Liquidations are crucial to DeFi. But they’re broken

Tldr; As demand for loans is high in DeFi, liquidations play an important role in the ecosystem. Lending protocols have different liquidation models but all of the leading protocols liquidate significant amounts of collateral to maintain their health every year. Lending protocols generate value during liquidations, but that value gets lost to the MEV supply chain.

Key takeaways:

DeFi lending protocols offer users easy access to leverage. To take out a loan, borrowers must post collateral.

When loans become undercollateralized, lending protocols sell the collateral at a discount to avoid accruing bad debt.

Liquidations are crucial to DeFi, but they’re broken because the value gets lost to the MEV supply chain.

DeFi has created endless opportunities for market participants. The DeFi ecosystem replicates many activities found in the traditional finance system, but in building on permissionless blockchains, it makes them accessible to a much wider user base.

DeFi lending has proven particularly successful. Demand for leverage is high in DeFi as users want to access the abundance of opportunities available to generate returns. To get leverage, they can borrow assets from lenders. The lenders put up their capital because they earn yield from the borrowers. Neither the borrowers nor the lenders need to visit their local bank branch or fill out any forms to participate — anyone can put up or take out a loan without asking another party for permission to do so.

But lending protocols must ensure that loans are overcollateralized, so they ask borrowers to deposit capital. After all, as some of crypto’s major blow-ups of the last few years have proven, issuing loans without requiring collateral is extremely risky.

Borrowers take on risk as they could get liquidated for their collateral. Liquidations are common in DeFi because crypto is volatile. In this piece, we detail why liquidations happen, how lending protocols take different approaches to liquidate positions, and the important role they play in the ecosystem.

Understanding DeFi liquidations

If a borrower’s position becomes undercollateralized, it’s in the lending protocol’s interest to liquidate their collateral as quickly as possible to avoid accruing bad debt. Protocols have different liquidation models, but most DeFi blue chips take one of two approaches: fixed spread liquidations or auction-based liquidations.

Lending protocols sell collateral at a discount because they need to avoid accruing bad debt.

Fixed spread liquidations

Aave and Compound are two of the biggest lending protocols on Ethereum. Both projects use a fixed spread liquidation mechanism, otherwise known as a liquidation bonus or liquidation discount factor.

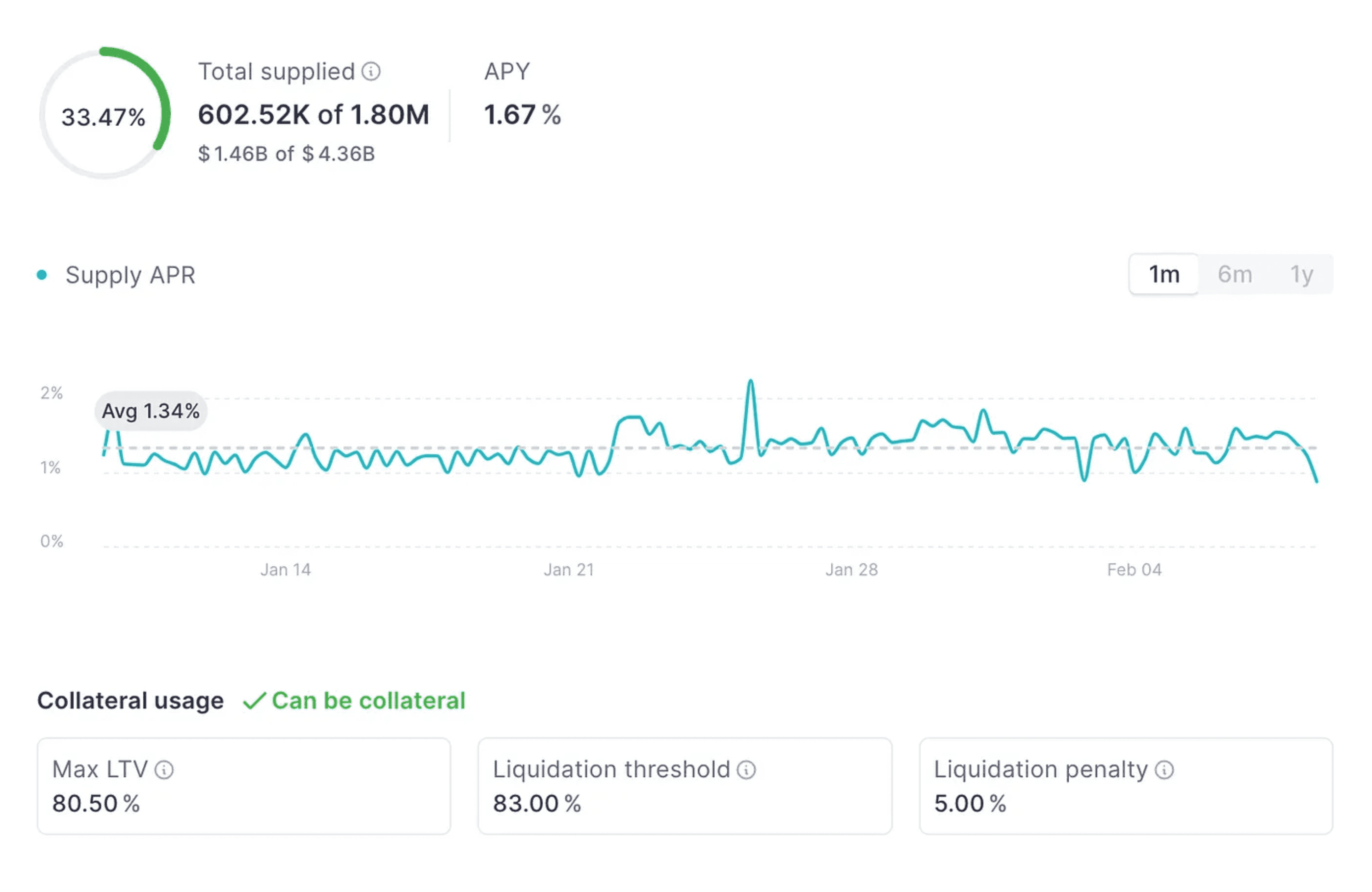

Let’s consider Aave’s lending markets. When a user wants to take out a loan, they deposit collateral. Most users deposit volatile assets such as $ETH as collateral to borrow stablecoins.

Aave’s supported assets have a loan-to-value (LTV) percentage, which represents the maximum amount that can be borrowed against an asset. For example, if an asset’s LTV is 80% and the user provides $1,000 as collateral, they can borrow $800. The more a user borrows against their collateral, the higher their LTV ratio and risk of liquidation.

Borrowed assets also have a liquidation threshold, which is based on the LTV ratio. The liquidation threshold represents the point at which an asset becomes undercollateralized. If a user takes out a loan with a liquidation threshold of 80% LTV, their collateral value must always exceed 80% of the loan’s value to avoid a liquidation.

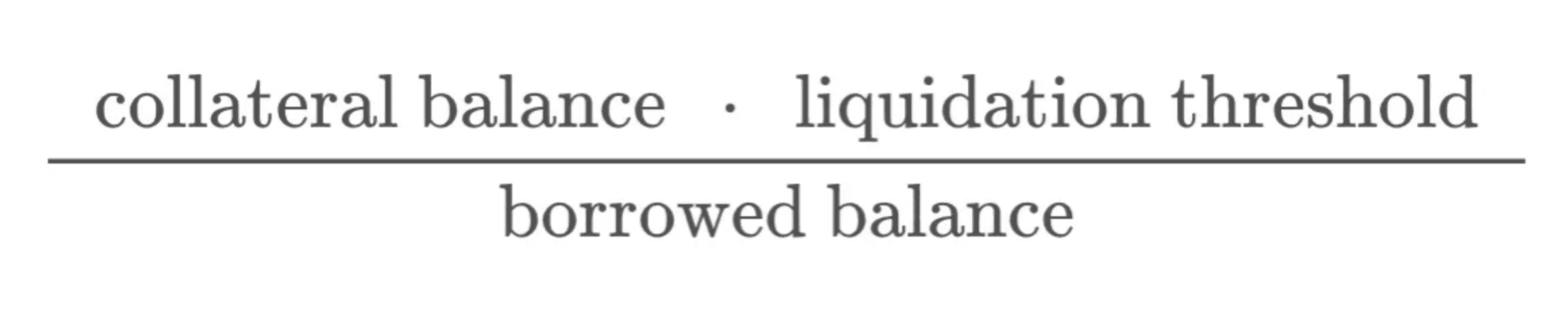

Aave uses a health factor formula to calculate when loans can be liquidated. The health factor represents the safety or “health” of a borrower’s collateral. It can be calculated as follows:

For example, with a collateral balance of $1,000, a liquidation threshold of 80%, and $500 borrowed, the borrower’s health factor would be 1.6.

Borrowers must maintain a health factor of at least 1. When the health factor drops below 1, their position can be liquidated.

Making a fixed spread liquidation

DeFi loans also have what’s called a close factor, which represents the amount of debt that can be repaid by a liquidator. On Aave, liquidators can typically repay up to 50% of a borrower’s debt, though V3 introduced Variable Liquidation Close Factor, allowing a position to be fully liquidated when the health factor drops below 0.95. Other protocols like dYdX also let liquidators close 100% of a borrower’s debt.

Borrowed assets have a liquidation penalty, sometimes referred to as a bonus or spread. Liquidators buy collateral at a discount and keep the penalty as a bonus. On Aave, the spread typically ranges from 5% for $ETH and stablecoins to 15% for more volatile assets, though V3 introduced an “Efficiency Mode” where borrowers can get a higher LTV and lower penalty when their collateral and loan track closely in price, such as levering up on $stETH. Additionally, in Aave V3, the Aave DAO takes 10% of the liquidation bonus.

Liquidators effectively pay off a portion of the borrower’s debt for the right to claim the bonus. This means they can claim a greater profit from collateral with a higher spread.

For example, if the borrower deposits $1,000 worth of $ETH and the liquidation threshold is 80%, they can borrow up to $800 worth of $DAI and a liquidation can be executed when their collateral value drops below $800.

If the collateral’s value drops below $800, the liquidator can repay the $400 loan to buy the collateral and pocket the bonus. Aave’s liquidation penalty is 5% for $ETH, so the liquidator effectively buys the borrower’s deposit for an equivalent price of $1,000 / 1.05 = $952.38.

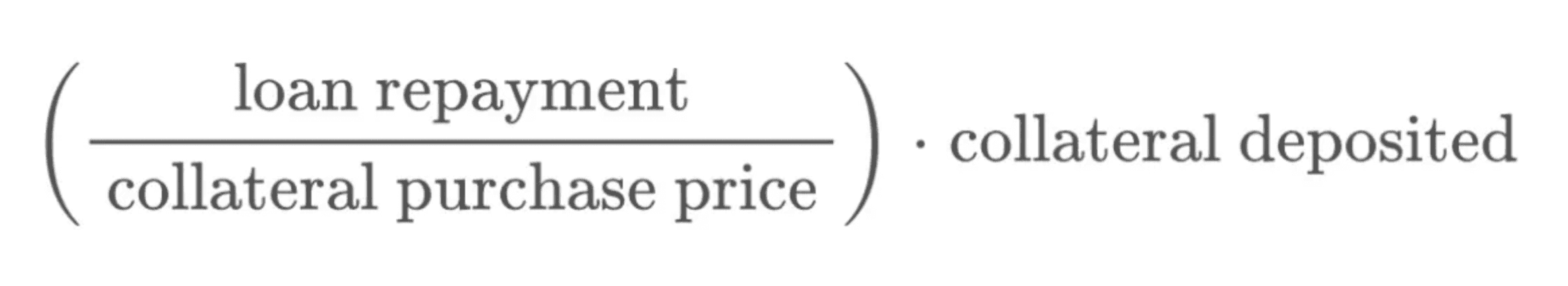

The liquidator’s return can be calculated as follows:

$400 / $952.38 x $1,000 = $420

The liquidator repays $400 and receives $420, leaving them with a profit of $20.

As there is a financial incentive to liquidate positions, competition is high. As a result, fixed spread liquidations are executed quickly by sophisticated bots.

Liquidators also have gas fees to consider, as they often need to swap between different types of collateral. If network congestion is high, liquidation bots risk overpaying on gas to win the right to liquidate a position, rendering their transaction unprofitable.

Auction-based liquidations

Unlike Aave and Compound, Maker runs auctions to liquidate positions when Vaults become undercollateralized.

Maker Vaults have a liquidation ratio. If the collateral in a Vault drops below this ratio, the protocol holds an auction where liquidators bid until the debt plus a liquidation penalty are covered. Liquidations occur in a Dutch auction format, where the price of collateral decreases until a bidder enters a bid for the right to buy the collateral at a certain price.

Making an auction-based liquidation

Maker’s auction format is profitable for liquidators when auctions close below the collateral’s market value.

For example, if the liquidation ratio for $ETH is 150% and the borrower wants $1,000 in $DAI, the value of their collateral must always exceed $1,500. If the position becomes undercollateralized, bidders enter a Collateral Auction for the right to buy the collateral.

If the borrower’s collateral drops to a value of $1,400, the collateralisation ratio is only 140% and the position must be liquidated. The auction determines the price bidders will pay to cover the outstanding debt and liquidation penalty. If the auction closes at $1,300, the winning bidder makes $100 minus the liquidation penalty and transaction fee.

As the borrower’s collateral gets sold at a discount, Maker also runs Debt Auctions, where bidders buy $MKR. They bid with $DAI to cover the shortfall on the collateral. Debt Auctions increase $MKR’s circulating supply. Maker finally runs Surplus Auctions, where bidders buy $DAI fees collected in vaults. They bid with $MKR and the proceeds get burned, reducing the circulating supply.

Collateral Auctions last until a bidder steps in, which means they are subject to time delays. With the Dutch auction mechanism, liquidators can get a better price for collateral by waiting to bid, but they are in competition with other bidders. It’s in the borrower’s interest for them to bid as quickly as possible, as this minimizes their losses.

As with fixed spread liquidations, Maker’s auctions are competitive, and liquidators must consider transaction fees in order to be profitable. Additionally, if market conditions are particularly volatile, liquidators risk overpaying for collateral when they enter an auction, as the price may decline further after their bid.

Why liquidations are key to DeFi

With both fixed spread liquidations and auction-based liquidations, liquidators aim to acquire collateral at a discount, either by claiming a bonus or winning an auction below market value.

Lending protocols sell collateral at a discount because they need to avoid accruing bad debt. Protocols risk accruing bad debt if borrowers default on loans and their collateral becomes less than the value of the loan (plus gas fees) because they have no incentive to pay it off. When protocols accrue bad debt, lenders are unable to withdraw their funds.

Put another way, lending protocols must ensure that liquidators have an incentive to buy collateral at an attractive price relative to its market value to avoid bad debt. Liquidators stand to profit when the close factor and liquidation spread are higher, as this determines the amount of collateral they can liquidate and keep as a bonus.

As DeFi has evolved, value extracted by liquidators has increasingly been lost to the MEV supply chain.

On Aave, the spread for most assets is around 5%, with borrowers facing higher penalties on more volatile assets. The top liquidators expect to profit from undercollateralized borrowers because they get a discount of at least 5% each time, amounting to meaningful returns.

But as DeFi has evolved, value extracted by liquidators has increasingly been lost to the MEV supply chain. The borrower gets penalized when their collateral drops, searchers compete with each other to have their liquidation included, and as a result, they lose their profit as bids to block builders and proposers.

Protocols need to make liquidations happen to stay solvent. These liquidations generate value, but in the current system, the value gets lost outside of the system that created it. We’ll discuss this in more detail in part two of this series.

DeFi liquidations in history

The total sum liquidated in DeFi history is difficult to quantify. But while quotes vary across different sources, it is widely accepted that the number is high.

A Risk Labs analysis found that Aave and Compound have both liquidated over $1 billion worth of collateral, implying returns of over $50 million for each protocol’s liquidators based on a 5% spread (according to the analysis, the actual numbers are even higher).

During volatile market conditions, DeFi protocols are more prone to liquidations. To date, the most extreme example of such conditions has been “Black Thursday,” when the crypto market tanked over 50% in a day in response to COVID-19.

This was an extreme stress test for DeFi because myriad loans became undercollateralized due to $ETH’s sharp decline. During the events, gas prices soared, oracles started reporting outdated prices, and Maker accrued bad debt due to liquidators claiming collateral for free. Black Thursday highlighted the drawbacks of Maker’s auction system and showed that even the most robust protocols can suffer from bad debt.

When markets experience volatility akin to Black Thursday, liquidations occur in so-called “cascades,” where many positions are forced into liquidation in quick succession. Liquidation cascades can cause sharp declines in asset prices, as seen on countless occasions in DeFi’s history.

Market turbulence aside, lending protocols have also been impacted by the advent of flash loans. As flash loans do not require liquidators to post any collateral, borrowers can use them for strategies such as “self-liquidating” a position before it becomes undercollateralized and swapping collateral when they can not pay a debt. Flash loans are divisive due to their prominence in hacks but they have advantages for technically-proficient DeFi borrowers.

A key DeFi innovation

In summary, we’ve explained why liquidations are important in DeFi, detailing the different mechanisms lending protocols use to ensure that they maintain healthy balances. Liquidators play a crucial role in this system as they help protect protocols from insolvency, and in return they get to buy collateral at a discount.

DeFi liquidations are a crucial innovation. They keep lending protocols healthy and generate value, but in the current system, much of the value gets lost to MEV. Liquidations are broken — we’ll explore how Oval provides a fix in part two of this series.

For the next piece in this series, we’ll explore the impact MEV has had on DeFi, how lending protocols lose value in liquidations through Oracle Extractable Value, and what UMA is doing to make the ecosystem healthier with Oval.

References

Aave V2 & V3 OEV via Liquidation Bonuses [Risk Labs via Dune]

An Empirical Study of DeFi Liquidations: Incentives, Risks, and Instabilities [K Qin, L Zhou, P Gamito, P Jovanovic, A Gervais]

Compound V2 & V3 Liquidation Incentives [Risk Labs via Dune]

Crypto Black Thursday: The Good, the Bad, and the Ugly [Emilio Frangella via Aave]

Liquidations on Aave [Aave Document Hub]

Optimal Bidding Strategy for Maker Auctions [M Darlin, N Papadis, L Tassiulas]

The Auctions of the Maker Protocol [MakerDAO Technical Docs]

The MEV Supply Chain: a peek into the future of this industry [Flashbots]

Words by @dreamsofdefi