Tldr; Nexus Mutual, the onchain insurance alternative that protects DeFi users, has integrated oSnap to make its governance process more trustless and efficient. Nexus Mutual has served as a vital shield for DeFi since its inception and this update illustrates the value oSnap adds to the ecosystem.

Key takeaways:

Nexus Mutual has integrated oSnap as the project commits to decentralized DAO governance.

With oSnap, Nexus Mutual can execute the outcomes of governance votes onchain in a trustless and efficient manner.

Nexus Mutual is one of several DeFi pillars to adopt optimistic governance with oSnap, highlighting the solution’s usefulness across the ecosystem.

oSnap has quickly become a popular solution in the DAO ecosystem. Since launching in February 2023, the UMA-developed “Optimistic Snapshot Execution” tool has helped a wide variety of organizations get governance done in a truly decentralized manner. UMA made oSnap free to integrate to accelerate the industry as a whole and the solution continues to achieve that goal.

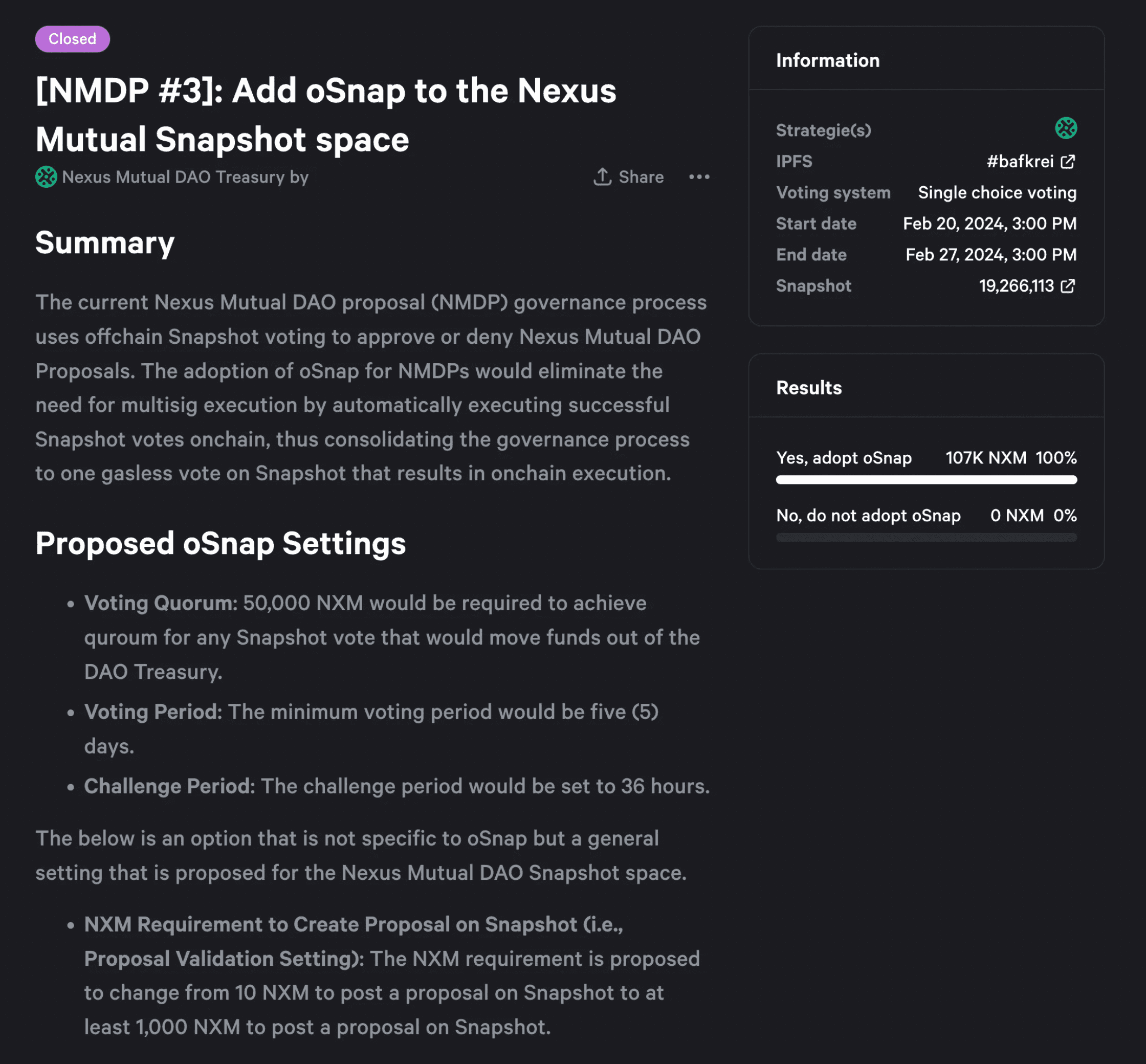

Many leading DeFi projects have integrated oSnap to trustlessly execute treasury-related governance decisions. Today we can announce another addition on the fast-growing list as Nexus Mutual has passed a governance vote to integrate oSnap. Nexus Mutual is a longstanding DeFi staple known for pioneering onchain protection and oSnap will streamline the DAO’s operations.

Nexus Mutual’s integration follows other DeFi favorites like CoW Protocol, Connext, and ShapeShift. As more and more projects embrace optimistic governance, oSnap has seen rapid growth, now securing over $525 million. We detail how Nexus Mutual will use the solution below.

oSnap explained

oSnap is a simple tool that helps DAOs embrace optimistic governance. It uses Snapshot’s gasless voting mechanism with Safe wallets, offering a way for DAOs to execute the outcomes of governance votes onchain without falling back to a central party. UMA’s optimistic oracle verifies transaction data, meaning governance decisions can be executed “optimistically” when a vote passes.

Put another way, oSnap enables “Optimistic Snapshot Execution.” This allows DAOs to get governance done without relying on teams or multisig wallet co-signers, making them more efficient and trustless.

In Nexus Mutual’s case, $NXM tokenholders will vote on proposals through Snapshot as normal. oSnap offers automated onchain execution, wherein a bot can automatically post a 2 $WETH bond to make an assertion to UMA when a vote passes. The transaction will get executed onchain if no one disputes the assertion within a challenge window, otherwise $UMA tokenholders will vote to resolve the bond. Disputers must also post a bond and $UMA tokenholders determine which party receives the other party’s bond. This mechanism uses incentives to ensure honest participation. As it’s costly to make an incorrect proposal or dispute, they are extremely rare.

How oSnap will benefit Nexus Mutual

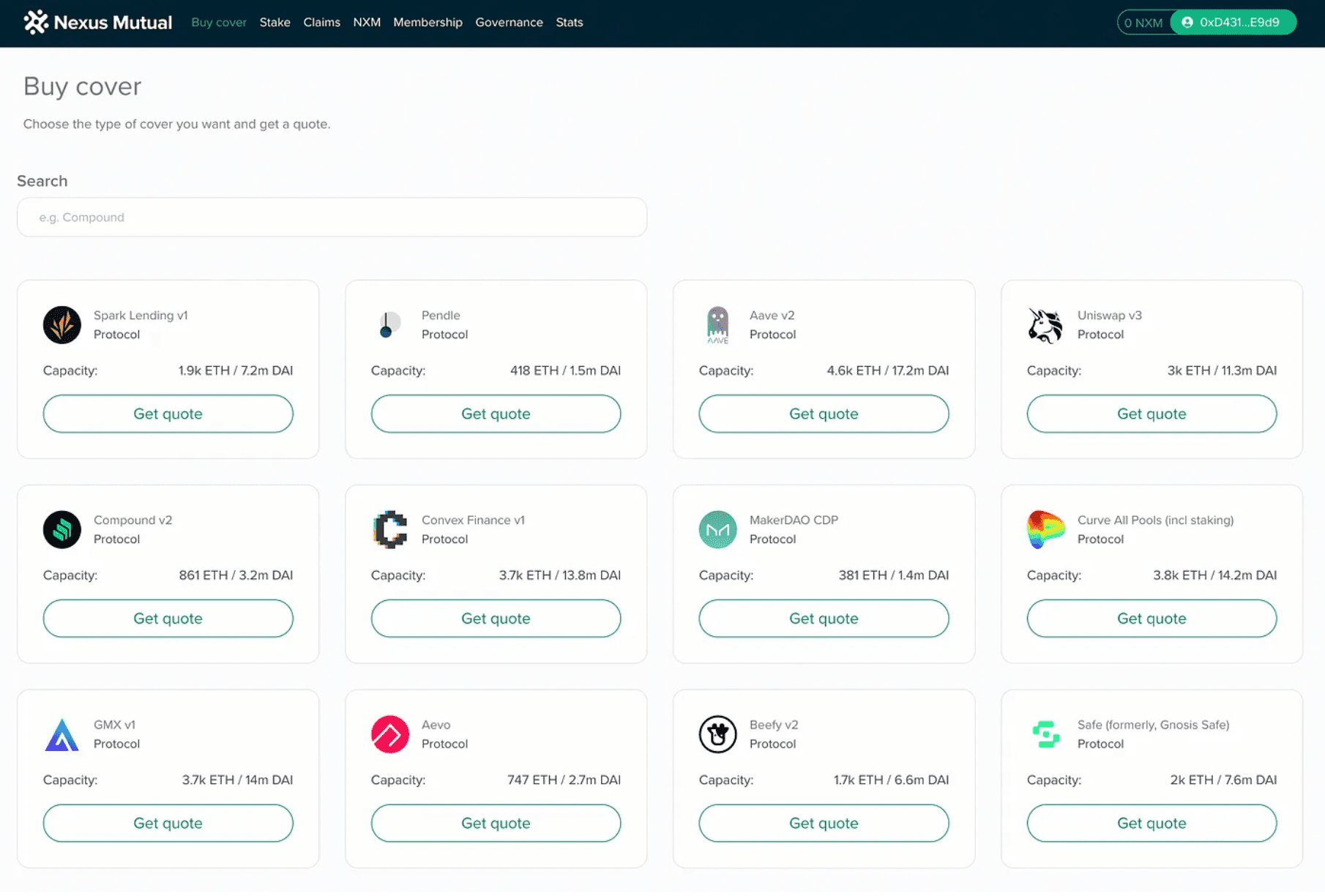

Nexus Mutual is widely viewed as one of the most essential projects in Ethereum’s DeFi ecosystem. Launched in 2019, it pioneered onchain cover as an insurance alternative for avid DeFi explorers. To date, the mutual has underwritten $4.5 billion in cover for assets on protocols like Uniswap, Aave, and Curve, resulting in over $18 million in payouts.

After multiple crypto cycles, Nexus Mutual is still serving as a vital shield for DeFi. If DeFi is to cater to the masses, it’s likely that insurance alternatives like Nexus Mutual will be widely adopted to protect users.

oSnap will support Nexus Mutual on its mission by helping the DAO maintain DeFi’s core tenet: decentralization. Adopting optimistic governance removes the DAO’s reliance on multisig wallets and fast tracks onchain execution. Executing transactions for budget requests is just one example of a potential use case for the DAO.

To strengthen security, Nexus Mutual has made several customizations to the oSnap parameters: at least 50,000 $NXM is required to reach quorum on votes for moving treasury funds, the minimum voting period is five days, and the minimum challenge period is three days. Additionally, the DAO added a Snapshot specification that DAO members must hold at least 1,000 $NXM to post a proposal.

Despite these small parameter fixes, Nexus Mutual will enjoy the same benefits as other oSnap: a path to seamless DAO governance without foregoing decentralization.

Securing the DAO ecosystem’s future

oSnap launched just over a year ago and has since welcomed a host of Web3’s foremost DAOs. In addition to Nexus Mutual, the likes of CoW Protocol, Connext, Across, and Shapeshift have adopted the solution to do DAO governance better.

oSnap is helping these cornerstone projects achieve that goal through Optimistic Snapshot Execution. However, we believe that it’s still early for the solution. oSnap secures $525 million across the DAO ecosystem today and many DAOs are yet to embrace the benefits of optimistic governance. oSnap will be there to support them once they do.

oSnap is free to integrate and only takes a few minutes to turn on. It’s been audited by OpenZeppelin. To learn more about integrating the solution into your project, please fill out our partnerships form, DM us on X, join the UMA Discord server, or reach out at integrations@uma.xyz.

Words by @dreamsofdefi