Tldr; Morpho lets market creators opt to capture OEV with Oval. Using Oval on Morpho Blue markets mitigates the risk of accruing bad debt while boosting lending yields, offering an insight into how the solution can help lending protocols thrive.

Key takeaways:

Morpho is a disruptive lending primitive that aims to compete with DeFi’s early lending staples. The protocol is also pioneering MEV capture with Oval.

Morpho lets users permissionlessly create markets and vaults. Those users can opt to capture OEV with Oval when selecting the parameters for a new market.

Oval revenue will be used to offset bad debt and boost lending yields, which means these markets should be safer and more attractive to lenders.

Morpho’s use of Oval highlights how MEV capture can improve DeFi and help lending protocols grow.

UMA has had an eventful 2024 so far. Many new DAOs have adopted oSnap, growing interest in prediction markets has highlighted the Optimistic Oracle’s limitless potential, and we’ve been part of Layer 2’s staggering growth. But perhaps our biggest update of the year has been the launch of Oval, the MEV capture mechanism built to create revenue streams for lending protocols.

Oval recently scored a win in the DeFi ecosystem as Morpho started letting market creators use it to capture OEV during liquidation events. Morpho is a novel lending primitive and this move to pioneer MEV capture cements the project’s place at DeFi’s cutting edge.

Morpho markets will benefit from using Oval because any revenue generated will go towards clearing bad debt and boosting lending yields. This illustrates why capturing OEV and lending on Morpho is attractive. It also shows how Oval can help lending protocols grow in the future. We explain more below.

How Morpho leaks OEV

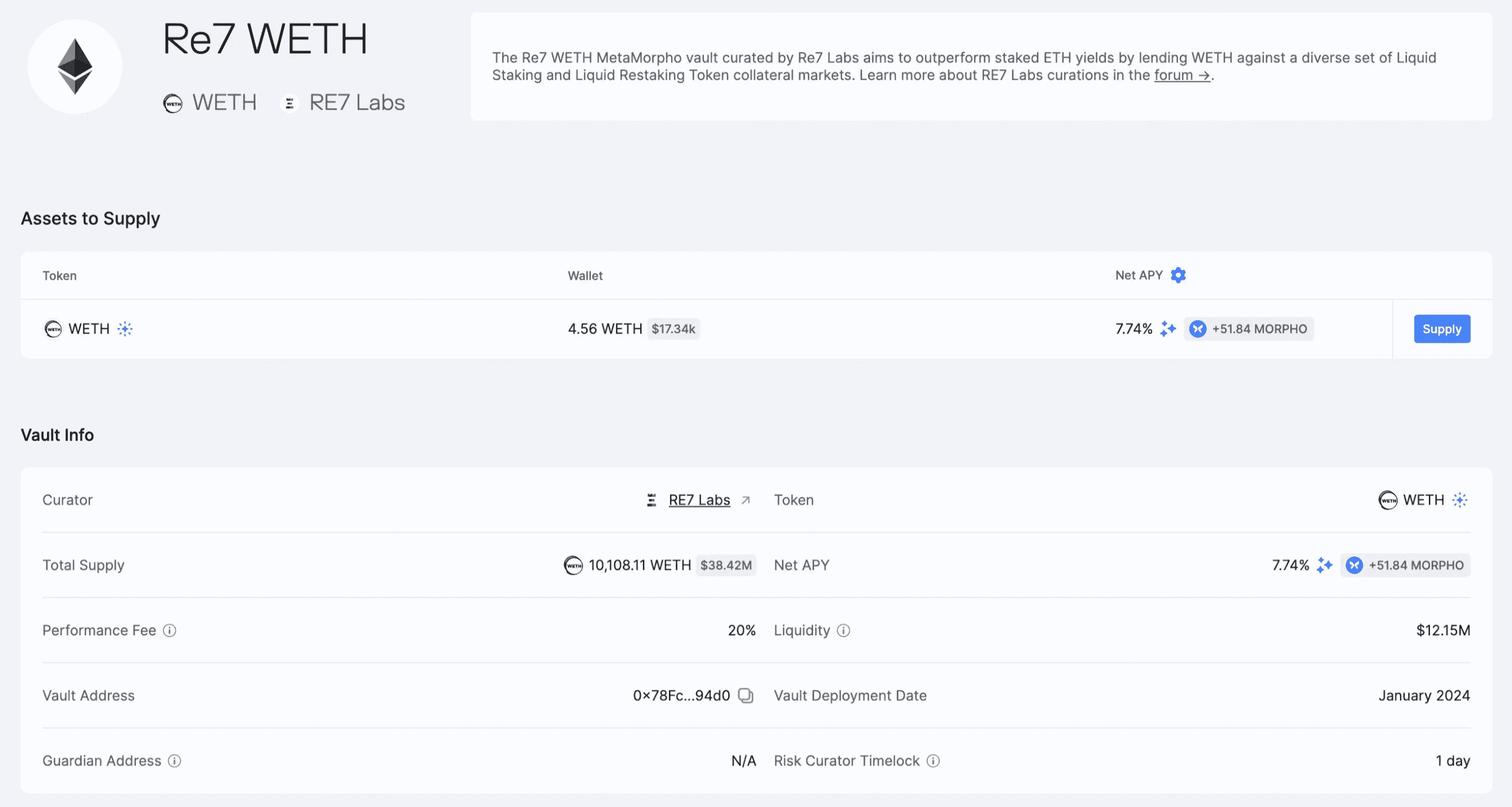

Morpho is a next-generation lending protocol that aims to compete with DeFi’s early lending projects. It differs from other solutions by offering permissionless creation of isolated markets. On Morpho Blue, anyone can create a market, and on MetaMorpho, anyone can create a vault with access to several markets.

Similar to other lending protocols, Morpho Blue markets use permissionless liquidations to close undercollateralized positions. Loans are underwater when the loan-to-value exceeds the liquidation loan-to-value (otherwise known as the LLTV or liquidation threshold).

MEV searchers can step in to close underwater positions and they earn a Liquidation Incentive (otherwise known as the bonus) for doing so. As Morpho must ensure liquidations happen swiftly, the bonus is set conservatively high.

Searchers compete to liquidate positions to claim the bonus. When an oracle price update exposes an underwater position, they compete to claim the discounted collateral. To ensure that their transaction gets included, they use a portion of the bonus to bribe block builders with “tips.” Block builders then pay off block proposers.

Morpho Blue markets have leaked an estimated $2.4 million worth of OEV to the MEV supply chain. Oval could have reclaimed that sum.

The leaked value is a type of MEV known as Oracle Extractable Value. Every DeFi lending protocol that uses permissionless liquidations leaks OEV today. Our calculations indicate that liquidators pass on up to 90% of their bonus. A Risk Labs study found that $2.7 million has been paid in Liquidation Incentives on Morpho Blue, of which an estimated $2.4 million worth of OEV has leaked out of the Morpho ecosystem.

This $2.4 million is a meaningful sum that markets could have reclaimed with Oval.

How Oval captures OEV

Morpho Blue markets currently leak OEV when searchers make liquidations. Oval lets the market capture this value by wrapping oracle price updates and funneling searchers into an order flow auction in Flashbots’ MEV-Share infrastructure. The price gets locked and searchers must bid for the right to use it. The winning bid essentially determines the true market price for the liquidated collateral.

Searchers still claim a reward when they liquidate a position, but a portion of their bid goes to the protocol rather than getting leaked to block builders and proposers. This is how Oval generates revenue.

The below process details how liquidations occur with Oval:

An oracle price update gets submitted to the mempool.

Liquidators submit liquidation transactions with a bid to Oval’s node.

Oval’s node bundles unlock transactions and liquidation transactions and sends them to MEV-Share.

MEV-Share releases bundle and refund parameters to block builders.

Builders select the highest bid and include the searcher’s backrun transaction immediately after the oracle price update.

Builders submit blocks to the proposer.

The proposer appends the most profitable block to the blockchain.

Oval does not delay new prices for any longer than the auction period. If an auction expires with no winner, the newest price automatically gets released. This ensures that liquidations occur quickly.

While Oval has offchain centralized components, they are designed to provide no new risks. If the Oval node went rogue, it would only be able to steal the OEV from builders and proposers. How Oval will benefit Morpho markets

In Morpho’s case, users can opt to capture OEV with Oval when they create a market on Mopho Blue. Managers can select this option when choosing other parameters such as the liquidation threshold and interest rate model.

Still, Morpho managers should consider appropriate risk parameters when launching a market. Using Oval requires selecting an auction period; Oval’s maximum delay is set to two blocks by default but extending it can ensure no OEV gets missed. In general, extending the maximum delay is more risky for more volatile assets.

Oval will benefit Morpho markets in two key ways:

Offsetting bad debt

Boosting lending APYs

When Oval captures OEV, it will be redistributed to Morpho with the goal of incentivizing growth. The revenue will go directly to the market it was captured in, ensuring markets remain independent.

Incentivizing lenders creates healthy market dynamics that should help the protocol grow. Increasing APYs should attract more lenders, which should attract more borrowers. This should help Morpho scale and compete against other lending projects that are yet to embrace OEV capture.

Those who use Oval can deploy a simple Oval wrapper contract when selecting their price feeds for a given market to start capturing OEV. Learn more about using Oval on Morpho’s markets via Morpho’s governance forum.

MEV capture and DeFi’s future

Few would argue that Morpho has accelerated DeFi. The protocol’s permissionless market creation feature was a unique offering, helping the project stand out from its competitors.

Now that Oval can capture OEV on Morpho’s markets, lenders have a greater incentive to launch them. Enabling Oval will boost yields for lenders while reducing the risk of accruing bad debt.

Morpho is a DeFi trailblazer and we believe its use of Oval will inspire other lending protocols to consider how they can benefit from MEV capture. Oval can supercharge growth for lending protocols by generating revenue that goes towards maintaining protocol health. Morpho is about to prove it.

To learn more about Morpho, visit the Morpho Blue app. To learn more about Oval and find out more about how your protocol can benefit from MEV capture, visit the website.

Words by @dreamsofdefi