What is a Prediction Market Dispute?

Prediction markets have been a major focus in the crypto space ever since they were first mentioned in the Ethereum whitepaper. These markets enable users to bet on the outcomes of real-world events, like elections or sports results, in a decentralized and trustless manner.

However, one persistent issue continues to challenge prediction markets: disputes.

Disputes are not easy to handle. In fact, resolving them in a decentralized manner has been a hard problem for the DeFi community.

Let's explore the challenges posed by disputes, examine how different platforms have attempted to resolve them, and discover how UMA’s Optimistic Oracle and Data Verification Mechanism are the industry standard for decentralized prediction market dispute resolution.

What is a Prediction Market Dispute?

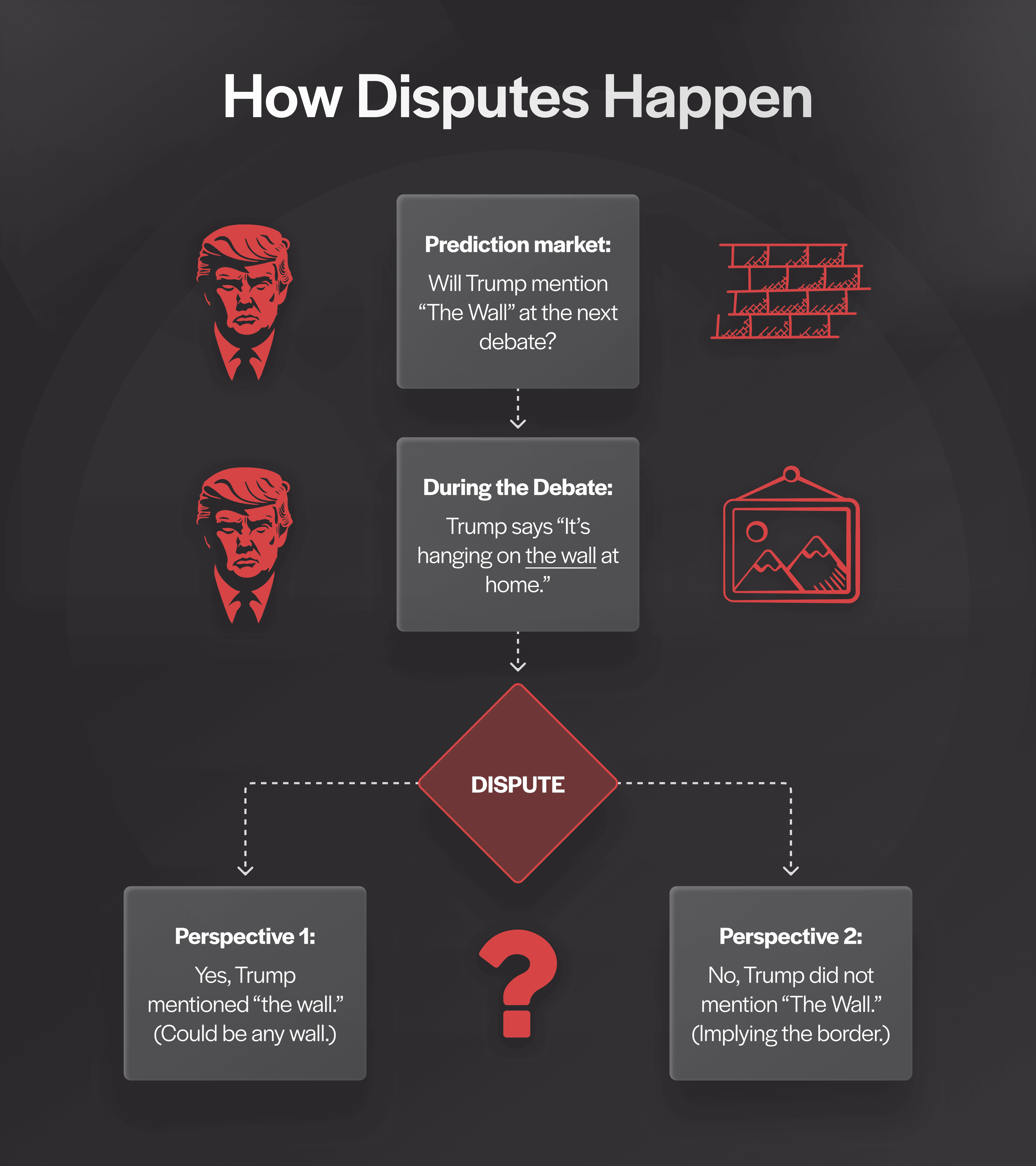

To better understand the nature of disputes, let's walk through a hypothetical example, from the conception of a market until the point where it becomes a dispute:

A user requests a market on a prediction platform: "Will Trump mention The Wall at the next debate?"

The prediction market deploys the market, and users begin placing their bets on 'Yes' or 'No'.

During the rally, Trump says a phrase like, "I've got a picture of that on my wall."

After the event, a user proposes to resolve the market with “Yes, Trump mentioned ‘The Wall'”.

However, another user disputes this, arguing that Trump didn’t specifically mention "The Wall" (implying the border wall) but rather referred to "a wall" (which could be any wall).

So, how do you resolve this dispute? The answer isn’t straightforward because it hinges on interpretation—did Trump really "mention the wall," or was it just "a wall"? This ambiguity demonstrates why disputes can be so challenging in prediction markets.

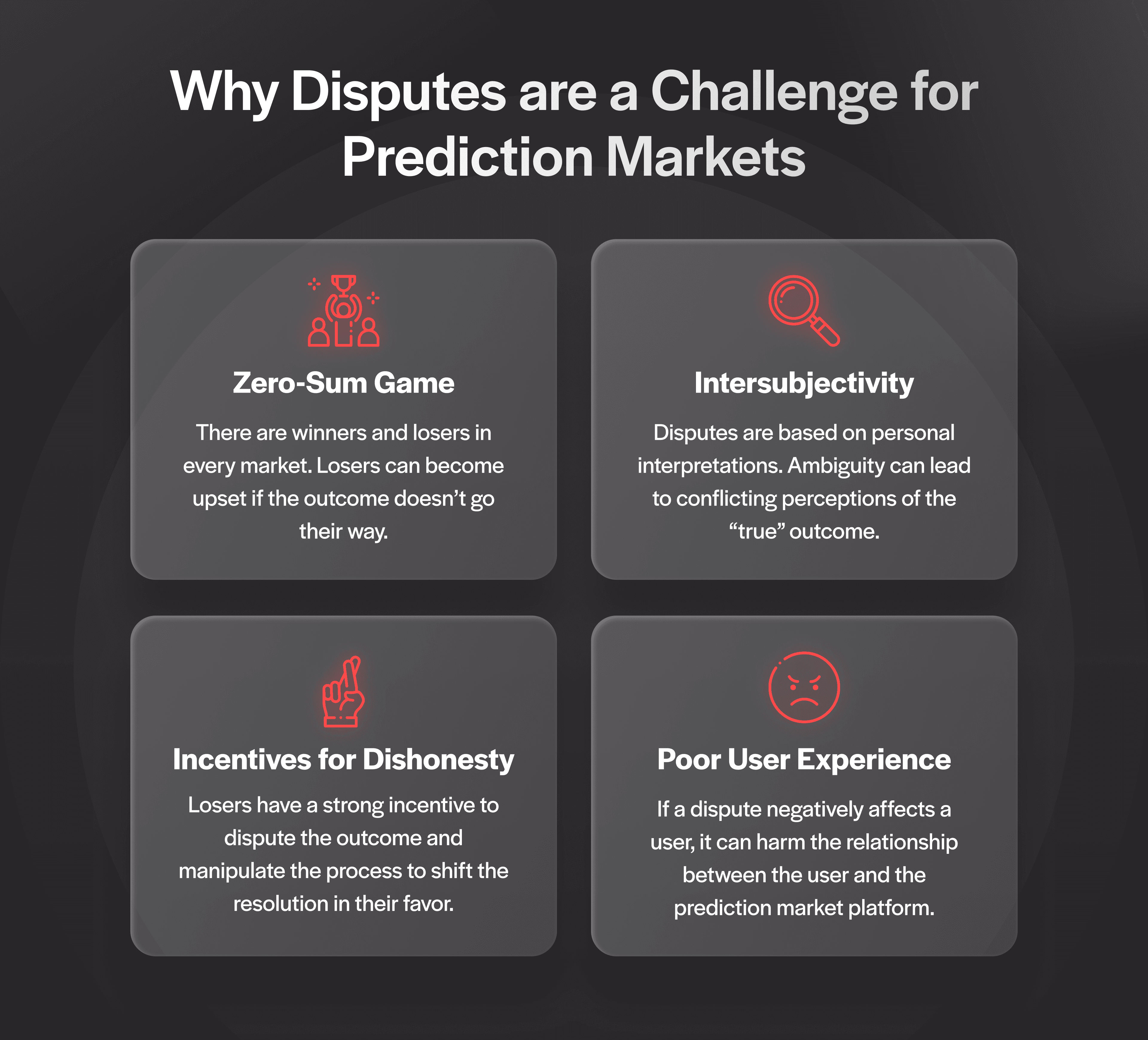

Disputes are Challenging

Disputes arise when there is disagreement over the outcome of a particular event. In blockchains, most problems are resolved cryptographically. Prediction markets however require blockchains to verify natural language statements, which can be subjective and open to interpretation. Let’s consider the specific challenges that disputes present in prediction markets:

It’s a Zero-Sum Game

Every prediction market creates winners and losers. Those on the losing side are often unhappy with the resolution. The greater the value lost, the unhappier they are. In prediction markets where an outcome is indisputable, everyone has to accept the outcome. This includes markets that track objective outcomes, like who won a sporting match, or the price of an asset. In exotic markets, such as markets about election winners or news events, sometimes the outcome can be disputed.

Intersubjective Perceptions

Disputes are inherently intersubjective, meaning they are based on personal interpretations rather than objective truths that can be mathematically proven. In prediction markets, if the rules of a market or the proposed outcome have any room for ambiguity, different participants may have conflicting perceptions of the “true” outcome, leading to disputes.

Strong Incentives for Dishonesty

When users lose in a market with an ambiguous outcome, they have a strong incentive to dispute the outcome. Often these disputes are honest, but there is the possibility that disputes can be motivated by dishonest behavior. For example, a bad actor could be willing to lie, spread mis or disinformation, or attack the credibility of the dispute process if they believed it could shift the dispute to resolve in their favor.

Poor User Experience

Disputes can damage the relationship between prediction markets and their users. A key goal for any prediction market is to provide a seamless and trustworthy user experience. However, if users feel that a dispute was resolved unfairly or against their interests, they may lose trust in the platform and leave. Maintaining user trust and confidence is essential for long-term sustainability.

Minimizing the Risk of Prediction Market Disputes

The best solution for prediction market disputes is prevention. Although disputes are inevitable, there are several ways that prediction market platforms can mitigate their occurrence. Disputes can be avoided by:

Providing very clear, well-defined YES and NO market conditions.

Defining credible sources for market resolution.

Clarifying unclear or ambiguous market rules. (

has pioneered this method of mitigating emerging market disputes.)

You can learn more about mitigating prediction market disputes here.

Resolving Prediction Market Disputes with UMA

The best way to resolve prediction market disputes is in a decentralized and transparent manner. This ensures that no single-entity has control over the resolution and establishes a trustless foundation to operate upon. UMA’s Optimistic Oracle has proven itself to be the best tool for the job.

The Optimistic Oracle uses a unique Data Verification Mechanism (DVM) to verify real-world information onchain. The DVM effectively employs a Schelling Point approach for dispute resolution. In this method, a group of reasonable strangers—individuals without a direct stake in the outcome—are asked to vote on the dispute in a shielded manner. The goal here is to reach a "Schelling Point,” which is a natural focal point where everyone arrives at a reasonable and fair conclusion. This approach leverages the wisdom of the crowd and reduces the likelihood of manipulation or bias. It's a unique way to resolve disputes while maintaining decentralization, fairness, and trust. So far, the Optimistic Oracle has successfully settled over 22,000 outcome assertions with a 1.67% dispute rate.

Several prediction market platforms, including Polymarket, use the Optimistic Oracle to settle prediction markets and resolve disputes onchain. You can learn more about how it works here.

Closing Thoughts

Disputes are a natural challenge in decentralized prediction markets. They arise from the intersubjective nature of real-world events and the strong financial incentives involved. Different prediction market platforms have adopted various approaches to resolving disputes.

At UMA, we believe in the power of decentralized, community-driven solutions. The Optimistic Oracle allows us to resolve disputes fairly, transparently, and in a decentralized manner. As prediction markets evolve and become more integral to the DeFi ecosystem, the ability to resolve disputes fairly and transparently will continue to be absolutely critical.

Get Involved

Want to earn rewards as a voter in the Optimistic Oracle? Learn how to get started here.

Ready to build your own prediction market platform? Learn how to build using the Optimistic Oracle as your backbone here.

Also, make sure to follow UMA on Twitter and join our Discord community to stay up to date on everything prediction markets.