Tldr; Oval, the MEV capture mechanism built by UMA, is set to reclaim OEV on Morpho’s lending markets. The groundbreaking lending primitive’s managers can select Oval to reclaim OEV generated through their permissionless markets and a portion of Oval revenue will be used to boost yields across lending pools, lowering risk and bolstering growth.

Key takeaways:

Oval will reclaim OEV leaked during liquidations generated on the fast-growing lending primitive Morpho.

Morpho Blue lets users permissionlessly create and manage isolated markets. Risk managers offer lenders access to multiple markets through vaults while borrowers interact directly with markets based on their risk tolerance.

With Oval, managers can opt to capture OEV when they create a market. If a market uses Oval, Morpho will capture OEV when searchers liquidate positions.

A portion of the Oval revenue generated during liquidation events will go towards protecting lenders from bad debt. The remaining OEV will be used to boost lending rewards on Morpho Blue.

DeFi is constantly evolving. From Layer 2 scaling to real-world assets and liquid restaking, many new innovations have helped the space thrive in recent years. Morpho is one of DeFi’s most promising emerging offerings.

Morpho is a novel lending primitive that aims to challenge early lending staples like Aave and Compound. But unlike Ethereum’s early blue chips, the project’s Morpho Blue protocol lets users permissionlessly deploy vaults and markets, offering flexibility and efficiency. Morpho has seen rapid growth in 2024, now holding ~$1.8 billion in locked value.

Today we can announce a major update for Morpho and the DeFi lending space as a whole as market creators now have the option to reclaim OEV with Oval. Markets that use Oval will capture MEV during liquidation events and then redirect it back to the markets as lending rewards.

MEV capture presents a new opportunity for protocols like Morpho and we believe it could be disruptive across DeFi. Oval is an innovative MEV capture tool. Oval should help incentivize adoption on Morpho Blue’s markets while showing other similar protocols how they can benefit from MEV capture. We explain more below.

What is Oval?

In Ethereum DeFi, MEV searchers use various strategies to extract value during block production. One popular strategy involves liquidating undercollateralized positions on lending protocols when oracle price updates expose liquidation opportunities. During DeFi liquidations, searchers buy discounted collateral to secure a profit, but they pass most of this profit (up to 90%) on to block builders and proposers to ensure their transaction gets included in a block. “Oracle Extractable Value” refers to the sum that gets leaked to the MEV supply chain.

Oval is a MEV capture mechanism built to let protocols reclaim the value that would otherwise go to block builders and proposers. Developed by UMA in collaboration with Flashbots, it wraps prices served by Chainlink Data Feeds and runs an order flow auction in Flashbots’ MEV-Share. The proceeds from the auction go back to the protocol instead of the MEV supply chain.

Oval reclaims the value generated during liquidation events instead of leaking it to the MEV supply chain.

DeFi lending protocols lose significant sums to OEV every year. Oval was built to offer those protocols a simple way to reclaim the lost value. While lending protocols have only recently begun to explore the possibilities of MEV capture, we believe many will come to embrace it as the ecosystem grows.

About Morpho

Morpho is a novel lending primitive that aims to compete with today’s most established lending protocols. Its core focus is making DeFi lending more efficient. Morpho is working to achieve this goal through two core products: Morpho Blue and MetaMorpho.

Morpho Blue is a permissionless lending protocol. Anyone can become a manager and create a market, where they can select the asset they want to lend, the liquidation threshold, the oracle, the interest rate model, and so on. This design differs from early lending protocols like Aave, which typically manage risk on behalf of users. For lenders, this offers greater freedom and flexibility when searching for ways to generate yield on their capital. Borrowers, meanwhile, can select according to their risk appetite and get greater capital efficiency. This is because they can borrow more against their collateral than they typically would be able to on other markets.

MetaMorpho is a protocol built on top of Morpho Blue. It lets risk managers create vaults with access to multiple Morpho Blue markets. Lenders can deposit assets to vaults to capture yield and the vault creators can earn revenue.

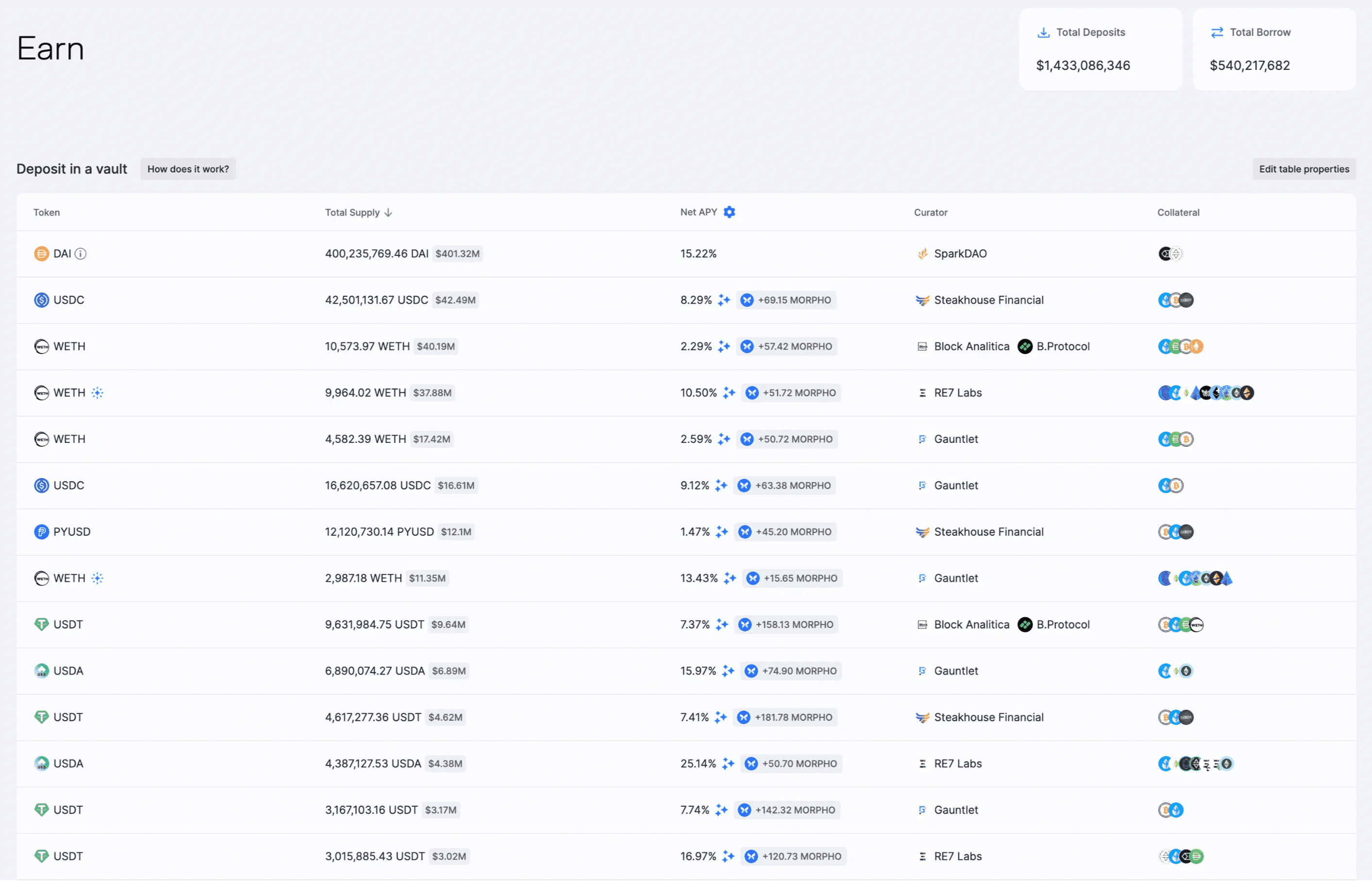

Morpho holds about $1.4 billion from lenders at the time of writing while borrowers have taken out $540 million. As an example, a borrower can deposit $wstETH to take out $USDC at a liquidation loan-to-value (LLTV) of 86% and a cost of 8.22%. So if the borrower deposits $10,000, they can take out up to $8,600.

How Morpho Blue markets can capture OEV with Oval

Positions on Morpho Blue markets can be liquidated when the loan-to-value exceeds the LLTV (also known as the liquidation threshold). If the borrower takes out $8,600 but $wstETH drops in value, the position is undercollateralized and liquidators can close the position.

MEV searchers liquidate positions to make a profit. On Morpho Blue, the close factor is 100%: liquidators can close the entirety of an account’s debt to claim the collateral plus a Liquidation Incentive (also known as a bonus). The size of the bonus depends on the market’s LLTV.

Oval should reduce the risk of accruing bad debt and boost lending rewards on Morpho Blue markets.

To date, when oracle updates have exposed an underwater position on Morpho Blue, searchers have claimed the bonus and used a portion to bribe block builders, then the builders have paid block proposers to get the transaction included. Oval is designed to capture this leaked value.

Lowering risk and boosting yields with Oval

On Morpho Blue, the Oval revenue will be used to promptly clear any protocol debt from loan defaults. The remaining revenue will be used to enhance yields across the protocol’s markets to incentivize lending. This has significant benefits for lenders: Oval-enabled markets will minimize risk and offer higher yields.

Oval-enabled markets should attract lenders because they will minimize risk and offer higher yields.

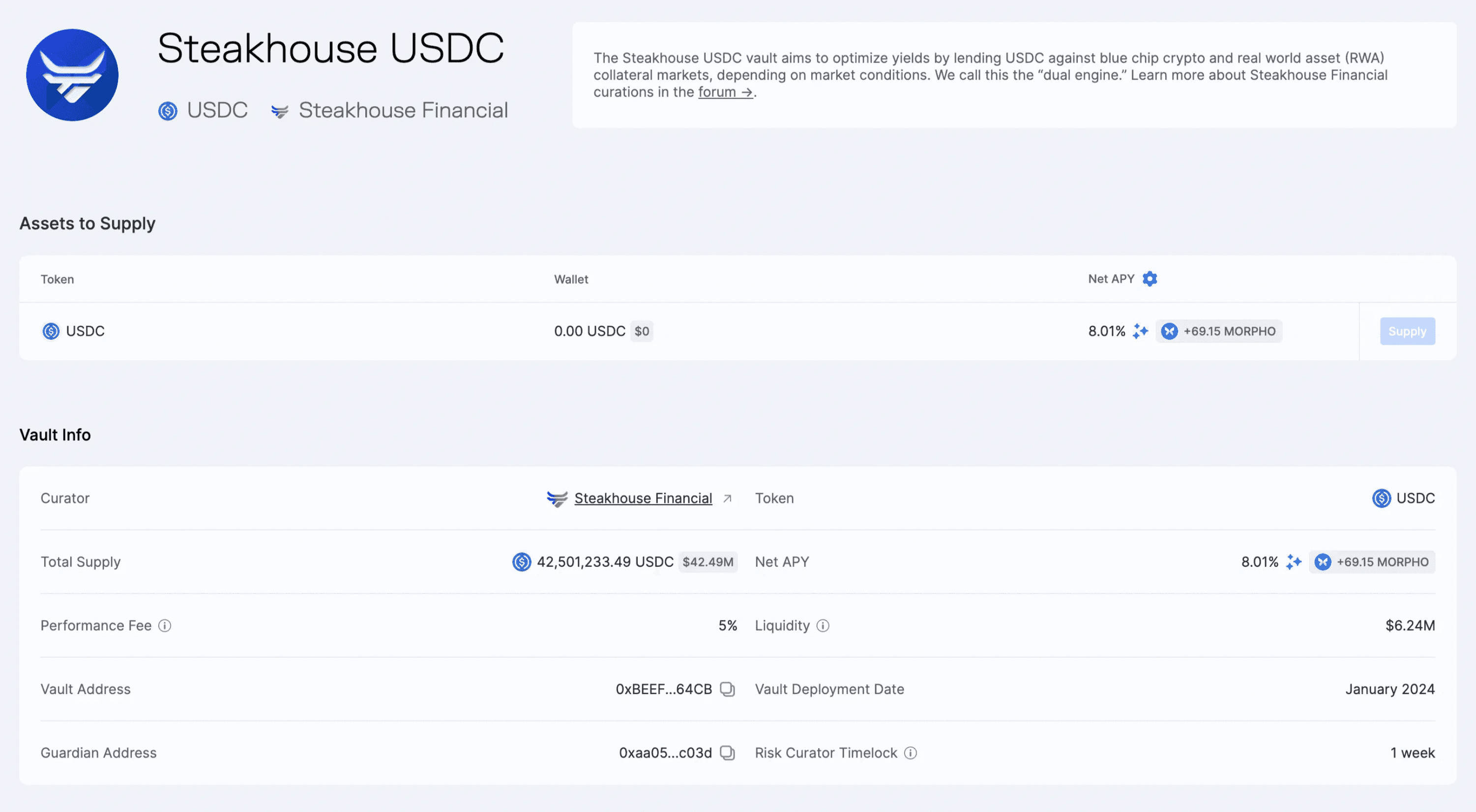

It’s worth noting that Morpho Blue lenders already receive attractive yields including $MORPHO incentives. For example, depositing $USDC into Steakhouse Financial’s biggest vault earned 8.01% at the time of writing, most of which is paid in $MORPHO.

With this model, Oval should reduce Morpho Blue’s risk of accruing bad debt and support new markets by encouraging lenders to deposit their capital. UMA will receive no revenue generated from Oval for a six-month period — the full sum will be redirected back to the same market it was generated in. The plan to distribute Oval revenue to incentivize Morpho lenders is detailed further on Morpho’s governance forum.

As DeFi evolves, MEV capture is becoming an increasingly hot topic, particularly among lending protocols like Morpho. Due to Morpho Blue’s permissionless nature, it’s likely that many market creators will default to capturing OEV when they launch markets in the future. Oval can help here.

Embracing MEV capture with Oval presents an exciting growth opportunity for Morpho since markets will be more attractive to lenders. We can easily imagine a world where Morpho and other solutions that reclaim OEV win market share from their competitors. This could lead to wider Oval adoption in the future.

How MEV capture will change DeFi lending

Oval will benefit Morpho by letting market creators opt to capture OEV. With Oval, Morpho Blue markets can mitigate the risk of accruing bad debt and offer greater incentives to lenders. This should encourage healthy growth, potentially allowing the protocol to win greater market share in the DeFi lending space.

On a broader level, Morpho’s use of Oval is a step forward for DeFi. Lending protocols leak value to the MEV supply chain every time they make a liquidation. It’s time for them to capture the value they generate instead. Morpho is blazing the trail here and we hope today’s announcement inspires other lending protocols to look at how they can earn from OEV instead of losing out.

To learn more about Morpho, visit the Morpho Blue app. To learn more about Oval and find out more about how your protocol can benefit from MEV capture, visit the website.

Words by @dreamsofdefi