Why 2024 is the year to build prediction markets with UMA

Tldr; The prediction market space is growing fast, helped in large part by the upcoming US presidential election. UMA is well positioned to support the growth of decentralized prediction markets due to its ability to verify any kind of truth and publish it onchain.

Key takeaways:

Prediction markets like Polymarket are picking up steam in the lead-up to the 2024 US presidential election.

The crypto space has recently spawned alternative forms of prediction market as traders bet on assets like points derivatives and PoliFi memecoins.

UMA powers crypto’s largest prediction market and is useful for other similar projects because it verifies natural language requests.

Just over a year ago, UMA published a deep dive piece exploring the state of crypto’s prediction market landscape. In it, we argued that projects like Polymarket had “not yet fulfilled their potential.” To do so, they would need more liquidity and scaling improvements, we concluded.

Crypto moves at lightning speed, so a year is a long time. Prediction markets have exploded in popularity since we last covered the scene in depth. That’s partly thanks to the rising market; the total crypto market capitalization has jumped and Bitcoin recently breached all-time highs. But perhaps more importantly, the US will choose its next President later this year, driving a betting frenzy on the likely winner on platforms like Polymarket.

New innovations in crypto have also given rise to alternative prediction markets, but even outside of blockchain’s inner reeds, they’re attracting more mainstream interest than ever. In this piece, we look at what’s driving the interest, how UMA fits into the story, and what could happen next.

Why use prediction markets?

Prediction markets let people trade contracts on future event outcomes. If they correctly predict the outcome, they receive a payout. On most prediction markets, shares trade for $1 or $0 when a market settles, and the market determines the price of shares in the lead-up to an event. In theory, the market’s trading activity should reflect the probability of an event happening.

Crypto prediction markets like Polymarket have advantages over centralized services. You don’t need to ask anyone for permission or go through KYC to bet, the house doesn’t have an edge over you, and you get paid instantly if you bet on the right outcome.

But some believe in prediction markets for more philosophical reasons. Their biggest advocates argue that they are the modern world’s most reliable source of truth because they ask people to put their money where their mouth is.

When you have to vote with your wallet, you’re incentivized to find the truth. If you make the wrong prediction, you lose money — and people can see you were wrong. This argument is particularly pertinent in a post-truth world.

Prediction market advocates argue that they are the modern world’s most reliable source of truth because they rely on the wisdom of crowds.

This also means prediction markets can inform decision-making based on what the market thinks the right outcome should be. If you can see your fans voting in one direction, whether you’re an artist, brand, or politician, you can choose what you want to do based on their expectations.

Additionally, prediction markets are more flexible than traditional betting markets, allowing trading on almost any event. And they’re fun, especially for those who choose the right outcome.

Why UMA is a perfect fit for prediction markets

UMA’s Optimistic Oracle is designed to make it easy for builders to deploy new prediction markets. The OO verifies things about the world and then records the information on the blockchain. As it can verify natural language requests, it’s extremely flexible. If traders want to bet on the US presidential election winner, a government’s response to a terrorist attack, or whether Cillian Murphy will win an Oscar for Oppenheimer, the OO can verify the outcome after the event has passed.

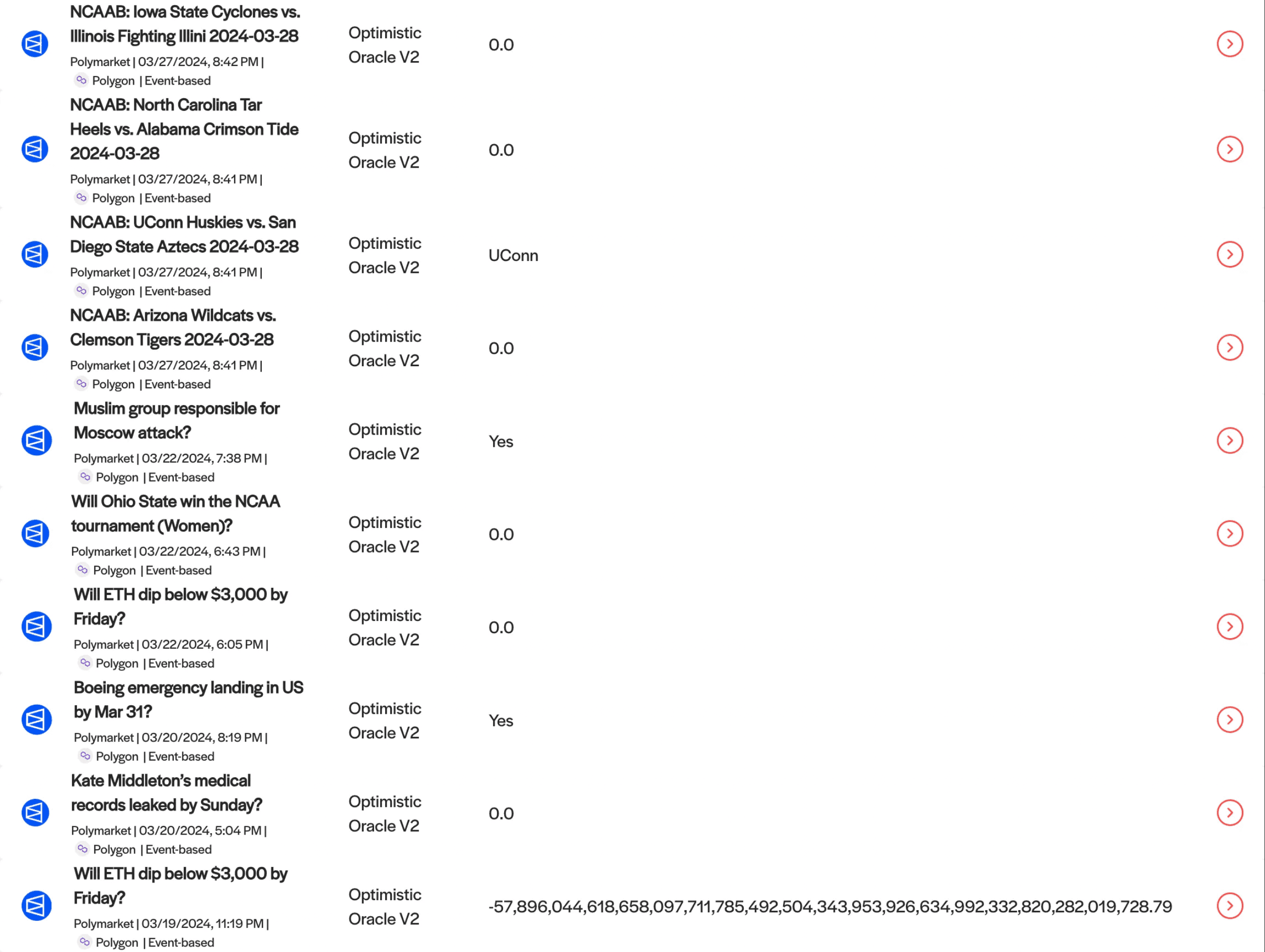

The OO differs from price feed oracles such as Chainlink in its ability to deal with ambiguity. It does not just bring prices onchain — it can serve any kind of data to smart contracts. The OO’s flexibility has made it a natural fit for Polymarket’s prediction markets. To date, the OO has settled over 8,000 Polymarket markets, most of which were resolved without dispute. The OO optimistically verifies event outcomes for Polymarket and $UMA tokenholders vote to settle markets when someone challenges the outcome.

In the past, ambiguous language on Polymarket has led to disputes and debates among $UMA tokenholders. Such incidents are a reminder of the importance of following best practices when launching a prediction market where money is on the line.

Polymarket is going from strength to strength as the prediction market scene grows. 2024 is its biggest year so far and the OO continues to power the platform smoothly and efficiently.

The prediction market landscape in 2024

Crypto-based prediction markets are not a new concept. Truthcoin (later named Hivemind) built a prediction market on Bitcoin in 2014, where BTC holders would use their coins to vote on events and get rewarded or penalized based on the winning vote. Augur was founded the same year and launched Ethereum’s first Initial Coin Offering in August 2015. Augur V1 launched as Ethereum DeFi was emerging in 2018.

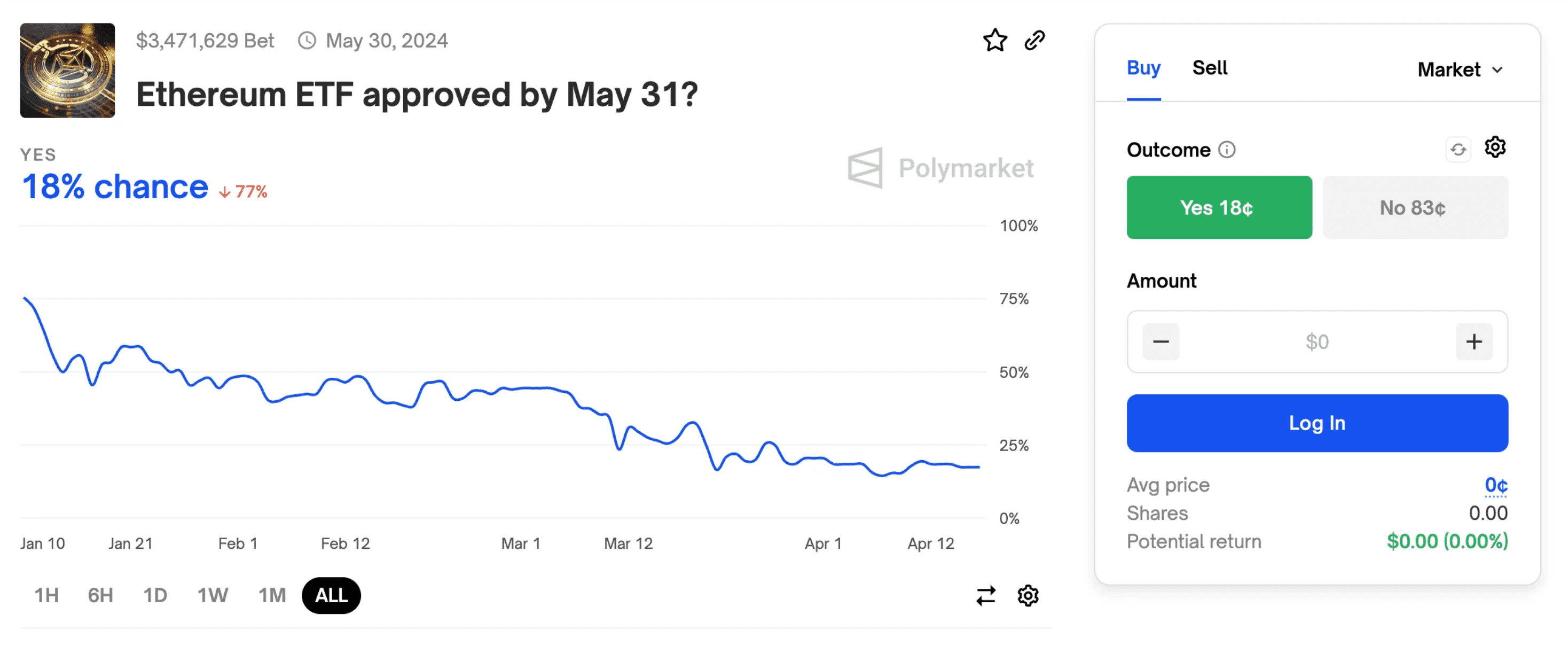

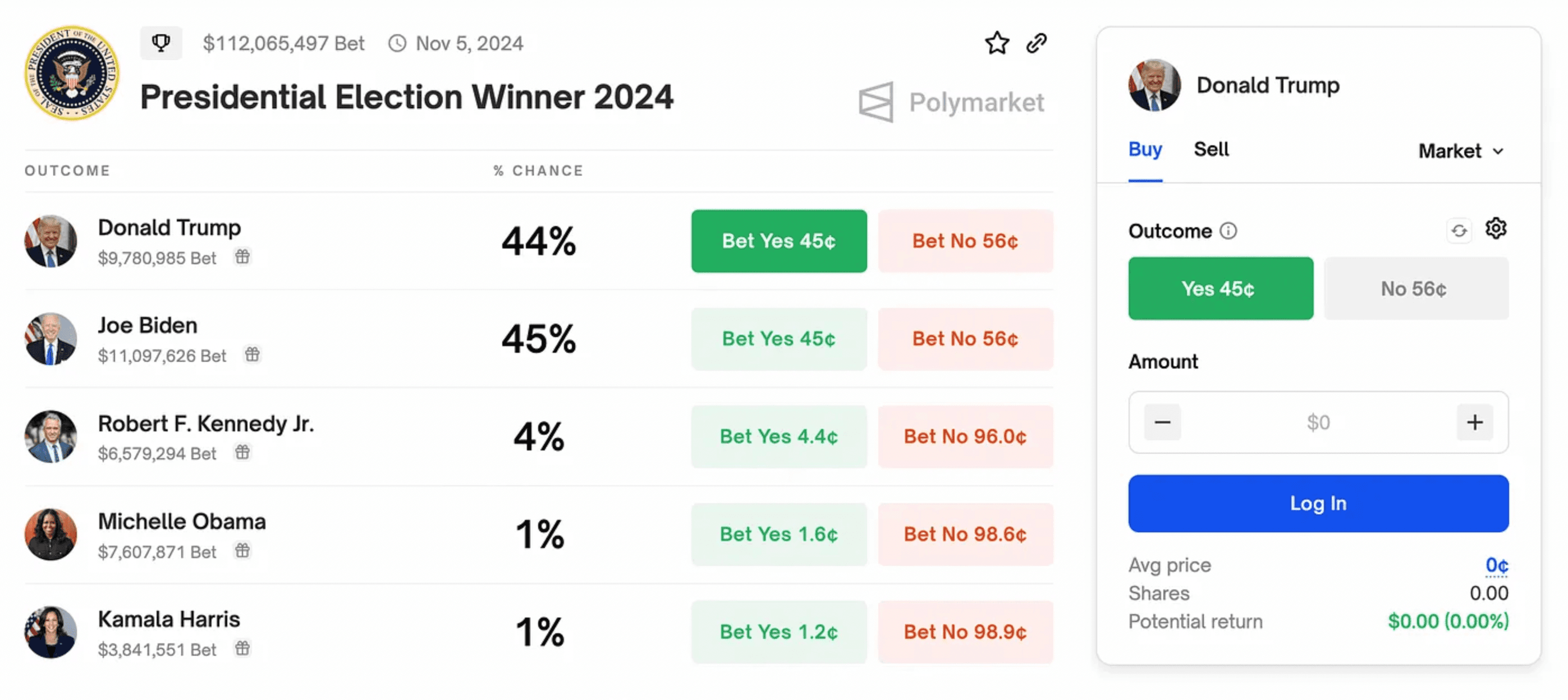

While prediction markets have taken on various forms in crypto over the last decade, adoption has only started to accelerate in recent months. This time last year, Polymarket’s most liquid market had about $2 million in volume. Today, traders have bet over $110 million on the winner of the 2024 US presidential election.

We can pinpoint several reasons for this. First, crypto is in the midst of a bull cycle with Bitcoin trading at highs. As more people enter the space and prices rise, more money can trickle into platforms like Polymarket.

Additionally, 2024 is an election year. While Polymarket trading is up across the board, its political-themed markets eclipse every other topic today. Anticipation for the election has driven people to bet on prediction markets and we have an idea of people’s expectations for November as a result.

Fake news and the post-truth era

One of the two leading horses on Polymarket’s “Presidential Election Winner 2024” market, Donald Trump, has also helped bring exposure to the platform, highlighting markets he features in to almost 7 million followers on his Truth Social platform.

During his campaign for the 2020 election, Trump became famous for calling out what he interpreted as “fake news.” So perhaps it’s unsurprising that he’s fond of prediction markets given that they’re designed to find the truth. In an era of growing distrust in traditional media and news outlets, prediction market proponents argue that asking people to put skin in the game curbs misinformation and false claims.

Fake news is not uncommon in today’s world but prediction markets can serve as a valuable source of fact checking. That’s because game theory suggests that people suggest vote correctly when money is on the line and they know they could be exposed.

How prediction markets become stronger as they grow

There is an argument against the fact-checking use case: prediction markets give leverage to rich people because they can use their outsized capital to influence the way markets trade. This means wealthy actors could use these markets to propagate misinformation or impact event outcomes.

Prediction markets are a source of information, gathering more information from more sources as they grow.

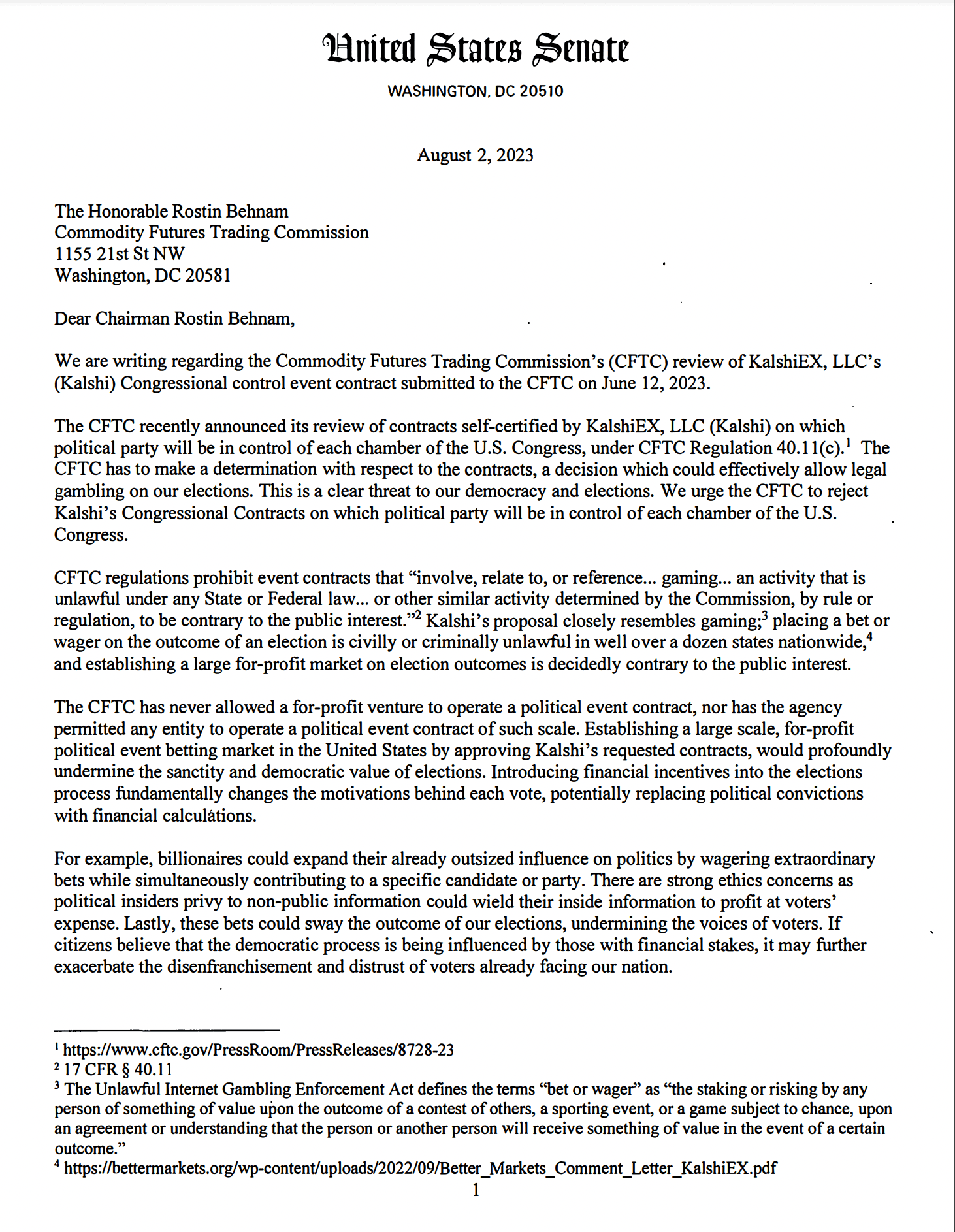

Six US senators raised this point to CFTC Chair Rostin Behnam in a joint letter in August 2023, saying that Congressional markets on the prediction platform Kalshi should be shut down as they were “a threat to our democracy and elections.” The US regulator obliged and the markets were halted.

But when they work, prediction markets are a source of information. They reflect the probability of an event outcome, and they gather more information from more sources as they grow. Put another way, they put the “wisdom of crowds” concept into practice.

The most liquid markets are usually the most accurate and they’re the hardest to influence. If you want to go and swing Polymarket’s market on the next US President, you need a lot of capital to have an impact.

In short, prediction markets get better as they get bigger. Today, crypto’s top prediction markets are as useful as they ever have been with ample room for growth.

Prediction markets in the mainstream

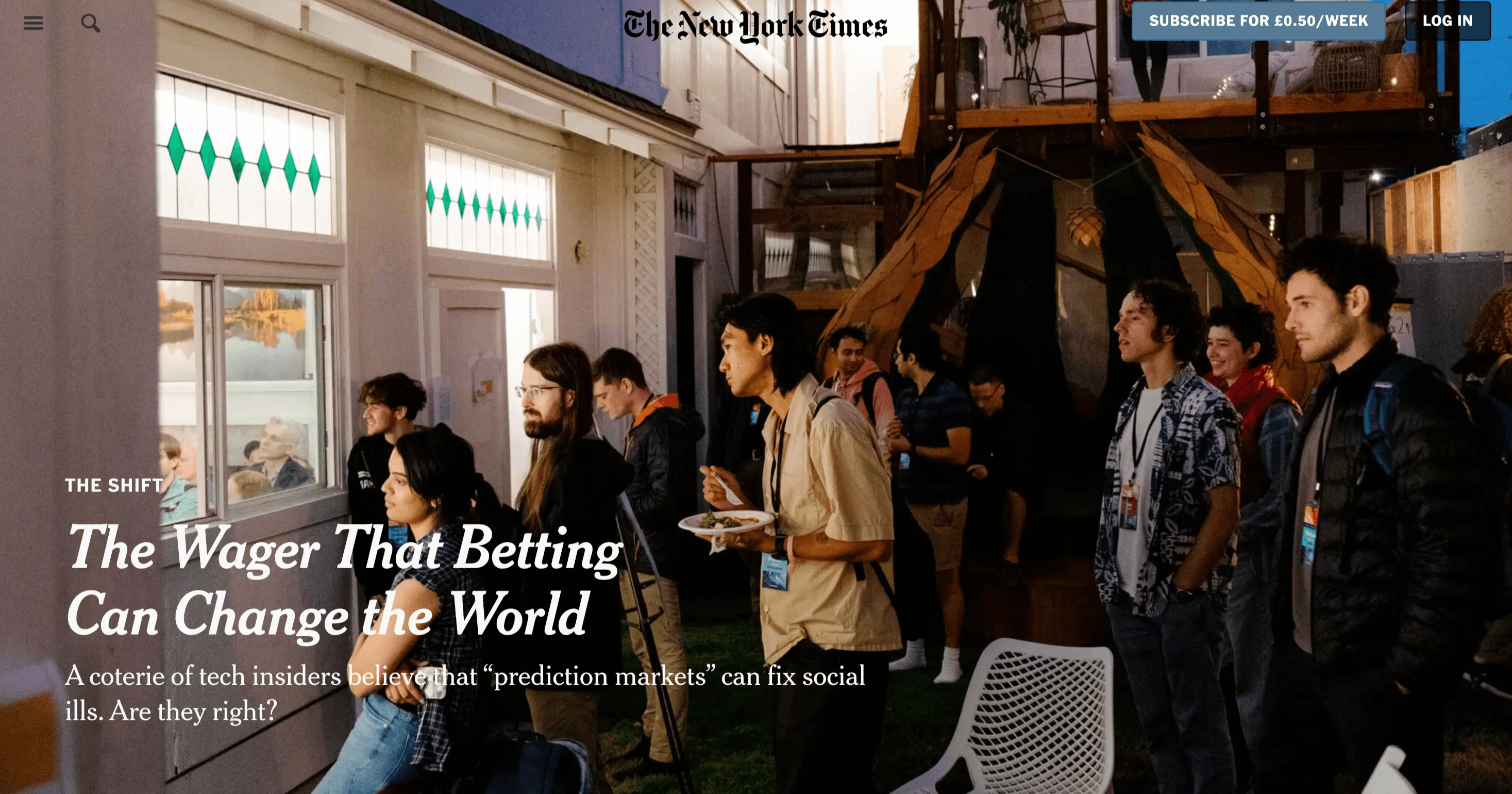

While prediction markets and crypto go hand in hand, they can work without blockchains. Manifold Markets is one example of a non-crypto platform, championed by prominent figures like the AI researcher Eliezer Yudkowsky and Aella, an X-famous sex researcher who launched a market titled “How many people will I have sex with at my birthday gangbang?” The New York Times profiled the platform’s Manifest conference in an October 2023 feature, writing that “trend-spotters have started looking at prediction markets for signs of the future.” Financial Times also explored how political betting has soared on prediction markets last year.

When mainstream media is covering a trend, that usually means it’s no longer a niche topic. Or at least, not as niche as it once was. Similarly, the US senators urging the CFTC is a sign of prediction markets gaining momentum outside of a small bubble of believers.

There’s a good chance that Polymarket will gain more exposure in the lead-up to the presidential election if money continues to flood into its biggest market. As with Bitcoin and the rest of the crypto market, press coverage attracts attention, which attracts more money, which attracts more attention, and so on.

How crypto has spawned alternative prediction markets

In a sense, any market that lets people bet on a future event outcome is a form of prediction market. In the crypto space today, speculating on how assets will be valued in the future is one of the technology’s most popular use cases.

Crypto traders use derivatives to long or short assets in hopes of securing profits. Futures trading first took off through centralized exchanges, but as DeFi has matured, platforms like GMX and dYdX have offered new ways for traders to make onchain bets on the market’s future.

Crypto futures trading has further evolved over the past year amid an increase in points and airdrops. Aevo listed $JUP futures ahead of Jupiter’s January 2024 airdrop, effectively creating a perp based on the asset’s funding rate on the exchange. Pendle, meanwhile, lets EigenLayer points farmers leverage or hedge against their points by buying or selling tokenized future yields. Vega also launched an EigenLayer points futures market in March, using UMA’s Optimistic Oracle to settle markets once an airdrop gets confirmed. These markets are evidence of the DeFi’s space’s growing appetite for experimentation in asset trading. But at their core, the ideas are pretty simple. In offering traders a way to value assets ahead of time, they are not a world apart from prediction markets like Polymarket.

Alongside points and airdrops, memecoins have been one of the dominant niches of 2024 in crypto. Most memecoins have a few classic hallmarks: they’re usually based on a funny meme or figure, they offer nothing in the way of fundamental value, and they have large token supplies to ensure the per-unit price always looks affordable. Recent standouts in this niche such as dogwifhat and Pepe carry these hallmarks.

PoliFi memecoins like $TREMP and $BODEN are an alternative form of prediction market.

As the memecoin space has expanded, some of the most popular memes have leaned into the same topic that dominates the prediction market scene: politics. So-called “PoliFi” assets like MAGA, Doland Tremp, and Jeo Boden have exploded because they make fun of the top presidential candidates at the perfect time. But they have also risen for more pragmatic reasons: they let people ride a meme as a way of betting on an event outcome. In this case, the event is the election and people can bet on Tremp or Boden based on their prediction for November. While silly on the surface, PoliFi memecoins have found success partly because by acting as an alternative form of prediction market.

What’s next for prediction markets?

So far, 2024 has been a big year for prediction markets. With a crypto and election cycle converging, there’s ample room for prediction markets like Polymarket to grow. The implications here are significant because these platforms get more useful as they grow. While prediction markets are not short of critics, their criticisms are likely to lose potency if these markets grow by another order of magnitude. The utopian vision for prediction markets calls for a future where the crowd can verify anything, from news to event outcomes and video content. While this future is likely decades away, growing disillusionment with traditional media and AI’s rapid rise suggests that it is possible.

In the crypto sphere, Polymarket has been the big winner of this emerging boom. But speculation on assets like points derivatives and memes hints that we’re still extremely early in the prediction market lifecycle. Based on recent market trends, we can easily imagine a future where people could bet on many different kinds of real-world events through Polymarket tokenized futures contracts, memes, and other innovations.

And all of this bodes well for UMA. So if 2024 is the year of prediction markets, what happens next? If we had to bet on it, we’d say the future looks bright.

UMA is free to use and integrate. To find out how to get started, visit our website.

References

CFTC Announces Review of Kalshi Congressional Control Contracts and Public Comment Period [CFTC]

Crypto promised us prediction markets. Is it delivering? [@dreamsofdefi for UMA]

Prediction markets can tell the future. Why is the US so afraid of them? [Oliver Roeder for Financial Times]

US Senate letter to CFTC [United States Senate]

The Wager That Betting Can Change the World [Kevin Roose for The New York Times]

Truthcoin Protocol on BTC [Hivemind]

Words by @dreamsofdefi