How DAOs are using oSnap for trustless execution today

Tldr; oSnap is an UMA-powered solution that helps DAOs execute the outcomes of governance proposals on-chain without falling back to a central entity. oSnap allows DAOs to stay decentralized while getting governance done in an efficient manner. Since launching, oSnap has already settled transactions such as expense payments, treasury reimbursements, and market-making loans.

Key takeaways:

oSnap is an UMA-powered tool that enables Optimistic Snapshot Execution, helping DAOs get governance done in a trustless manner.

Several leading DAOs, including Across Protocol and BarnBridge, have integrated oSnap in a commitment to decentralization.

oSnap is empowering DAOs by putting on-chain execution in the hands of the community. This means DAOs can get governance done efficiently and trustlessly.

oSnap is an UMA-powered solution that’s bringing trustless governance execution to the DAO ecosystem.

oSnap leverages UMA’s optimistic oracle with Snapshot’s off-chain voting mechanism and Safe wallets to enable Optimistic Snapshot Execution for DAOs. When a DAO uses oSnap, community members can vote on a proposal via Snapshot, and if it passes, any tokenholder can execute the transaction on-chain. This means DAOs can get governance done in a decentralized and autonomous manner without falling back to a centralized team.

UMA sits at oSnap’s core. UMA is an optimistic oracle that serves data to smart contracts. It’s a decentralized truth machine that publishes things about the world, allowing for any kind of verifiable truth to be recorded on the blockchain.

With oSnap, transactions get executed optimistically unless someone raises a dispute. As a result, DAOs can operate in an efficient manner, and any tokenholder can execute vote outcomes on-chain.

oSnap launched in February 2023 and has quickly found traction in the DAO ecosystem. At the time of writing, oSnap secures around $38.7 million across five partnering DAOs: Across Protocol, BarnBridge, Lossless, +DAO, and ShapeShift.

oSnap will soon be integrated into other leading DAOs. In the meantime, it’s already helping our first few partners make DAO governance happen without foregoing decentralization. Here’s a look at some of the first transactions it has enabled.

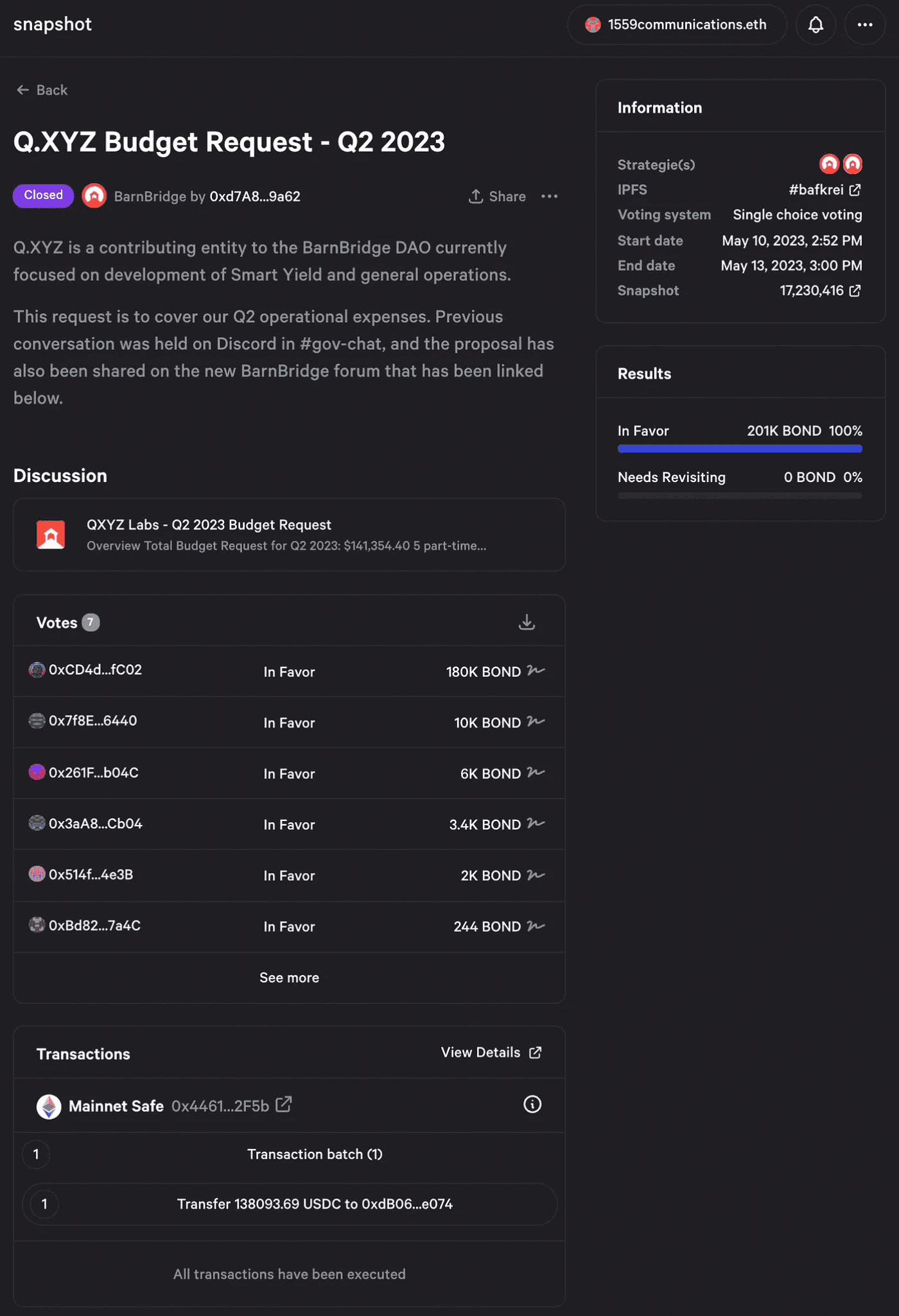

Paying for DAO operational costs (BarnBridge)

On May 1, QXYZ Labs requested $141,354.40 from the BarnBridge DAO. QXYZ Labs is a contributing entity to the BarnBridge DAO, and the request was to cover operational expenses for Q2 2023.

When the proposal went to a Snapshot vote on May 10, it passed with 100% of respondents voting in favor.

On May 18, oSnap enabled a transfer of 138,093.69 $USDC from the DAO’s treasury to QXYZ Labs’ Safe wallet. The transaction also included a 10,000 $USDC bond.

The transaction can also be viewed via the oracle dApp, and anyone was able to dispute it within the liveness period.

This transaction marks the first example of oSnap enabling a payment for operational costs, but it’s unlikely to be the last. As DAOs frequently allocate treasury funds to external contributing entities, oSnap has a clear use case in ensuring payments get made. Using oSnap to execute such transactions improves efficiency and eliminates the need for centralized treasury management.

Making reimbursements for liquidity provision (Across)

On May 11, Risk Labs treasury manager Kevin Chan submitted a proposal to the Across DAO for an $ACX token reimbursement and a series of additional payments. It later went to a two-part Snapshot vote.

The proposal came after Risk Labs deposited 2.3 million $ACX in bribe payments to Aura Finance to drive emissions in the $wstETH/$ACX pool on Balancer between December 2022 and May 2023. The goal of this series of deployments was to improve $ACX liquidity and benefit tokenholders.

The Across DAO proposal noted that Risk Labs had achieved its goal with the Balancer pool topping $1 million at its peak. As a result, it said, the Across DAO should reimburse the 2.3 million $ACX. It also requested 600,000 $ACX tokens to cover an additional four bribe payments to Aura Finance.

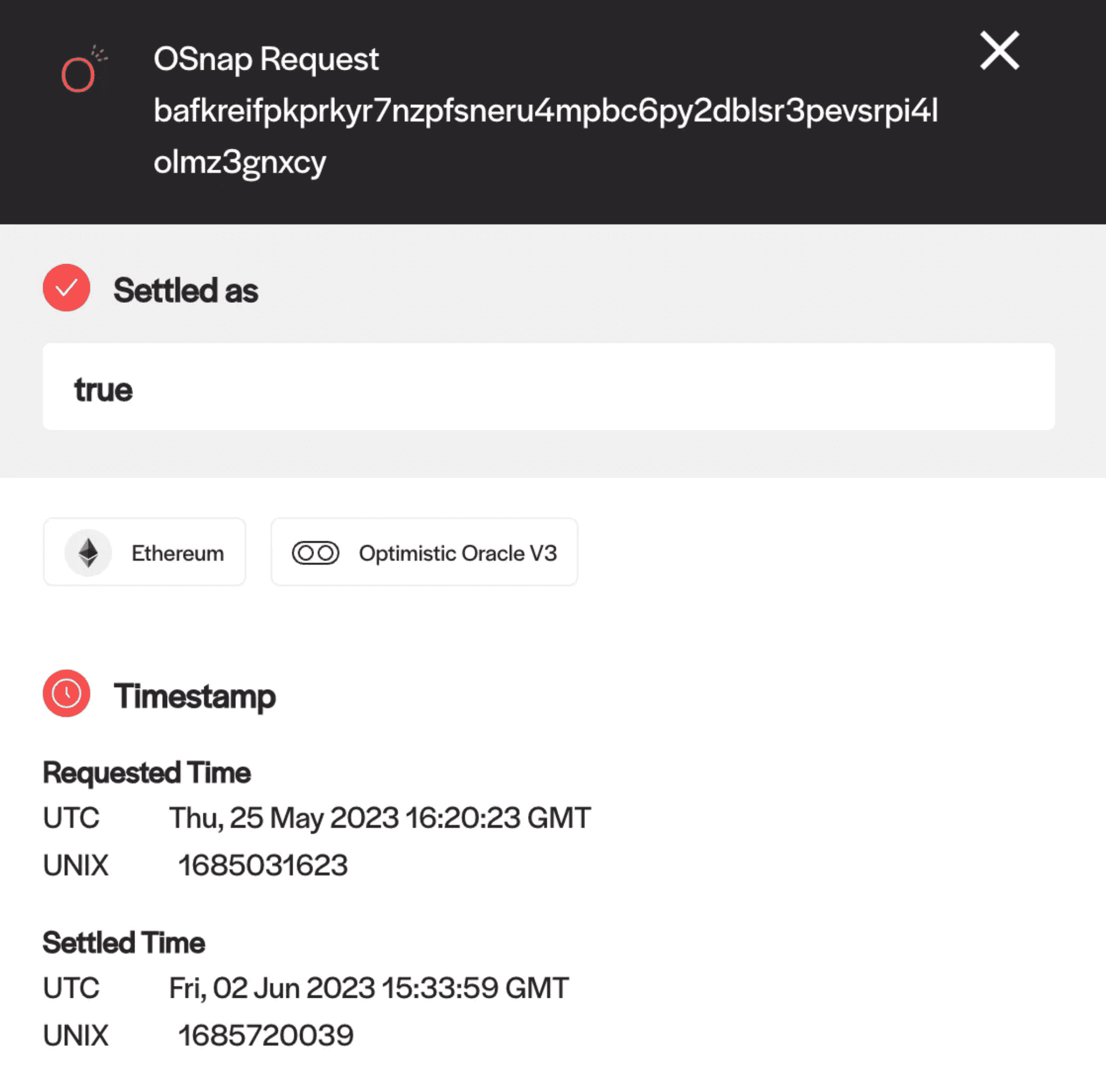

The proposals reached 130% quorom with 98.86% and 99.87% of respondents voting in favor. On June 2, oSnap enabled the transaction for the 2.3 million $ACX from the treasury to Risk Labs. The transaction also included a 10 $WETH bond.

The transaction can also be viewed via the oracle dApp.

As Chan noted in this tweet storm, he executed the transaction from his wallet as an $ACX tokenholder, with no multi-sig signers involved. As with all oSnap transactions, any tokenholder could have made the execution.

While reimbursements are not as common as other treasury payments in the DAO ecosystem, this transaction highlights oSnap’s ability to help DAOs maintain decentralization by making the community responsible for execution. With oSnap, any tokenholder can execute a transaction, regardless of the size of their holdings.

Issuing a loan for market-making (BarnBridge)

On May 10, early crypto adopter GSR presented a proposal to the BarnBridge DAO in hopes of becoming a market-maker for the project’s $BOND token.

The proposal sought to transfer 300,000 $BOND as a loan to GSR and went to a Snapshot vote on May 19. As the proposal was put forward shortly after oSnap’s launch, it was divided into three tranches.

The proposed transfer of the funds was subject to an agreement that GSR would return the funds to the BarnBridge DAO. The three votes passed with 100% quorum, with 194,000, 190,000, and 212,000 $BOND tokens voting in favor.

On May 25, oSnap enabled the first transaction for 100,000 $BOND. On June 5, oSnap enabled the second transaction for the same amount. Both transactions also included a 10,000 $USDC bond.

The transactions can also be viewed via the oracle dApp.

This series of transactions is the largest oSnap has enabled to date, totalling a value of $720,000 at settlement time. By the time the third tranche completes, BarnBridge will have cleared over $1 million worth of transactions with oSnap. BarnBridge’s oSnap adoption shows that the solution can help DAOs make larger transactions without the need to fall back to a small number of trusted individuals that oversee millions of dollars in funds.

Trustless execution and the future of DAO governance

These use cases show that oSnap is already proving itself as a useful tool for DAO governance. They also hint that the DAO ecosystem is beginning to evolve into a world where DAOs maintain decentralization in their operations.

oSnap also supports ShapeShift, Lossless, and +DAO, and will soon be integrated into other DAOs in the ecosystem. This fits neatly into our vision of a future where DAOs embrace trustless execution and communities are empowered to govern themselves autonomously. Although it’s still early, oSnap is in a strong position to support this future today.

oSnap is easy to integrate. If you’re interested in joining the oSnap family or you want to learn more about Optimistic Snapshot Execution, get in touch with us here. Alternatively, you can always reach out at integrations@uma.xyz or say hi on Twitter or Discord. We look forward to hearing from you.

Words by @dreamsofdefi