Why Prediction Markets Need Oracles

Prediction markets are as old as Ethereum.

Since their initial shout out in the Ethereum Whitepaper, prediction markets have become a cornerstone in the DeFi space and one of the hottest topics in 2024.

At their core, prediction markets enable people to speculate and bet on the outcomes of real-world events. However, these markets are not just betting platforms anymore. They have evolved into powerful tools for crowd-sourced intelligence that reflect real-time sentiment about a wide range of topics—from political elections and sporting events to financial forecasts and cultural phenomena.

While building prediction markets might seem straightforward on the surface, the biggest hassle is verifying outcomes. Who do you trust to decide the correct outcome when millions of dollars are on the line?

In this report, we will explore the challenge and why oracles are the solution—let’s dive in.

TL;DR

The prediction market space is booming: Platforms like Polymarket have seen massive growth in volume and active users. This a prime time for new builders to enter the space and capture market share.

Oracles are essential for reliable prediction markets: Oracles ensure accurate and trustworthy outcome verification, which is crucial for maintaining fairness and user confidence in prediction markets.

UMA’s Optimistic Oracle is designed for prediction markets: By providing transparent, decentralized verification and dispute resolution, UMA’s Optimistic Oracle empowers developers to build robust prediction markets without needing to rely on centralized entities.

The Prediction Market Challenge

Onchain prediction markets are revolutionary because they bring transparency and decentralization to a sector traditionally dominated by centralized bookkeepers or intermediaries. Anyone can create an market, place bets, and see the data—all these without an intermediary.

Why is this transformative?

Prediction markets unlock the door for global markets controlled by participants, rather than “the house.” They enable us to bet on our beliefs in a fair environment and provide direct insight into market sentiment data.

However, things get challenging when when the truth is questioned. How do we know if the outcome is true? What information is it based on?

Without an efficient and reliable mechanism to address this issue, prediction markets risk breakdowns in trust, fairness, and user participation. If users can’t trust the outcome determination process, it undermines the market’s purpose and value.

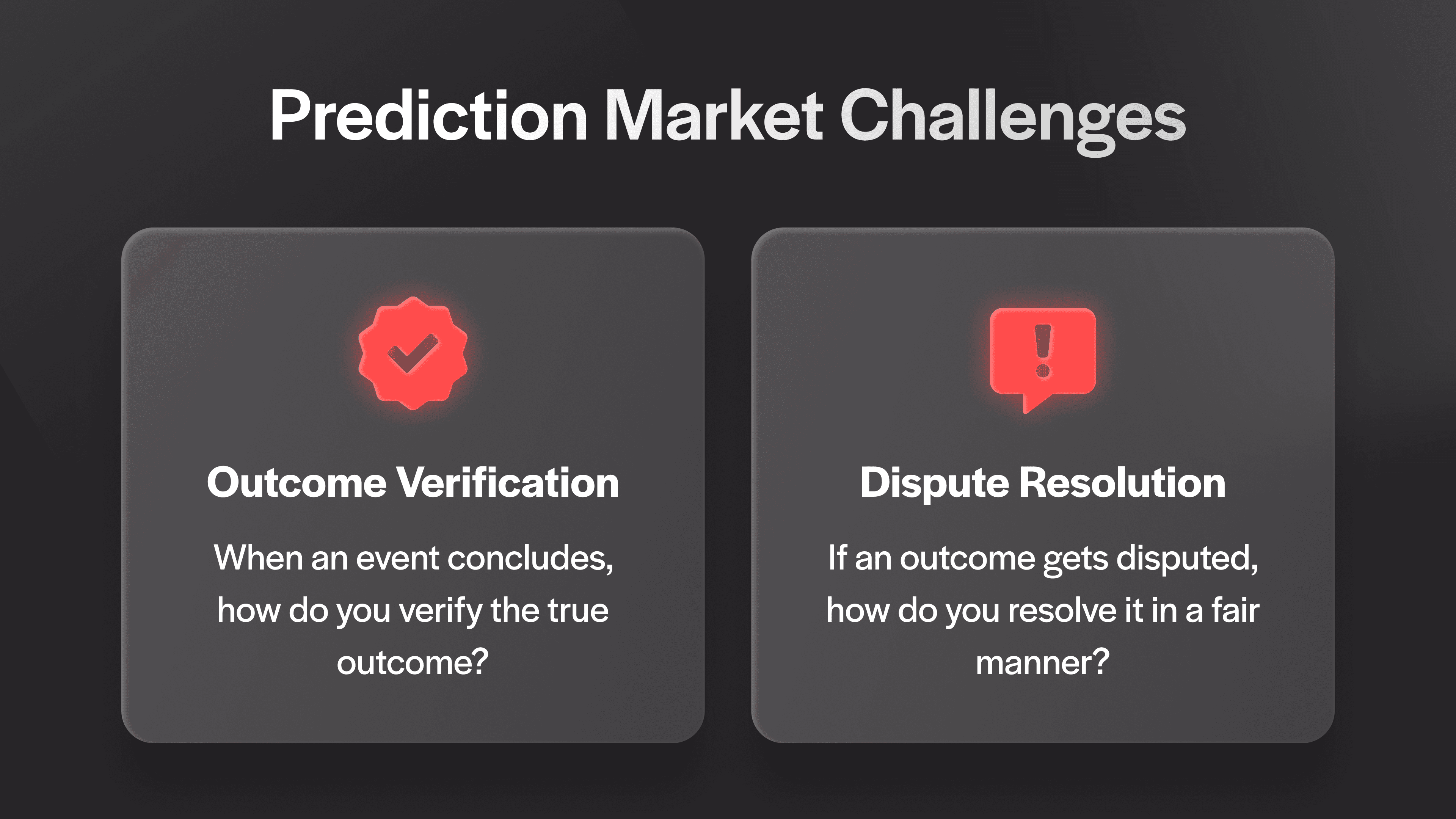

For prediction markets to remain decentralized, they cannot rely on a centralized authority to verify and confirm market results. This presents a twofold challenge:

Verifying real-world event outcomes: Imagine a market created to predict the outcome of a political election. Once the election results are in, participants in the market will want to settle their trades based on the outcome. But who determines whether the event happened as reported? If the market relies on a single data source, such as a news outlet, it introduces a potential single point of failure.

Resolving disputes: There are often scenarios where outcomes aren’t entirely black-and-white. Consider a sporting event where the results are disputed due to unforeseen circumstances, such as a weather delay or rule infraction. In these cases, who decides how to interpret the outcome? This is known as an intersubjective dispute, where the definition of what “really” happened is debatable. These disputes pose a challenge for prediction markets aiming to maintain a decentralized and objective system. Read more about prediction market disputes here.

This is where blockchain oracles play a critical role in the prediction market landscape.

What are Blockchain Oracles?

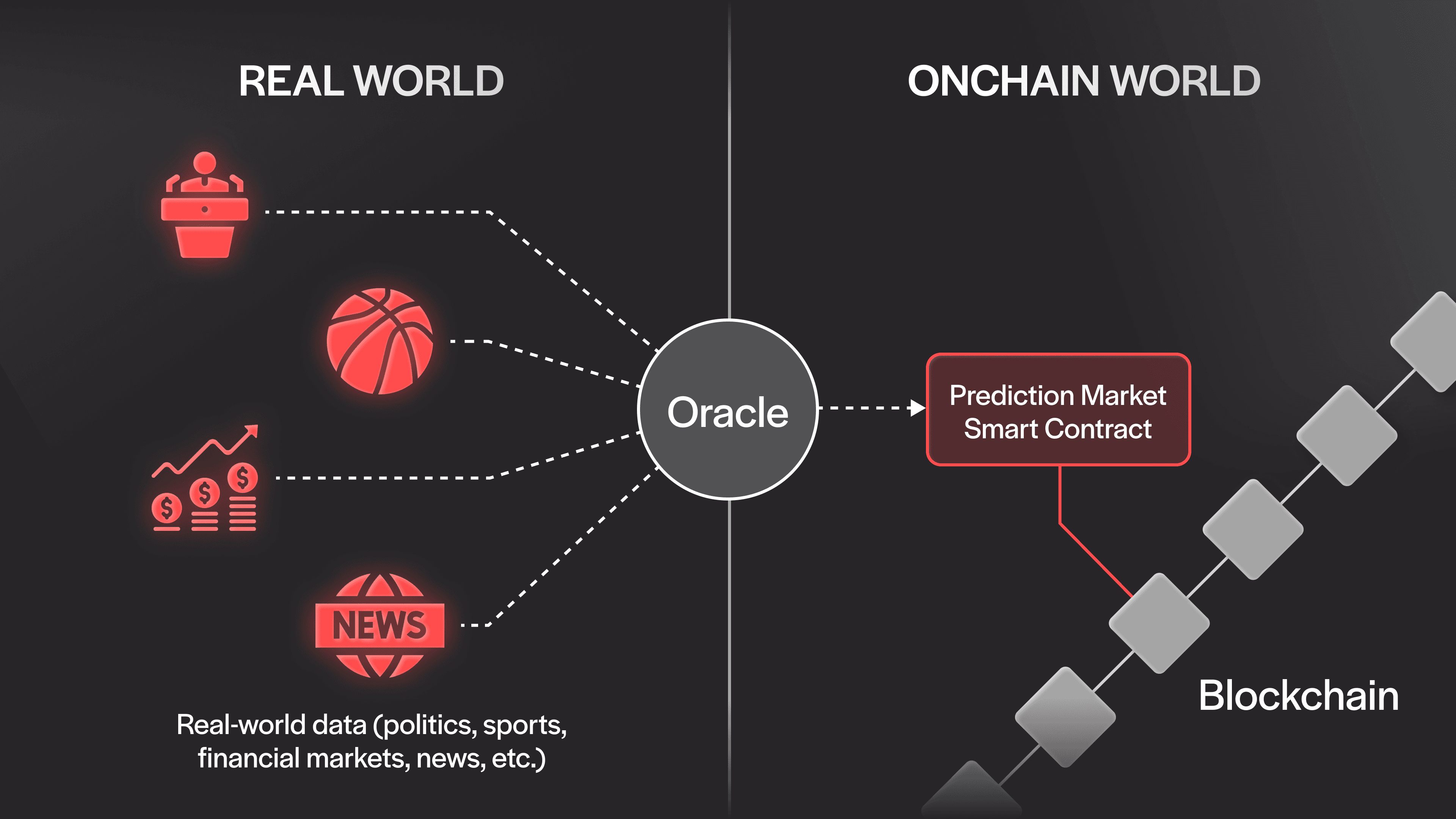

Blockchains provide an environment for smart contracts—digital agreements that are automated, trustworthy, and ready to execute once conditions are met. But there’s a catch: they can’t see or interact with the world outside their blockchain. They don’t know who won the game, what the temperature is, or whether the latest stock price hit a new high. This is where blockchain oracles come in.

Oracles act as bridges between the onchain world and the real world. They pull in data from sources outside the blockchain and feed it directly to the smart contracts, enabling them to execute based on events happening in the real world.

There are different types of oracles, including centralized, decentralized, and hybrid models. Centralized oracles rely on a single source of truth, which creates risks of manipulation, censorship, or inaccuracy. Decentralized oracles, like UMA's Optimistic Oracle, distribute the responsibility of providing data and verifying outcomes among a decentralized network of participants.

How Prediction Markets Use Oracles

Oracles enable prediction markets to settle trades based on real-world data. Without oracles, prediction markets would be left blind, unable to resolve bets or settle outcomes. The result? A broken system that no one can trust.

In prediction markets, an oracle has three core functions:

Collect data about real-world events: This could be as simple as pulling election results, sports scores, or price feeds—or more complex data like market trends or weather conditions.

Verify the data: In decentralized systems, data can be disputed, so having a mechanism in place to resolve disputes and ensure data integrity is essential.

Provide finality: Once the data is verified, the outcome needs to be cemented onchain, allowing the smart contracts to execute and settle trades within the prediction market.

Choosing the right oracle isn’t just a technical detail; it’s the difference between a thriving market and one that collapses when it matters most.

UMA’s Optimistic Oracle: Designed for Prediction Markets

UMA’s Optimistic Oracle was designed with these challenges in mind. It provides an efficient approach to market outcome verification coupled with a decentralized and efficient mechanism for resolving disputes and verifying outcomes. The Optimistic Oracle operates on the principle that most market participants are honest, and only intervenes when there’s a dispute.

Here’s how it works in the context of prediction markets:

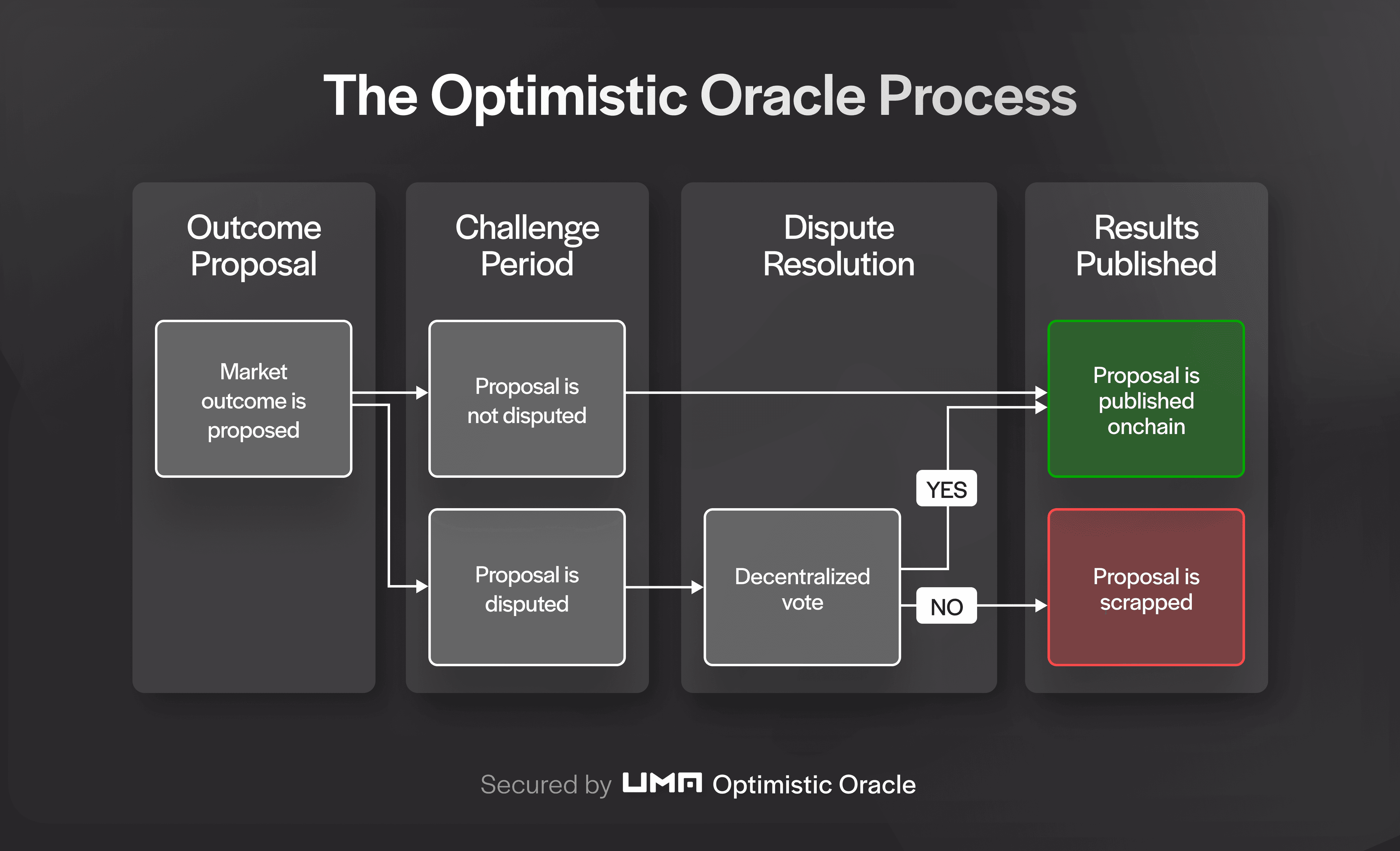

Outcome proposal: After the event concludes, anyone can propose an outcome based on publicly available data. This can be done through UMA’s protocol, which publishes the outcome onchain. Proposers are economically incentivized to tell the truth by providing a USDC security bond.

Challenge window: Once the outcome is proposed, the Optimistic Oracle opens a window during which anyone can challenge the proposed outcome. If there’s consensus and no challenge, the proposed outcome is accepted and published onchain. However, if someone disputes the proposed result, a decentralized dispute resolution process kicks in. Disputers are also economically incentivized to tell the truth by matching the proposer’s security bond.

Decentralized dispute resolution: In the event of a dispute, UMA’s system relies on a decentralized and shielded voting mechanism, where participants in the UMA ecosystem stake tokens and vote on the correct outcome. The outcome with the majority of votes is accepted as true. Voters are economically incentivized to vote truthfully—they earn rewards when they vote correctly and lose a small portion of their staked tokens when they vote incorrectly.

Publish the results: Undisputed proposals are optimistically published onchain. Disputed proposals that are voted as true are published onchain after the vote ends. Proposers that are deemed correct receive their security bond back along with a reward. Proposers that are deemed incorrect lose their security bond. The same reward and punishment system applies to disputers as well.

A key benefit of this model is its optimistic approach—by assuming that most users are honest, the system avoids expensive and slow dispute processes unless necessary. This approach maintains decentralization without sacrificing efficiency.

How Polymarket uses UMA’s Optimistic Oracle

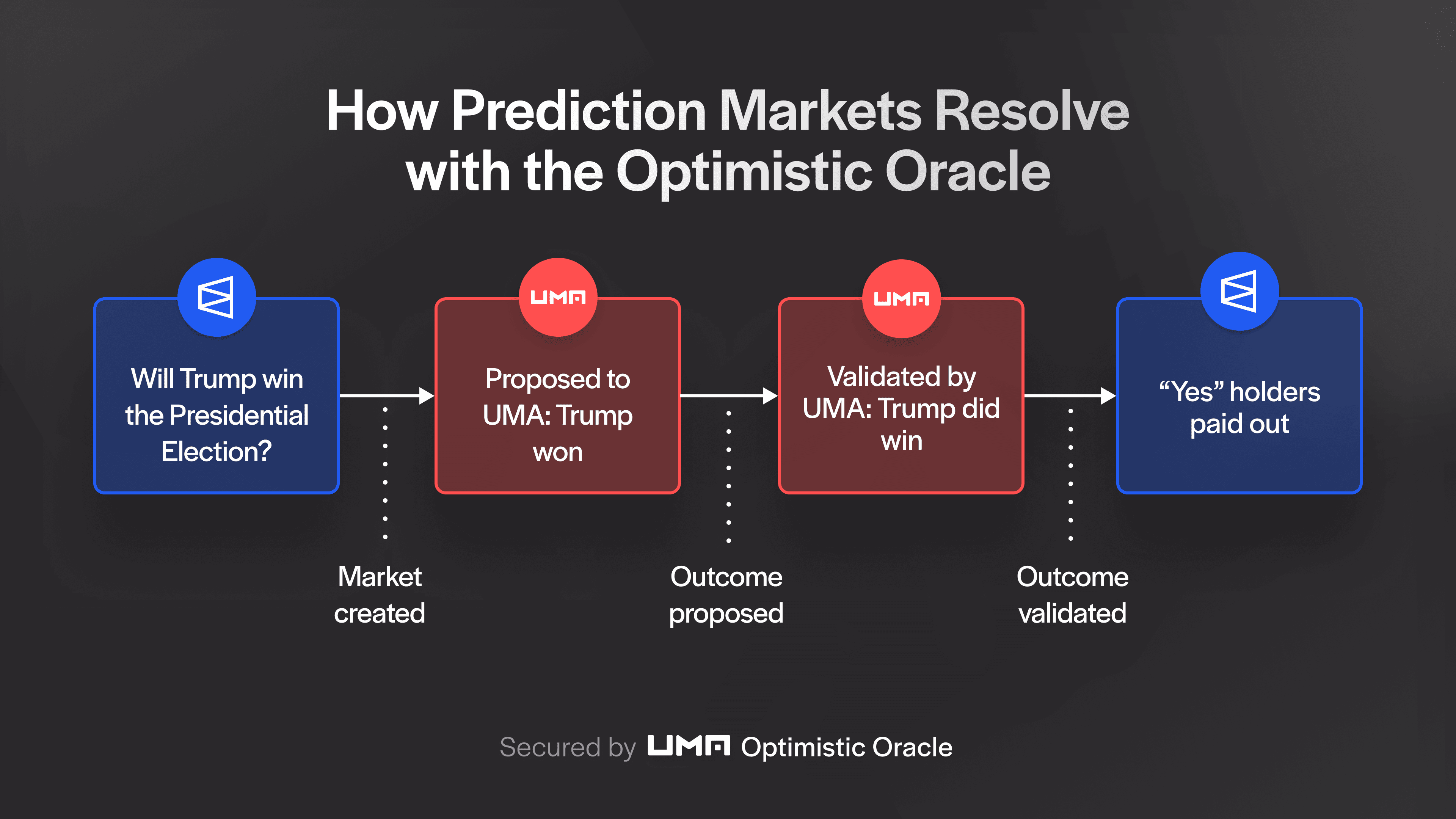

Polymarket, the leading onchain prediction market platform, relies on UMA’s Optimistic Oracle to ensure accurate and transparent outcome resolution. Polymarket covers a wide range of topics, enabling users to “bet on their beliefs” with substantial optionality.

By using UMA’s Optimistic Oracle, Polymarket can confidently settle trades on outcomes that are publicly verifiable and resolve any disputes in a decentralized, transparent manner. This not only ensures trust and accuracy in outcome reporting but also enhances user confidence in the platform’s reliability.

For example, in the case of a major election result, Polymarket can use UMA’s Optimistic Oracle to propose the winning candidate based on official results. If a user believes the result is incorrect, they can challenge the outcome within a defined time window. UMA’s dispute resolution system will then determine the final result, ensuring a decentralized process.

Build Prediction Markets with UMA's Optimistic Oracle

The onchain prediction market space is growing fast, and this a prime time to claim market share. In 2024, Polymarket alone has experienced an increase from $6.6 million to $533.5 million in monthly volume, along with around a 5,525% boost in monthly active traders.

You can build the next Polymarket with UMA’s Optimistic Oracle.

UMA’s Optimistic Oracle offers a key piece of the puzzle that you need to pull it off. It provides a powerful and accessible tool for anyone looking to build prediction markets onchain. It simplifies the verification process for event outcomes and enables a decentralized, trustless mechanism for dispute resolution.

UMA provides extensive documentation and resources to make it easy for you to integrate the Optimistic Oracle into any prediction market project. Whether you’re building on an existing platform or starting from scratch, UMA’s infrastructure makes it simple to offer decentralized and trusted outcome verification for any onchain prediction market.

Closing Thoughts:

Prediction markets offer a unique and dynamic way to capture real-time sentiment on real-world events. However, their success relies on on the reliability of the data that determines market outcomes. Oracles—especially decentralized oracles like UMA’s Optimistic Oracle—play a crucial role in ensuring that prediction markets remain decentralized, transparent, and trustworthy.

UMA’s Optimistic Oracle efficiently handles the complex challenges of verifying market outcomes and resolving disputes, freeing developers to focus on what really matters: building awesome prediction markets.

Start building with the Optimistic Oracle here.

Get Involved

Want to earn rewards as a voter in the Optimistic Oracle? Learn how to get started here.

Ready to build your own prediction markets? Learn how to build using the Optimistic Oracle as your backbone here.

Also, make sure to follow UMA on Twitter to stay up to date on everything prediction markets and join our Discord community for support.