Unpacking Polymarket’s meteoric rise in numbers

Tldr; Polymarket might be the world’s most talked-about consumer crypto app in 2024 and the numbers prove that there’s good reason for the hype. The world’s top prediction market is experiencing parabolic growth buoyed by the upcoming US election and growing mainstream attention.

Key takeaways:

Polymarket has become one of the world’s most used crypto products this year as new users flock to trade on the app.

The upcoming US election has been a significant factor behind the product’s rise, with markets related to the November 5 vote accounting for much of its growth.

As Polymarket’s trusted dispute resolution mechanism, UMA keeps the platform’s markets secure with over 11,000 markets settled to date.

Editor’s note: The data for this report was compiled using figures pulled from Polymarket, rchen38’s Dune Analytics dashboard, and UMA. It was correct at the time of writing on July 31, 2024. Due to Polymarket’s rapid growth and the fast-changing nature of its markets, some figures have slightly changed since the data was compiled.

There’s no denying it: this is Polymarket’s moment. Prediction markets have exploded in 2024 and Polymarket is still the scene’s undisputed leader. Thanks largely to the upcoming US election, the world’s biggest prediction market has become a real-time sentiment tracker for major news events, often beating mainstream media outlets to the chase on the most important stories.

The buzz surrounding Polymarket has been palpable to anyone watching crypto closely for a while now. But a quick dig into hard metrics reveals that Polymarket’s rise isn’t just another hype story. It’s clear that Polymarket is becoming a significant force in crypto and the Internet as a whole—and this may only be the beginning of its story.

As the dispute resolution mechanism that secures Polymarket, UMA plays a role in this story because it keeps the platform’s markets secure. For our latest feature, we looked into some of Polymarket’s adoption metrics to track its recent breakout. The numbers paint a clear picture: Polymarket is dominating in 2024, and while the current US political landscape has been an important factor, it looks like the platform could be here to stay.

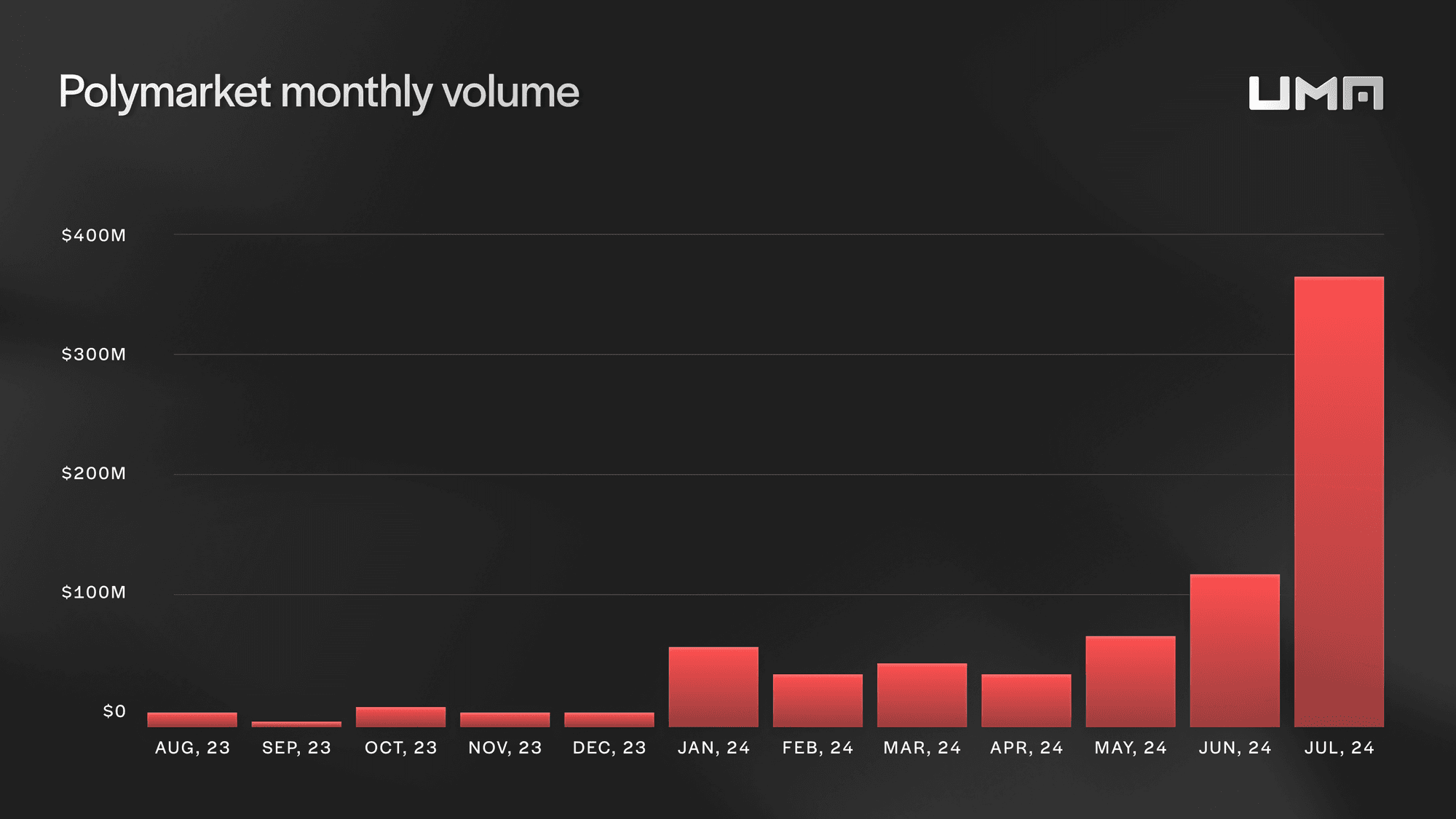

50x increase in monthly trading volume

Polymarket saw over $360 million in trading volume in July 2024. That’s more than almost every DeFi protocol aside from the early blue chips, every NFT marketplace, and practically every other consumer crypto app on the market.

In 2023, Polymarket averaged around $6.7 million in monthly volume, closing the year with $73.2 million in total volume. July’s trading surge marks a 50x jump on the platform’s monthly average for 2023 and an increase of around 400% on Polymarket’s total volume for the year.

Polymarket is processing more volume than almost every DeFi protocol, every NFT marketplace, and practically every other consumer crypto app.

Though trading volumes have been rising since Q2, they went parabolic in July. The month-on-month increase jumped from 59.3% in May and 79.8% in June to over 200% in July. The surge came amid a period of US political upheaval, with events like the assassination attempt on former President Trump and President Biden’s dropout from the election race impacting markets.

While July was undoubtedly Polymarket’s biggest month ever, trading volumes will likely continue to run hot even if they don’t make new highs. Crypto thought leaders like Vitalik are helping bring exposure to Polymarket and more and more people from outside the crypto bubble are becoming aware of the platform due to the election.

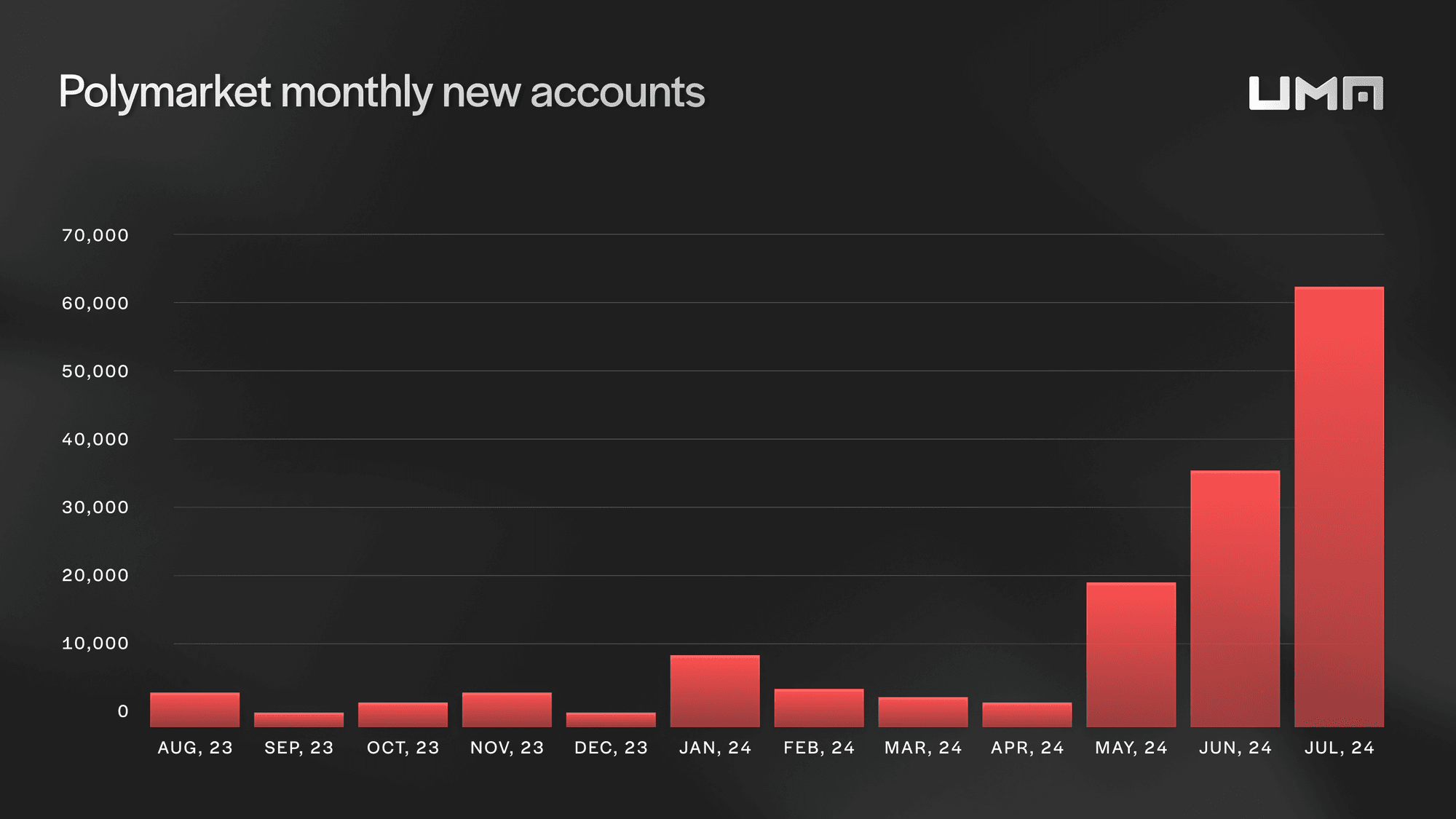

60,000 monthly new accounts

The number of new accounts joining Polymarket is soaring with trading volumes. The platform welcomed over 60,000 new accounts in July 2024. Similar to the trading volume numbers, this figure outpaces the number of new accounts that joined across the whole of 2023.

Polymarket welcomed around 2,300 new accounts per month last year. The number of new accounts has significantly increased in Q2 2024, with about 120,000 accounts joining since April.

The month-on-month rise was 415.9% as the platform started to enter the mainstream from April to May, which was around the time we dubbed 2024 “the year of prediction markets.” The number of new accounts has risen in the two months since, albeit at a slower pace.

If Polymarket maintains its current trajectory, the platform could see 90,000 new accounts join in August (this would mark a 50% month-on-month increase, which is slower than the growth recorded in June and July).

It’s notable that the surge in new accounts is highly correlated with the surge in trading volumes, evidenced by the July spike. This trend suggests that new users are heading to Polymarket to bet on political events and the platform is gaining real traction.

The growth also appears to be more sustained than other consumer crypto apps that have gained popularity in recent years. While other apps experienced “hockey stick” growth and a short lived moment of mania, Polymarket looks like it’s on a continuous trajectory.

The numbers prove that Polymarket is currently crypto’s fastest-growing consumer application. For now, this trend is yet to show any signs of slowing down.

100x growth in total sum bet

At the time of writing, the total amount bet on Polymarket’s open markets (across all markets of at least $100,000 in size) is about $992 million. This time last year, the platform had seen less than $10 million bet across all of its open markets.

Moreover, Polymarket’s biggest markets had seen roughly $2-3 million in bets placed this time last year. Today, the top two markets sit closer to $294-450 million and account for about 75% of all bets placed.

Few metrics illustrate Polymarket’s explosion better than the 100x growth in the size of its top markets and total sum bet.

Polymarket is becoming more popular and more powerful.

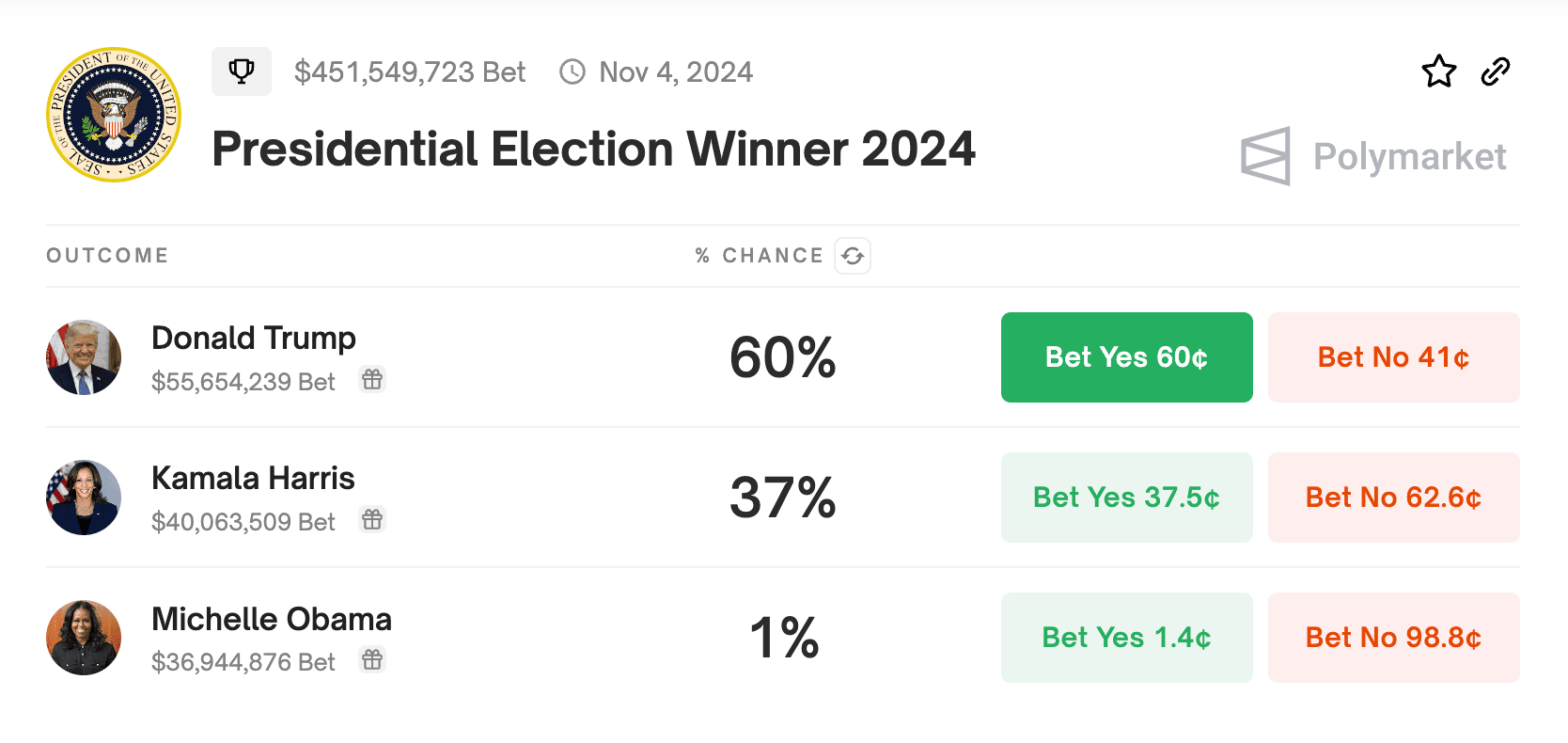

The biggest market today, “Presidential Election Winner 2024,” is currently at about $450 million bet, which illustrates how people are becoming increasingly accustomed to using prediction markets to signal their beliefs.

As prediction markets are information aggregators, they become more useful as they gather more information. The growth in bets placed on Polymarket suggests that the platform is not just becoming more popular—it’s also becoming more powerful.

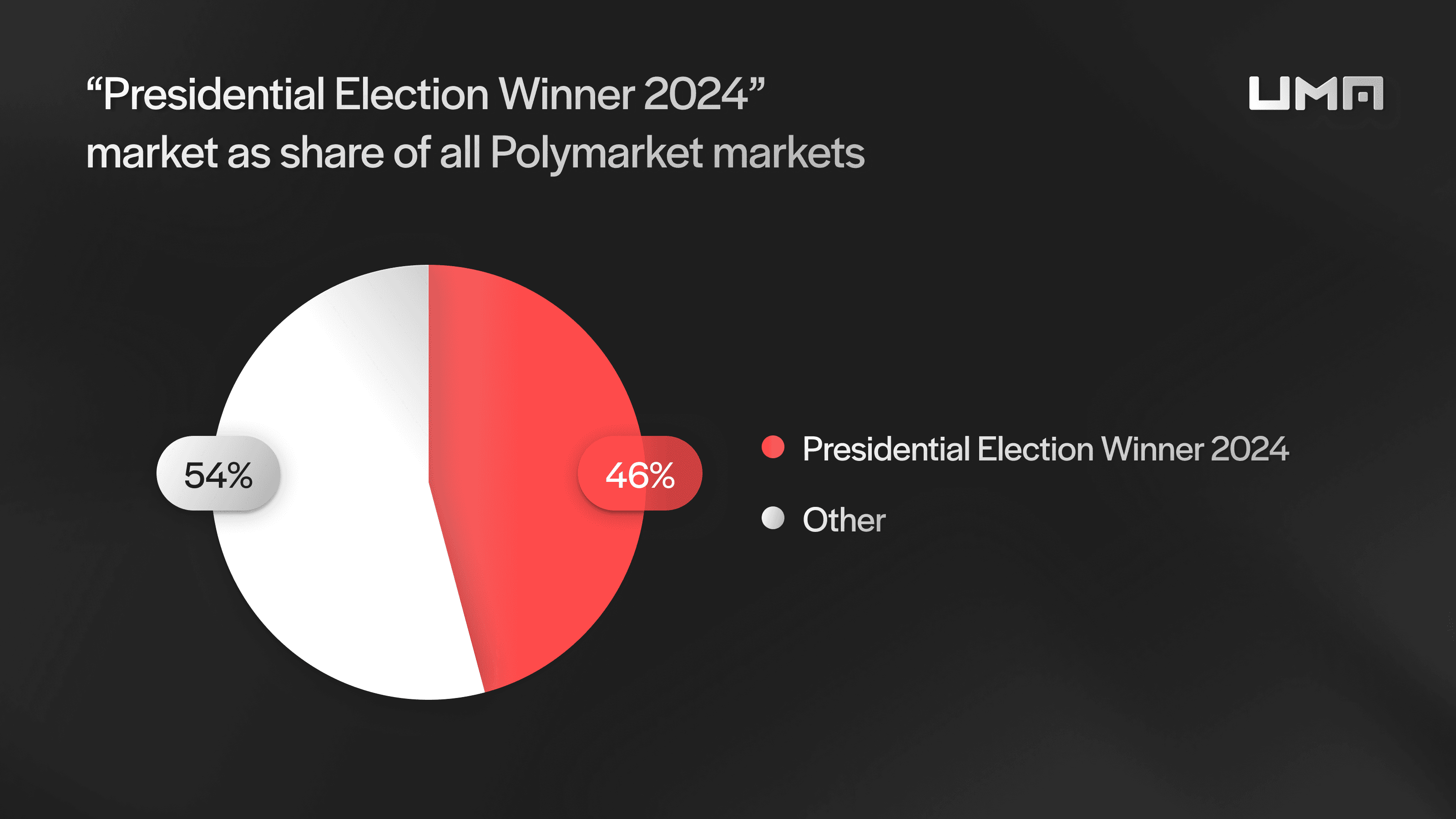

46% of total sum bet on the next US president

Of the $992 million bet across Polymarket’s top markets, the $450 million placed on the top market equates to roughly 46% of the platform’s total sum bet. Additionally, a staggering 95.8% of the sum bet accounts for markets directly related to the US election. These figures prove that the election has been the biggest catalyst behind Polymarket’s growth.

However, Polymarket is neither limited to politics nor new to crypto. Since launching in 2020, the platform has settled thousands of markets that are not related to the election, covering topics such as Coinbase’s App Store rankings, the Eurovision 2024 results, and the outcome to Julian Assange’s court case. UMA’s Optimistic Oracle is useful for settling markets like this as it can verify natural language requests.

The US election has helped the tide rise and lifted many boats.

The distribution of bets placed on Polymarket shows that the most liquid markets have become capital magnets. Still, with over 30 markets receiving at least $1 million in bets placed, there’s a case to be made that the election has helped the tide rise and lifted many boats.

The top two markets, where traders have been placing bets on the next president and Democratic nominee, are two of the platform’s most accurate because they have received information from multiple sources. These markets, alongside others such as the one that foreshadowed Biden’s dropout from the race, have fluctuated in real-time in response to news events. In some cases, they have all but confirmed event outcomes ahead of mainstream news services.

Polymarket’s most liquid markets have become capital magnets.

With so much volume tied to the November 5 event, questions remain over whether Polymarket will continue on its current trajectory into 2025. However, Polymarket has attracted thousands of new users and entered mainstream consciousness. The platform’s goal is to act as an alternative to traditional news. With more and more sources drawing attention to Polymarket, it’s possible that 2024 and its political backdrop could be looked back on as a tipping point in which its mission became a reality.

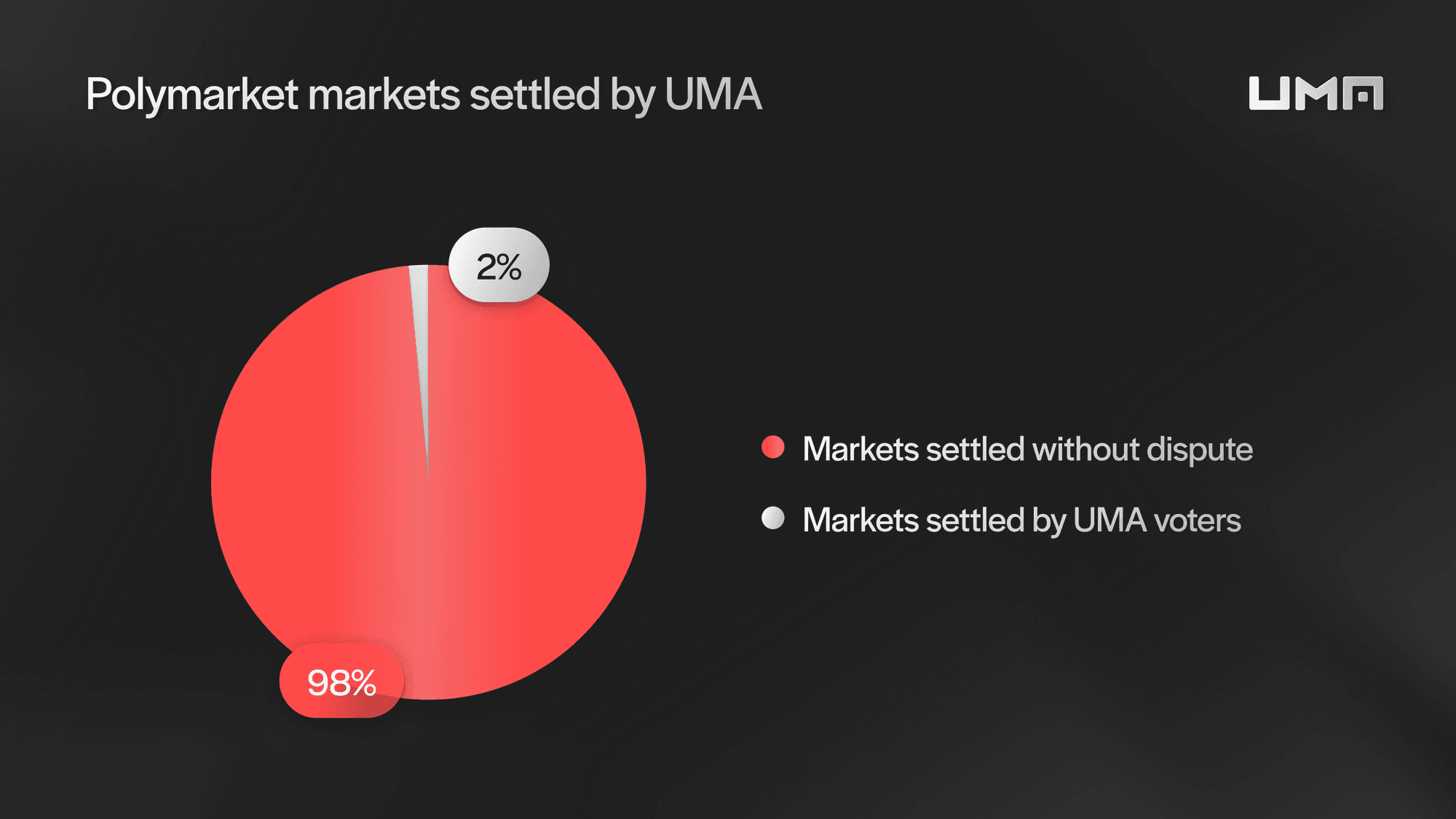

11,000 markets secured by UMA with 98% undisputed

Polymarket has gained exposure through its election-related markets this year, but the platform settles dozens of different markets of all kinds every day.

All markets are secured by UMA’s OO. Markets offer at least two event outcomes and the share price for an outcome trades at either $1 or $0 when the market closes. Event outcomes are “optimistically” verified when a market closes, which means the market automatically gets resolved unless someone raises a dispute. This mechanism incentivizes honest behavior with economic incentives so dispute cases are extremely rare.

UMA secures Polymarket and 98% of markets are settled without a dispute.

At the time of writing, UMA has settled 11,093 Polymarket markets, with 217 disputes raised. In other words, 98% of markets were undisputed when asserted to UMA and the market was settled.

In rare dispute cases, $UMA tokenholders vote on the outcome to decide whether the asserter or dispute gets the other party’s bond. The majority vote determines the correct outcome. $UMA tokenholders receive staking rewards for securing the oracle and they get slashed if they miss a vote or vote incorrectly. Due to the ambiguity of human language used in certain markets, votes can occasionally be contentious. However, as the numbers prove, these cases are few and far between.

In 2024, UMA has settled more markets for Polymarket than its early years, averaging around 545 monthly. About 98% went undisputed, which is consistent with the number of disputes raised in the OO’s lifetime.

Additionally, the rise in activity on Polymarket correlates with an increase in UMA voter participation. The number of active voters increased as Polymarket boomed in July 2024, rising over 20% on the average turnout for 2023.

In short, as Polymarket is capturing more attention, UMA adoption is also growing, and the system is still keeping it secure with extreme efficacy.

“The new news”?

Polymarket hopes to replace traditional news services. While that’s a lofty goal, the numbers tracking its rise in 2024 show that the platform is on the right track. Volumes are up, new accounts are flocking to place bets, and its markets have ballooned in the last year. Polymarket is growing and there is precious little doubt that it is the prediction market scene’s winner today.

If Polymarket is to continue its hot streak, it faces some challenges. With so many markets centered around the US election, the platform will need to think of ways to retain users after November 5. UX improvements will also be crucial to long-term sustainable growth. But based on the recent adoption metrics, Polymarket is on track to become “the new news.” UMA looks forward to supporting its mission.

References

Crypto promised us prediction markets. Is it delivering? [@dreamsofdefi for UMA]

How Polymarket is making prediction markets mainstream [@dreamsofdefi for UMA]

Polymarket markets [Polymarket]

Polymarket data [@rchen39 via Dune Analytics]

The Hot New Trade That Everyone Is Watching: Will Biden Drop Out? [The Wall Street Journal]

Why 2024 is the year to build prediction markets with UMA [@dreamsofdefi for UMA]

Words by @dreamsofdefi