TLDR

UMA has proven itself as web3’s oracle for truth, securing billions in value and resolving tens of thousands of disputes. Still, myths arise: from false claims of whale manipulation to doubts about handling controversial disputes. This post clears the air, tackling the most common misconceptions about UMA and revealing how its system works in practice.

Introduction

UMA is web3’s oracle for bringing real-world truth onchain. Our system is battle-tested and proven, with 90,000+ natural language assertions resolved and billions in value secured.

But with scale comes scrutiny, and in a system designed to resolve real-world disputes, it’s easy for misunderstandings to turn into myths.

This post clears the air.

We’re addressing the most common criticisms of UMA directly with transparency, data, and lived experience from our community. Because our mission is to verify truth onchain, and that starts with clarifying it offchain.

Here are the myths that we’ll bust:

UMA can’t handle subjective disputes

All UMA holders vote on outcomes

Whales control UMA’s outcomes

UMA’s voter base is small and disinterested

UMA is easily manipulated by bad actors

UMA makes the wrong call on controversial markets

UMA isn’t suitable for IP or arbitration disputes

UMA’s dispute process is broken

Let’s dive in.

Myth #1: “UMA can’t handle subjective disputes.”

Fact: UMA was built for intersubjective disputes.

The oracle isn’t just for yes/no (binary) data feeds. It’s designed to resolve complex questions: political outcomes, news events, even creative disputes. These aren’t coin flips. They require informed judgment.

That’s where UMA’s Schelling point game theory comes in. Voters are rewarded for aligning with the answer they believe most other voters will consider correct. In practice, this creates a strong incentive to coordinate around the most reasonable, well-supported outcome.

Because incorrect votes are penalized (through slashing), straying from the Schelling point is costly. The result is that evidence-backed, widely credible answers consistently win out. Not bias, not noise.

That’s why UMA’s community doesn’t just vote. They research, debate, and bring evidence to the table. From Discord threads to primary-source submissions, the process is transparent and serious.

For example: Imagine a market asking, “Did Candidate X’s speech in Iowa count as an official campaign launch?” That’s not a clean API query. But UMA voters can weigh in with context, reporting, and precedent to reach a trusted resolution.

Myth #2: “All UMA holders get to vote on outcomes.”

Fact: Holding UMA ≠ voting with UMA.

It’s a common misconception that whoever holds the most UMA tokens controls the oracle. In reality, the top wallets you see onchain are mostly staking contracts, DAO treasury addresses, or exchange reserves, not individual whales. These tokens are either locked for governance, held in reserve, or simply sitting on exchanges.

Only UMA that is actively staked in the voter dApp participates in resolving disputes. Those voters put their tokens at risk of being slashed if they’re wrong, which aligns incentives toward accuracy. Passive holders (whether individuals, CEXs, or treasury wallets) don’t influence oracle outcomes.

For example: On March 13, 2025, one address showed a balance of 34.6M UMA (34% of supply), which sparked claims that a single whale controlled UMA. In reality, that address is the UMA staking contract where hundreds of UMA voters stake their UMA, not a single person. The same goes for other top holders: UMA DAO reserves, Binance custody wallets, and staking pools. None of these can unilaterally swing votes. Only actively staked UMA in the voting system can be used to vote on disputes.

Myth #3: “Whales control UMA’s outcomes.”

Fact: The data says otherwise.

UMA uses token-weighted voting, but influence isn’t concentrated in a single wallet. Currently, around 23 million $UMA tokens participate per vote (~25% of the total supply). To settle a vote, at least 65% of staked $UMA must align on the outcome. This means someone would need to stake ~15M $UMA to single-handedly decide the outcome of a vote, which is far more than any active voter holds.

UMA voter data is transparent, and as of right now, the top active voter currently stakes 2.07M $UMA. There are some addresses that hold up to ~7M $UMA, but they are not actively staked or participating in voting. Staked amounts drop significantly as you scroll down the roster. Top voters often disagree, and no single actor can swing outcomes alone.

By contrast, in traditional proof-of-stake systems, whales can passively stake large amounts of capital and still earn rewards, even if they don’t actively participate. UMA flips that dynamic: voters must actively research and cast accurate votes or risk losing funds. Top voters often disagree, outcomes are transparent, and wrong answers are penalized.

Crucially, UMA voters risk their capital every time they vote. Incorrect votes are slashed at a rate of 0.1% of their staked $UMA per vote. This means the incentive is to be accurate, not to manipulate.

And even if someone wanted to brute-force control, there’s a catch: buying up enough UMA to manipulate outcomes would send the price skyrocketing on the way in and collapsing on the way out. The attempt itself would destroy the value of the attacker’s own position, making it economically irrational.

In short: slashing incentives guide voters toward truth in the short term, while the long-term security comes from the fact that corrupting UMA destroys the very value of the tokens an attacker would need to control.

For example: Imagine a large holder with 2 million $UMA tries to force the wrong outcome on a disputed election market. Other voters, citing official results and verified reporting, coordinate on the Schelling point. The whale’s vote is slashed, costing them ~2,000 $UMA (roughly $2,800 at today’s prices). To truly force a corrupt outcome, they’d need to control at least 65% of all UMA staked. And if they ever succeeded, the value of UMA would collapse, and their entire stake would effectively go to zero before they could exit.

Myth #4: “UMA’s voter base is small and disinterested.”

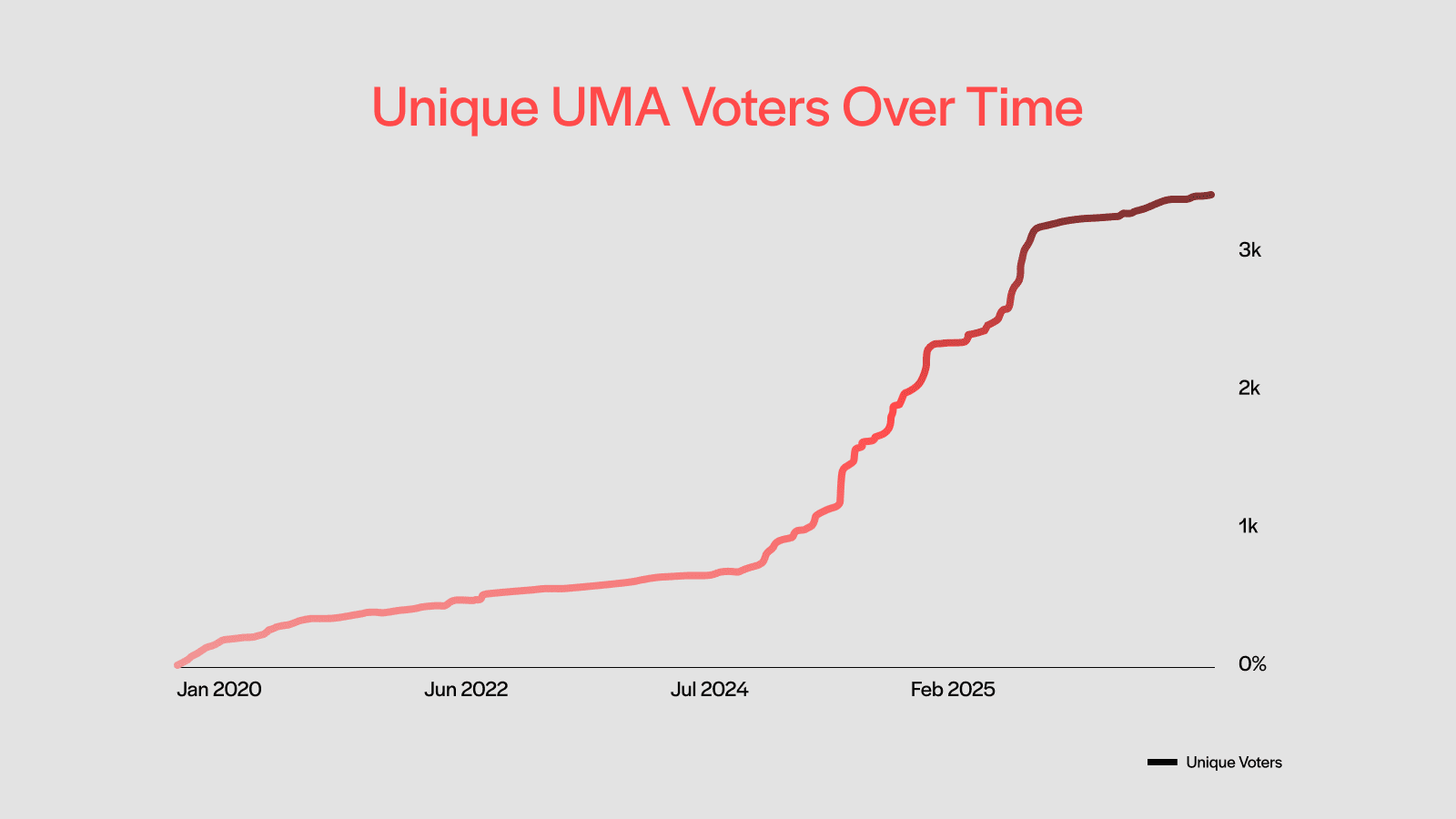

Fact: Voter engagement is more active than ever and climbing fast.

Participation is growing month over month, with new voters joining weekly. Markets often resolve with lightning-fast analysis, and disputes have sparked essays, data deep-dives, and even memes (yes, including the fart market).

This isn’t apathy. It’s proof that UMA’s voters are active, informed, and invested.

For example: If a disputed prediction market asks, “Will Country X ban TikTok by June?”, voters will quickly share government statements, news articles, and legal filings to back their positions, resolving the question in near real-time.

Myth #5: “UMA is vulnerable to economic manipulation.”

Fact: Manipulation is prohibitively expensive.

The system is designed with bonding, slashing, and adversarial game theory to resist attacks. Could someone try to game it? In theory, yes. In practice, it’s economically irrational.

As we outlined in The Economics of Truth, pulling off an attack would require risking millions in capital with slim odds of success. The UMA community would almost certainly notice and dispute. Additionally, UMA implements a commit-reveal voting system to prevent collusion and voter manipulation.

UMA makes honesty the most profitable strategy.

For example: Imagine trying to flip a prediction market about the winner of an NBA game. To succeed, you’d need to deposit bonds (~$750 each), risk your voting stake, and go against a community that’s actively watching. The attempt would cost more than any payout.

Myth #6: “UMA is vulnerable to communication manipulation.”

Fact: Discord chatter is not a voting mechanism.

Another common misconception is that bettors or market participants can sway UMA outcomes by flooding Discord or comment threads. While it’s true that UMA’s Discord is permissionless (anyone can post their perspective) voters don’t blindly follow opinions.

UMA’s voters are incentivized to coordinate around verifiable facts and credible sources, because only truth-seeking is profitable. Posts in Discord may provide useful context or links, but they don’t dictate outcomes.

Example: In a heated political market, bettors might try to spam Discord claiming that the wrong candidate won a race. But UMA voters know their tokens are at risk if they get it wrong. Instead of parroting chatter, they align with official reports and credible sources, inevitably reaching the Schelling point.

Myth #7: “UMA makes the wrong call on controversial markets.”

Fact: Sometimes the truth is controversial.

UMA resolves 99.8% of markets without contention. Only a fraction have been truly contentious. And when they are, disagreement is expected because controversial questions divide opinion by nature. The key difference is that UMA doesn’t hide those disputes. Instead of a single newsroom or centralized platform making the call behind closed doors, hundreds of real people openly debate and decide.

The system is resilient. UMA is the most credible decentralized way to resolve contentious markets, because its design forces alignment around the Schelling point: the outcome most participants recognize as correct. And while UMA doesn’t promise perfect consensus, it provides the best possible answer to controversial questions, reached transparently, with incentives aligned toward truth.

Example: Take the Iran Cyberattack prediction market on Polymarket. Conflicting news reports and lack of official confirmation made it difficult to resolve at first, and the vote rolled multiple times. But the community kept debating, sharing sources, and refining arguments until it reached P2 consensus. The outcome reflected collective due diligence, and UMA’s transparency meant everyone could see exactly how the decision was reached.

Myth #8: “UMA’s dispute process is broken.”

Fact: The system works insanely well, actually.

Over 99% of all proposals are resolved without escalation. When disputes do arise, voters often reach >90% consensus. That’s not broken. That’s a mechanism working under pressure.

Still, we’re iterating. UMA has scaled its voter base 10x in the last year, launched AI proposer agents, and streamlined the voter UI. The process is tested, proven, and constantly refining.

For example: Think of it like air travel. Thousands of flights land safely every day, but the few delays or cancellations grab headlines. UMA’s system resolves thousands of markets smoothly and leverages rare disputes to improve over time.

Closing Thoughts

UMA is a pioneering oracle that’s constantly improving. It’s the only decentralized system capable of resolving real-world, natural language claims at scale, onchain, and in the open.

This isn’t the end of the conversation, but rather an invitation to join it. Ask questions. Raise criticisms. Propose markets. UMA is open, and that’s the point. This is how we get better, together. Want to learn how UMA works? → Explore the Oracle Want to dive into the data? → View Voter Data on Dune → View Optimistic Oracle Metrics on Dune

Still have questions? → Join UMA’s Discord