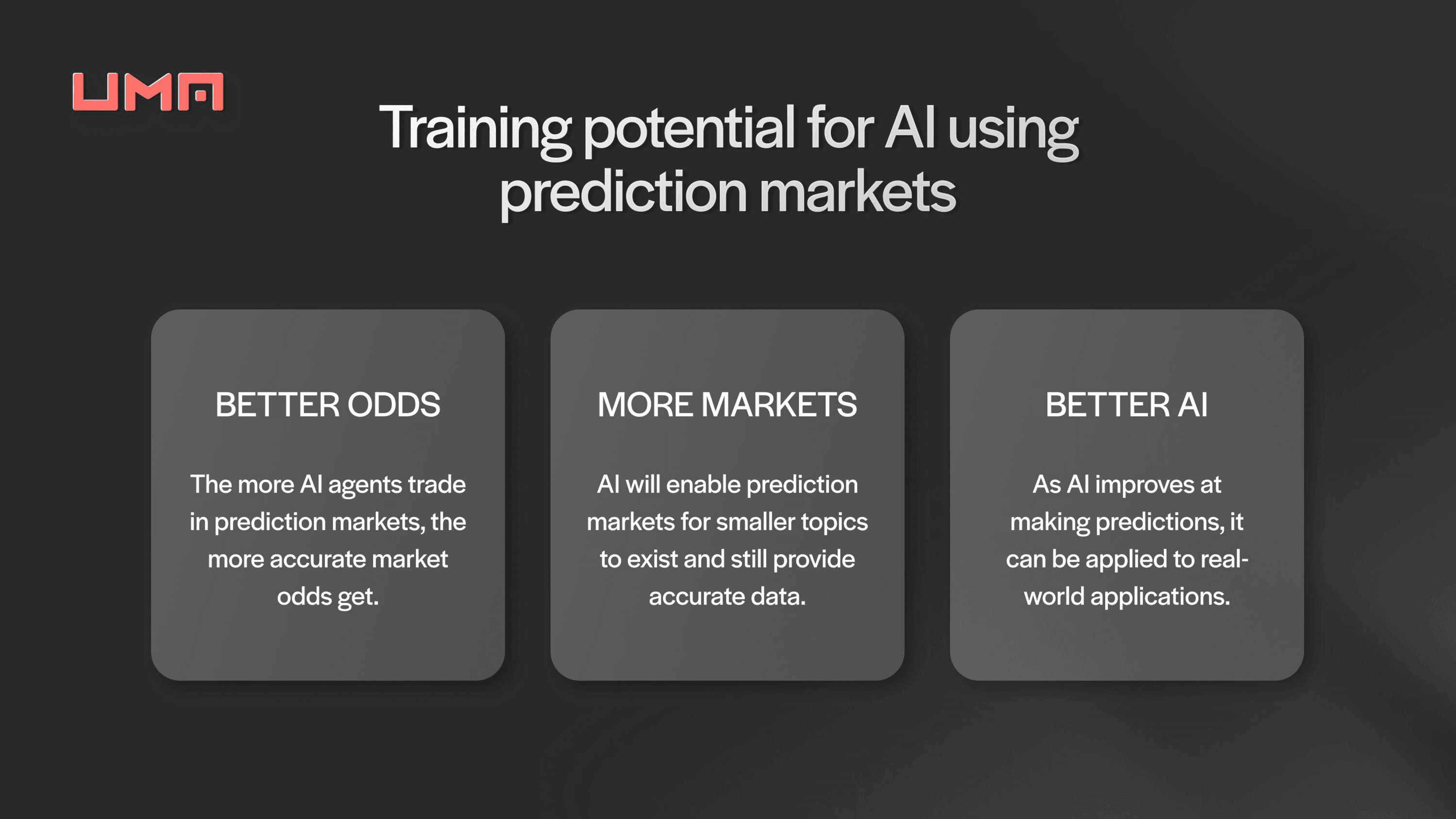

AI Training and Prediction Market Growth

AI agents can serve as "sharps" in prediction markets, outperforming others through superior data analysis. However, they can also be used for training purposes, refining their predictive capabilities over time. By participating in prediction markets, AI agents can learn to make more accurate predictions, leading to several positive outcomes:

1. More Prediction Markets

Prediction markets have the potential to be excellent data sources for forecasting real-world outcomes, but they often require substantial liquidity to function effectively. Traditionally, only popular markets, like major elections, have enough volume to provide accurate predictions.

AI agents can significantly enhance liquidity in prediction markets. Unlike human traders, AI agents require lower incentives to participate. They are programmed to analyze data and execute trades based on predefined strategies, without the need for large rewards. This lower cost of participation means AI can support and sustain prediction markets on more niche topics that typically struggle to attract human participants.

Additionally, AI agents can operate continuously and consistently, providing a steady stream of activity that keeps markets vibrant. Their constant presence can fill the gaps during periods when human traders might be less active, thereby ensuring that markets remain liquid and responsive at all times.

2. Better Predictions

AI agents can analyze vast amounts of real-time data to make more accurate predictions, enhancing the overall accuracy of market odds. This is crucial for individuals, media outlets, and institutions relying on these markets for insights.

For instance, GnosisAI’s agents have achieved about 65% accuracy in forecasts, indicating that AI-driven markets can offer reliable predictions even for complex events. As these agents continue learning from market interactions, their performance is expected to improve, leading to more efficient markets.

AI also mitigates human biases and reacts to new information instantly. This ensures that market odds remain accurate and up-to-date, creating a more dynamic and trustworthy prediction market environment for all participants.

Real-World Applications of AI-Driven Prediction Markets

The specialized AI agents honed within prediction markets have potential applications far beyond the crypto sphere. For instance, AI agents that excel at predicting election outcomes could be outsourced to political parties to refine their campaign strategies. Similarly, agents skilled in forecasting share prices could become valuable assets for investment institutions seeking an edge in the financial markets.

Here are few other domains in which AI-driven prediction markets have potential applications:

Financial and Cryptocurrency Markets: AI agents analyze financial markets and execute trades based on patterns identified in historical and real-time data. GNY.io’s machine learning tools, for example, attempt to forecast cryptocurrency volatility and provide buy/sell signals. In prediction markets, AI agents can use this information to place informed bets on various financial outcomes, enhancing market accuracy.

Gaming and Social Media Engagement: AI can introduce prediction markets into gaming environments, allowing players to predict outcomes in real-time. For example, gamers might bet on outcomes within a game like Minecraft or Roblox. Streamers could engage their audience with prediction markets about in-game events or performance, creating new layers of interaction and value.

Cultural Events and Trends: Prediction markets can cover a wide range of cultural events, such as predicting music chart rankings, movie box office numbers, or even celebrity events. AI can help aggregate and analyze relevant data, improving the accuracy of these predictions and increasing market liquidity.

Creating and Resolving Prediction Markets with AI

Creating user-generated prediction markets has been an industry aspiration since the launch of Augur v1 on Ethereum. However, the complexity of designing market rules and resolving disputes has proven to be a significant hurdle. UMA’s Optimistic Oracle has emerged as the industry standard for prediction market oracles and dispute resolution, but the process remains challenging.

As AI technology advances, there is hope that it will streamline market creation and resolution, reducing the likelihood of disputes. However, a resolution layer will still be necessary to manage disputes that arise from AI-generated resolutions. Therefore, while AI can enhance the efficiency of prediction markets, a human element will likely remain essential for ensuring fairness and accuracy.

Closing Thoughts

The fusion of AI and prediction markets presents a promising frontier in the crypto space and beyond. From enhancing user experience to enabling more niche markets and improving predictive accuracy, AI is set to revolutionize how prediction markets function and scale. As AI agents become more sophisticated, their impact will extend beyond crypto, influencing various real-world sectors in ways we have yet to imagine.

UMA's Optimistic Oracle stands at the forefront of this evolution, offering robust solutions for creating and resolving prediction markets. As AI continues to integrate with these systems, the future of prediction markets looks increasingly dynamic and valuable to global audiences.

What do you predict will happen next?

References

Cointelegraph: Real AI use cases in crypto: Crypto-based AI markets, and AI financial analysis

Cointelegraph: Prediction markets are the killer blockchain app we've been waiting for

Get Involved

Want to earn rewards as a voter in the Optimistic Oracle? Learn how to get started here.

Ready to build your own prediction market platform? Learn how to build using the Optimistic Oracle as your backbone here.

Also, make sure to follow UMA on Twitter and join our Discord community to stay up to date on everything prediction markets.