Tldr; UMA staking went live earlier this month as part of UMA 2.0. Protocol emissions are based on voter participation, which currently equates to roughly 28.4% APR. UMA also offers extra rewards to active voters for securing the oracle. This means there’s an economic incentive to staking $UMA.

Key takeaways:

UMA staking is live. The emissions rate is currently around 28.4% APR based on voter participation.

The protocol redistributes rewards from inactive stakers to stakers who turn up to vote and vote correctly.

While there are many variables that can impact staking returns, there’s an economic incentive to staking $UMA over passively holding tokens.

UMA started a significant new chapter earlier this month with the launch of the Data Verification Mechanism (DVM) 2.0 upgrade. Among the suite of updates UMA 2.0 introduces, the protocol now distributes token rewards to $UMA stakers.

Where $UMA voting rewards were previously based on a snapshot of token balances, now tokenholders stake $UMA to earn rewards and participate in votes. UMA staking builds on early Proof-of-Stake designs and game theoretical principles to incentivize tokenholders to secure the oracle.

$UMA stakers continuously accrue rewards, and they’re also rewarded when they align with voters to solve oracle disputes; when they vote successfully, they receive a portion of the stake from those who miss a vote or vote incorrectly (voters must choose the option the majority answers and reveal their vote within a set timeframe). There’s also a seven-day cooldown period for withdrawals. Similar to Proof-of-Stake Ethereum, this new model ensures that stakers have skin-in-the-game to increase security.

Earning from UMA staking

After the UMIP-174 proposal to turn on protocol emissions passed governance, emissions commenced on 11th March 2023. The emissions rate is calculated based on voter participation. With just under 20 million $UMA tokens staked at the time of writing, stakers earned around 28.4% APR.

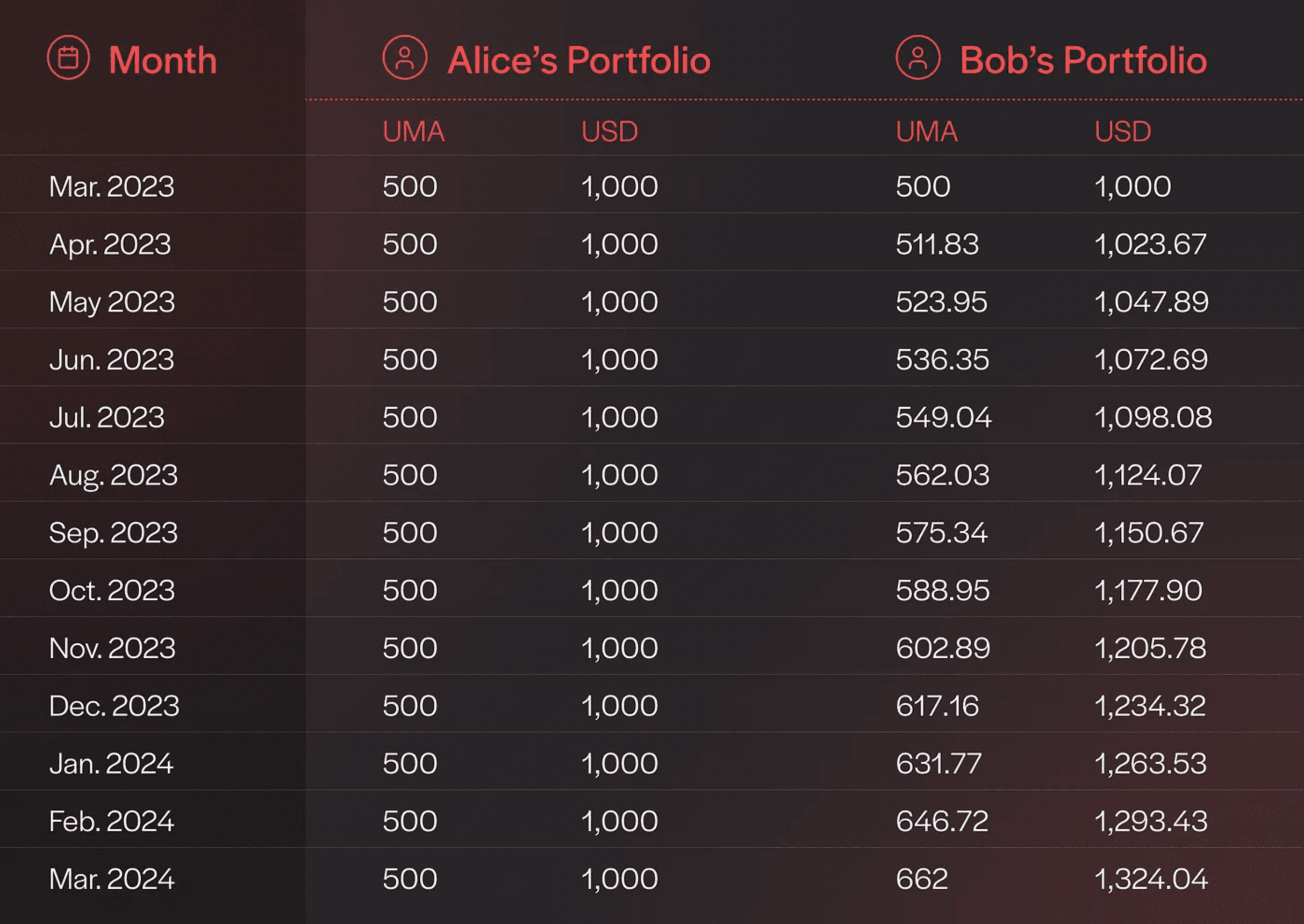

The below example compares the potential difference in returns between passively holding $UMA and participating in staking and voting over a one-year timeframe.

In this example, Alice deposits $1,000 worth of $UMA to a cold wallet in March 2023. Bob stakes $1,000 worth of $UMA and takes part in voting. He also stakes his accrued rewards on a monthly basis to compound his returns.

This means Alice earns 0% yield, while Bob earns 32.4% APY.

It also assumes that $UMA holds its trading price at the time of writing, which was around $2.00.

Please note: the above example shows a hypothetical scenario based on today’s token market prices and voter participation. $UMA and other tokens are prone to price volatility. The example should not be interpreted as financial advice — returns from holding $UMA and participating in staking are not guaranteed.

At the end of the year, Bob makes 32.4% on his 500 $UMA holdings, accruing 162 $UMA in rewards. Alice, meanwhile, still holds 500 $UMA with no rewards accrued. Additionally, as the circulating $UMA supply increases over time due to staking emissions, Alice’s holdings get inflated away and her 500 $UMA represents a smaller portion of the overall supply.

To put this example to the test, I staked 500 $UMA from my token holdings via this Ethereum address ahead of emissions commencing. I plan to use this wallet to participate in all votes and stake accrued rewards on a monthly basis to ensure returns compound until March 2024.

The Risk Labs Foundation offers gas rebates in $UMA for voters who commit and reveal, which will be segregated from the staking returns. The total ETH spent on claiming and staking rewards will also be deducted from the total returns at the end of the year.

The aim of this experiment is to compare the returns someone can earn from securing the protocol against passively holding the $UMA token. After one year, I will compare the value held in the wallet against the market value of 500 $UMA.

$UMA is a work token, and UMA 2.0 is designed to reward active voters. While there are many factors that can influence the yield accrued, this experiment should show that there is a financial incentive to staking $UMA.

Variables that can impact staking returns

While we can use today’s market price for $UMA and the 28.4% APR to forecast potential staking rewards, in reality there are many variables that will impact the returns stakers earn.

Fluctuations in rewards — as the emissions rate depends on the number of tokens staked, it will fluctuate over time. As the portion of the $UMA supply locked in the staking contract increases, the rewards paid to stakers decrease, and vice versa.

Frequency of rewards claims — the emissions rate is currently 28.4% APR, but in our example, Bob earns 32.4% APY because he stakes his rewards on a monthly basis. Stakers can compound their returns by staking their accrued rewards (but they must also spend $ETH to cover gas costs). As more rewards get staked, other tokenholders see their holdings get diluted due to the circulating supply increasing. (If everyone claimed-and-staked at the same time, the net effect to APY would be zero.)

Number of votes and voters — stakers accrue rewards continuously regardless of whether there are votes to participate in. But as the number of votes increases, staking returns will vary for different stakers. The staking mechanism redistributes 0.1% from stakers who abstain from voting or vote incorrectly to successful voters. This means someone who participates in every vote successfully will earn a higher yield than a passive staker who does not turn up to vote. $UMA tokenholders settled 96 votes in 2022. However, if the oracle processed 10 times the number of votes, the responsibility would increase for stakers. For active participants, they would have a greater chance of earning extra rewards, but they would have to turn up every time to receive them. It’s also worth noting that the redistribution rate could increase or decrease from 0.1% in the future pending a governance vote, which would impact both active and inactive voters and the rewards they receive.

Based on the current APY of 28.4%, it only takes around 31 hours of staking to break even with a missed vote, so it is not very punishing (though the DAO can change that in the future.)

Gas rebates — to incentivize voting, the Risk Labs Foundation offers monthly rebates in $UMA tokens to active voters who successfully commit and reveal in votes. This means that any voters who choose to stake their rebate tokens can accrue greater returns. In my staking experiment, all $UMA rebates will be segregated from the staked supply.

Ethereum congestion — while the Risk Labs Foundation offers rebates on committing and revealing in voting, stakers cover their own gas costs for claiming and staking rewards. This means that stakers may face additional $ETH costs during periods of peak congestion. I will aim to claim rewards when Ethereum activity is at a relative low and track the amount of $ETH spent on compounding returns throughout my experiment.

Market conditions — as $UMA’s market price increases, the fiat value of staking rewards increases. Broader market conditions can also impact staking rewards as tokenholders may be more incentivized to participate in the ecosystem during bullish trends. Historically, $UMA voter participation has peaked in tandem with the token’s market value. As $UMA currently sits down from its all-time high while crypto winter ensues, it’s arguably a more favorable time to stake for tokenholders who want to secure the protocol’s long-term future.

Next up for UMA 2.0

UMA staking marks the start of a new phase for the protocol, incentivizing tokenholders to secure the oracle. But this update is only one of several upgrades to come as part of UMA 2.0. The revamp will also introduce improvements to the voter dashboard and adjustments to the protocol’s security model.

Check this guide to get started with UMA staking and follow UMA on Twitter for further news on UMA 2.0.

Words by @dreamsofdefi