How Polymarket is making prediction markets mainstream

Tldr; Polymarket is enjoying a breakout year as traders increasingly look to prediction markets to bet on real-world events. In 2024, Polymarket has become a real-time sentiment tracker for major events like the upcoming US presidential election. As the optimistic verification mechanism that settles markets, UMA’s Optimistic Oracle is helping Polymarket on its mission to become a source of truth for the world.

Key takeaways:

Prediction markets are going mainstream and Polymarket is the big winner of 2024.

Polymarket has become a powerful tool for tracking the market’s sentiment and predicting events related to US politics ahead of the presidential election.

UMA’s Optimistic Oracle powers Polymarket, verifying natural language requests and settling markets.

While Polymarket has experienced significant growth this year, there’s reason to believe its ascent will continue as it offers the world an alternative source of news.

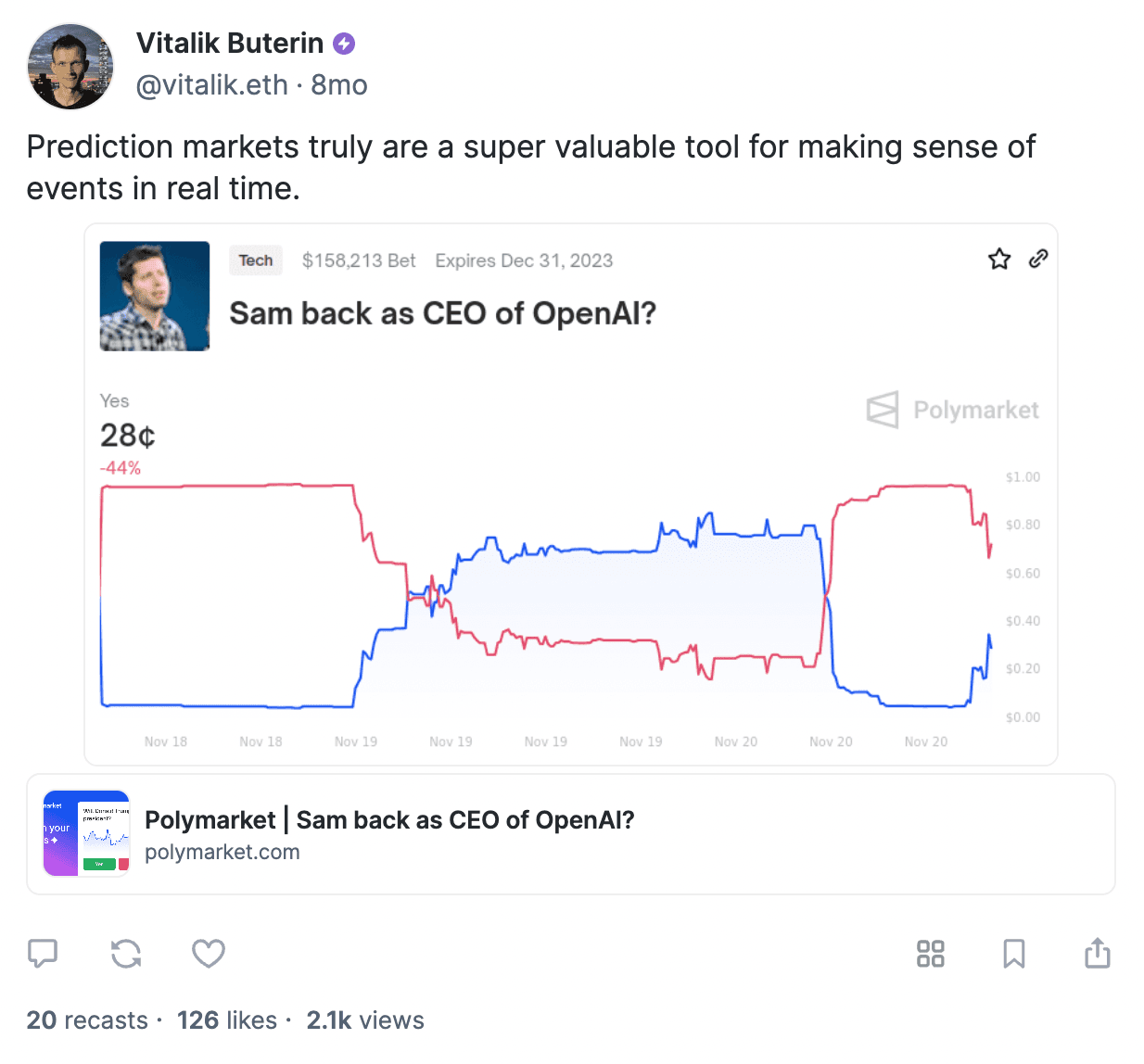

2024 is the year of prediction markets. We put that claim to print in April, arguing that the election cycle, mainstream media hype, and crypto’s appetite for speculation had created a perfect storm. It’s now clear that our call was right and this is the space’s breakout moment. And the big winner of this trend? Polymarket.

Crypto’s top prediction market is quickly becoming crypto’s hottest consumer application. But this is not just a buzzy trading venue—Polymarket is now a reliable predictor for major news events. The story the world is watching right now, of course, Biden vs. Trump. Polymarket traders have been on top of everything from Biden’s speech gaffes to the Trump shooting, often outpacing mainstream news services.

This boom has offered an early preview into how prediction markets could change the way we consume information on the Internet. In this deep dive feature, we explore Polymarket’s staggering growth, how UMA fits into the story, and why prediction markets are likely to have a big impact on our future.

Polymarket’s story

Polymarket is the world’s largest prediction market today. While it was an early entrant to the space, it was not the first. Launched in 2020 with support from a host of industry heavyweights, Polymarket was modeled on early ideas put forward by the likes of Vitalik Buterin and Augur, the pioneering prediction market that launched the first ICO on Ethereum in 2015.

Like other prediction markets, Polymarket lets people trade contracts on future event outcomes. When a market settles, shares trade for $1 or $0. Holders of the correct share receive a $1 payout when the market settles, and the price of each share fluctuates based on the market’s expectations of an event.

Polymarket wants to establish a reliable source of truth for the Internet.

Polymarket differs from traditional betting venues in that it’s built on Polygon so anyone can go and trade on it permissionlessly without going through KYC hurdles. Moreover, the house does not price any market and winners receive instant payouts.

Critics may be tempted to dismiss Polymarket as another hyper-financialized application built for degens who would bet on anything as long as the incentives align. But this view misses the forest for the trees. The platform’s core mission is to establish a reliable source of truth for the Internet.

In theory, people should be incentivized to vote for the right outcome because they have to put skin in the game. That means Polymarket can indicate what the world believes about the future.

Polymarket attracted attention as the broader crypto space did in 2021 then suffered as the space did the following year. Its vision for building a platform where anyone can bet on their beliefs took off in earnest this year.

As people are incentivized to vote for the right outcome, Polymarket can indicate what the world believes about the future.

At the time of writing, Polymarket’s top two markets—both of them offering traders a way to bet on the US election—have seen a combined $380 million in bets placed. The platform announced a $45 million Series B funding round in May with participation from Peter Thiel’s Founders Fund, Vitalik, and others. More recently, the team enlisted the celebrated statistician and author Nate Silver as an advisor as it eyes expansion.

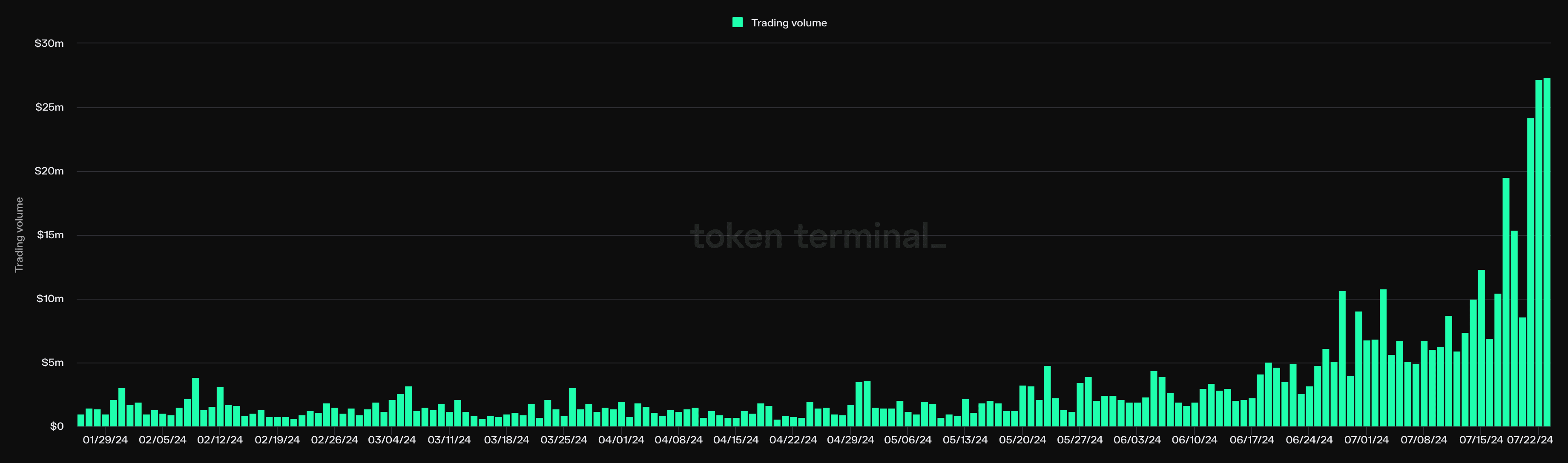

Trading volumes have jumped to new highs this summer, with over $100 million traded in June 2024, per Token Terminal data. The platform is currently on track to cross $200 million this month.

According to Dune Analytics data compiled by Richard Chen, over 35,000 new Polymarket accounts were created in June with another new all-time high in sight for this month.

Rising volumes are good for Polymarket as they signal rising adoption. Moreover, prediction markets are information aggregators. As they receive more information, they become more reliable.

A major critique against prediction markets is that they are prone to manipulation from well-capitalized market participants. But that argument carries less weight as markets grow in size.

Prediction markets are information aggregators. As they receive more information, they become more reliable.

As markets welcome more participants, more people use the information they have to signal their beliefs. These markets exercise the wisdom of crowds concept. Polymarket has proven that this model can be extremely effective, particularly in recent months.

Polymarket and the US political climate

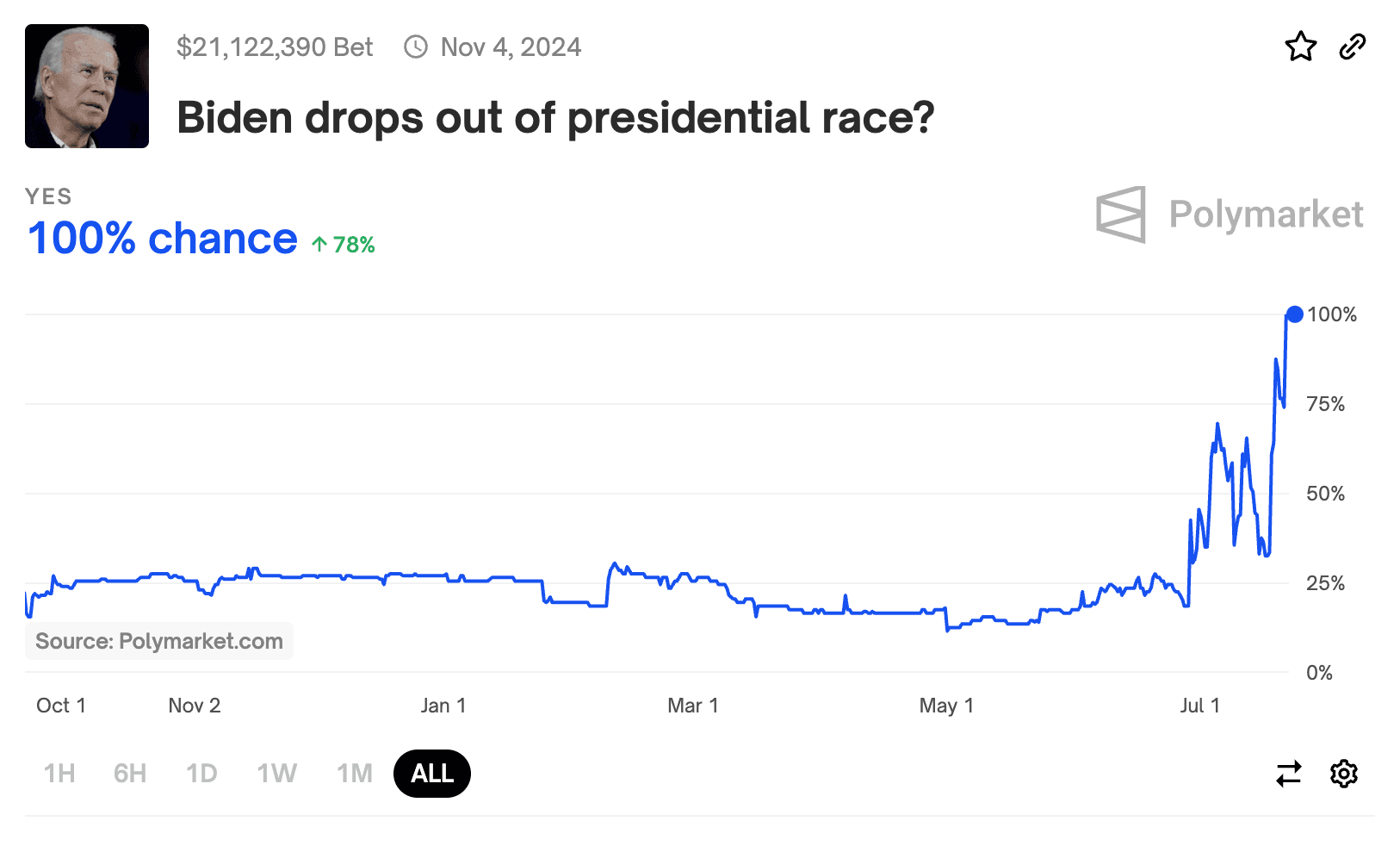

The upcoming stand-off between President Joe Biden and former President Donald Trump has been a major factor in Polymarket’s rise this year. But while the market for betting on the White House’s next leader is its hottest one, many others have taken off in response to the fast-moving political landscape.

Polymarket markets have fluctuated at a rapid speed in response to major events related to the election cycle. This means they act as a real-time tracker of market sentiment. Several markets have shown Polymarket’s growing importance on the world stage in the last few weeks alone.

A Polymarket share price signals how the world interprets big news events and what could happen next.

After Biden visibly struggled in a debate with Trump on June 27, the price for a share betting on his dropout from the election doubled from 20 cents to 40 cents overnight. This signals that traders thought there was a 40% chance of him stepping out of the race in response to his performance.

Later, when he confused Vice President Kamala Harris with Trump and Ukranian President Volodymyr Zelenskyy with Russian President Vladimir Putin at a NATO press conference, “yes” shares soared to 70 cents. Media outlets were quick to report on his gaffes and Polymarket traders weren’t far behind.

This market continued to swing as new updates on Biden’s possible dropout have emerged and even The Wall Street Journal picked up on it. The price for “yes” shares spiked once again when it was announced that Biden had caught COVID-19 and traded at 99 cents ahead of his dropout announcement. In the advent of prediction markets like Polymarket, it’s becoming more widely accepted that a share price can signal how the world interprets big news events and what could happen next.

Polymarket has become a real-time sentiment tracker for major events.

Polymarket also saw active trading around Trump’s VP pick in the lead-up to him announcing JD Vance on July 15. Vance was priced as an early favorite on Polymarket and peaked at 99% ahead of the announcement. The share price surged before any media outlet had reported on the news.

But the most notable Polymarket activity relates to the biggest news story of the year so far. Minutes after Trump survived an assassination attempt at a Pennsylvania rally on July 13, his odds of a victory surged to 70%. Trump has repeatedly referred to his election odds on Polymarket throughout his campaign.

A share price can signal how the world interprets big news events and what could happen next.

Since the shooting, conspiracy theorists on both sides of US politics have come up with convoluted ideas to suggest the event was a set-up. One Polymarket market questioned whether the shooter used a real gun; the market unanimously resolved to “yes” following a dispute, showing Polymarket’s ability to quash fake news.

As the November date draws closer, Polymarket is increasingly becoming a powerful source of information that tracks key updates related to the election.

How UMA secures Polymarket

Polymarket and other prediction markets face a big challenge: it’s difficult to bring information about the world onchain in a decentralized manner. Prediction markets deal with human language and ambiguity and the information differs from data such as asset prices.

Polymarket relies on UMA’s Optimistic Oracle to settle markets. The OO solves the problem prediction markets face because of its flexibility—the OO can verify natural language requests, which means it can serve any kind of data to smart contracts.

The OO’s ability to process human language sets it apart from price feed oracles. The OO can settle ambiguous cases, which is helpful for Polymarket. The OO has settled over 10,000 Polymarket markets at the time of writing and most go undisputed. Event outcomes are optimistically verified and raising a dispute requires a bond.

In dispute cases, $UMA tokenholders vote to settle the market. They decide on the correct outcome and the market settles based on the majority vote. Either the proposer or disputer receives the other party’s bond based on how the $UMA tokenholders vote. Additionally, $UMA tokenholders are rewarded for choosing the correct outcome or penalized if they vote incorrectly or no-show.

This system incentivizes honest participation because everyone has skin in the game. Though ambiguous language has occasionally led to contention over how markets should be settled, UMA has kept Polymarket secure as it expands its presence within the heart of the crypto ecosystem and global news cycle.

UMA is committed to supporting Polymarket on its mission to build a source of truth for the world. But the OO can power all kinds of prediction markets due to its flexibility. UMA is the preferred Web3 infrastructure for resolving prediction markets. In addition to Polymarket, the OO secures other projects like Bookies, FORE, and PolyBet.

Maybe you want to launch a sport-focused betting platform or crypto futures market on Base. If you’re building a prediction market, get in touch with our team and we’d love to help you bring your idea to life.

Polymarket in 2024 and beyond

We recently argued that 2024 was the year of prediction markets. Now that we’re in the second half of the year, our bet has come in and prediction markets are continuing to capture attention. This year, Polymarket became the place people look to when major world news breaks. We believe that this trend will continue before and after the election.

As Polymarket increasingly draws information and offers real-time predictions about the future, it’s inching closer to its goal of establishing a go-to source of truth for the Internet. Historically, our society has trusted news outlets to provide information and present it to the public. Things have changed as the world has entered the digital age. With the US political landscape as the backdrop, 2024 could be the year we look back on as a tipping point. Prediction markets could replace traditional news sources and this election is showing how.

As Polymarket fan Vitalik recently pointed out, crypto UX improvements like ERC-7683 could also pave the way for mass adoption in the future. We’re not yet in a world where people are placing bets on the future from the palm of their hands via the Polymarket app. But we think that world is coming.

We look forward to supporting Polymarket as the prediction market space continues to flourish.

References

Across and Uniswap Labs propose standard for cross-chain intents to accelerate cross-chain interoperability [@dreamsofdefi for Across Protocol]

Biden Mixes Up Kamala Harris and Donald Trump After Doing the Same With Zelensky and Putin [The New York Times]

Bookies integrates UMA’s Optimistic Oracle to power prediction markets on Base [@dreamsofdefi for UMA]

How to Design Indisputable Prediction Markets [Alex Gaines/@againes_ for UMA]

Nate Silver joins prediction market startup as more people bet on news [Axios]

Peter Thiel’s VC Firm Backs Election Betting With Polymarket Investment [Bloomberg]

Polymarket data [@rchen39 via Dune Analytics]

Polymarket data [Token Terminal]

The Hot New Trade That Everyone Is Watching: Will Biden Drop Out? [The Wall Street Journal]

Trump Assassination Attempt: What Happened? [BBC]

Trump shooting shows conspiracy theories not confined to right wing [The Guardian]

Who won the debate? Biden's incoherent debate performance heightens fears over his age [BBC]

Why 2024 is the year to build prediction markets with UMA [@dreamsofdefi for UMA]

Words by @dreamsofdefi