UMA and Polymarket are Building a Next-Gen Prediction Market Oracle using EigenLayer

TL;DR

UMA, Polymarket, and EigenLayer are collaborating on research for building a next-gen prediction market oracle.

This collaborative approach will also take into consideration input from interested stakeholders on building an oracle that can better serve users, scale quickly and remain secure under rapid growth.

Some research ideas include developing an oracle that can support multiple tokens for dispute resolution, to allow prediction markets to better align with their communities.

We are also researching additional features like dynamic bonding, AI agent integration, and enhanced security against bribery attacks.

We invite feedback from market participants, community members, and researchers to help shape the future of this next-gen oracle.

Prediction markets, led by Polymarket, are in the limelight for their ability to cut through bias, misinformation, and noise—offering real-time, skin-in-the-game predictions that are more reliable, wide-ranging, and decentralized than ever before.

As prediction markets grow in popularity, we need oracles that are more adept at verifying natural language long-tail markets and that are more aligned with users. UMA’s optimistic oracle (OO) has led the charge to date, helping to resolve complex markets with unparalleled economic security.

Now, in collaboration with Polymarket and EigenLayer, we are conducting research to build the next-generation oracle – one that can align with users, scale quickly, and become much more secure under rapid growth.

Prediction Market Oracles Today

Prediction markets require oracles that can resolve truths as diverse as election outcomes or the number of times Tim Walz will say the word “Couch” in a debate. Additionally, some markets are expected to include subjectivity from creation, while others unexpectedly become subjective due to events between market creation and resolution.

Most oracle systems are not capable of handling human-readable questions or subjectivity. AI may be able to aid in this process but does not yet have the trust or economic security required to independently resolve markets.

Oracles for prediction markets need to be able to resolve a wide range of natural language questions with varying amounts of subjectivity. For this reason, prediction markets cannot rely only on price feed style oracles that publish data from API sources onchain. The optimistic oracle meets the needs of prediction markets by responding to any type of natural language question. Proposed answers can be disputed by anyone during a single challenge period, although in practice, disputes only occur on about 1% of proposals.

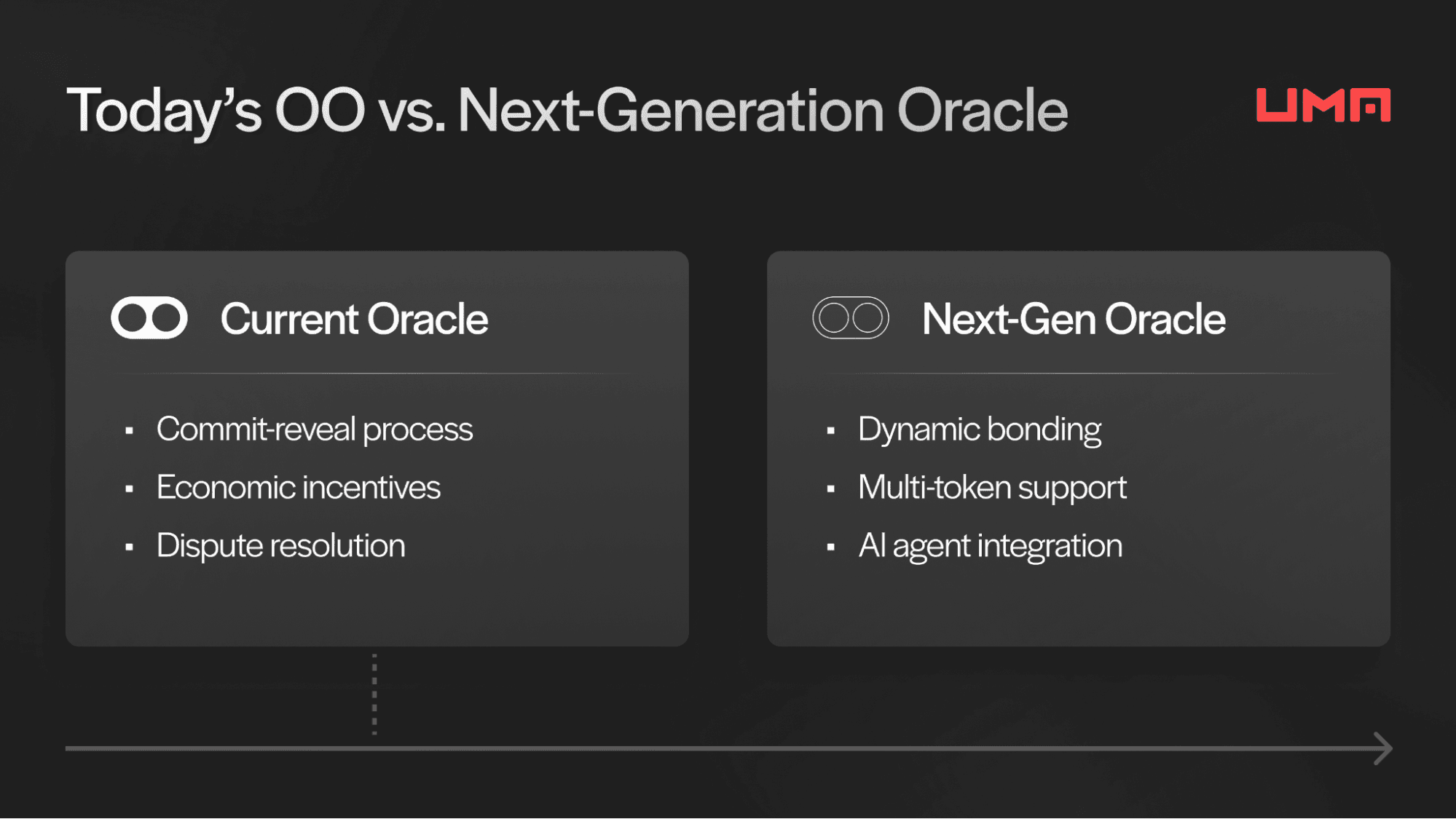

However, prediction market oracles must also be able to correctly handle disputes with trust and economic security. The OO uses UMA’s Data Verification Mechanism (DVM)—a Schelling Point mechanism inspired by Vitalik Buterin’s SchellingCoin idea, to resolve disputes. In the DVM, UMA stakers cast secret votes and are incentivized to align with the majority decision through game theoretic principles.

The optimistic oracle is the leading Schelling Point system and prediction market oracle. UMA secures over $1B of value across a wide range of integrations, including Polymarket. Polymarket is the largest prediction market by volume, with over $6B cumulative trading volume and 14k markets resolved since early 2022.

The Vision for UMA’s Next-Generation Oracle

As prediction markets continue to grow and expand, the need for oracles that can keep pace is undeniable. That’s why UMA is collaborating with Polymarket and EigenLayer to research the next-gen prediction market oracle. With UMA’s deep oracle expertise, Polymarket’s scale and adoption, and EigenLayer’s innovation in intersubjectivity, we are creating an oracle that will allow prediction markets to more directly align dispute resolutions with their community and scale both oracle capacity and economic security.

Aligning Prediction Markets

For prediction markets to scale effectively, their communities need to be able to contribute to how disputes are resolved.

Currently, the $UMA token is used to resolve all UMA’s optimistic oracle disputes, but the next-gen oracle should allow prediction markets to choose the token(s) used for dispute resolution.

For a Schelling mechanism to work optimally, the economic value of the underlying token should be linked to the correct function of the oracle. This is the case for integrations using $UMA to resolve disputes, but for protocols with a sufficient market cap and an active voting community, using another token(s) may allow for more direct alignment and involvement.

Allowing different or multiple staked tokens to vote on dispute resolutions also increases the maximum possible economic security of the oracle. It turns UMA’s oracle into a composable platform, opening up new cases and the ability to serve larger protocols that require higher economic security and want to be self-sovereign over their own oracle data.

Scaling Oracle Capacity

Today, there are over 1,000 open markets on UMA’s optimistic oracle. As more markets launch in longer tail segments, this number could continue to grow exponentially, putting pressure on the current network of human proposers, disputers, and voters.

The next-gen oracle may include a dynamic bonding system that scales bonds and challenge periods according to the market’s properties and gives multiple proposers and disputers flexibility to enter and exit bond positions within the variable challenge period. This innovation will increase the oracle’s efficiency and lower the number of unnecessary disputes due to human error or subjectivity.

This bonding system will allow for smaller bets and ongoing risk management of bond positions. This market structure will be conducive to AI agent participation, and other ways to encourage bonded AI participation in proposing and disputing will be researched to help scale the oracle beyond solely human proposing and disputing.

Scaling Economic Security

One potential weak point of all Schelling Point systems is that hypothetical bribery attacks (e.g., P+ε style attacks) can limit their economic security. UMA has worked on a credible solution to mitigate these types of attacks. UMA, Polymarket, and EigenLayer are researching further ways to identify bribery as an intersubjective truth. This would allow the next-gen oracle to handle the more subjective task of resolving prediction markets while also benefiting from the added intersubjective security enabled by EigenLayer and the EIGEN token for bribery protection.

The Future of Decentralized Truth

UMA’s optimistic oracle has already established its value across the prediction market landscape, but the journey toward decentralized truth is only beginning. By building on the success of UMA’s optimistic oracle and improving integration alignment, oracle capacity, and economic security, the next-generation prediction market oracle is poised to drive the next wave of prediction markets and other intersubjective truth protocols.

As we continue this research, we also invite market participants, community members, and researchers to help shape the next generation of the optimistic oracle.

For more updates, follow UMA, Polymarket, and EigenLayer and join the discussion on UMA’s Discord